Short-Term & Long-Term Index Price Periods of Moving Average (MA)

Adjust the time periods for index prices in the moving average calc.

How Do I Trade with MA

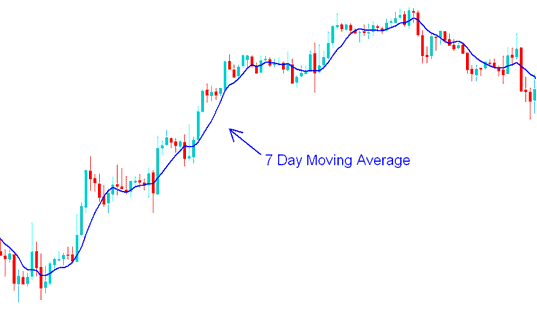

Conversely, if a trader utilizes shorter price observation periods, the MA Moving Average will react more swiftly to changes in the Stock Indices' prices.

For illustration if a trader uses the 7 day Stock Indices moving average then, moving average indicator will react to the Indices price change much faster than a 14 day or 21 day Index Moving Average(MA) would. However, using short time Index price periods to calculate the MA Moving Average may result in the indicator giving and generating false whipsaw signals (whipsaw signals).

7 Day Moving Average(MA) - MA(Moving Average) Indices Strategies

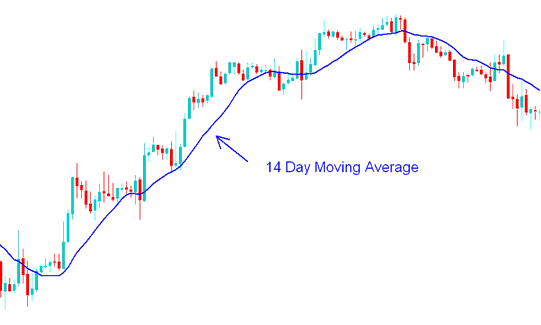

When using longer timeframes, another trader may notice that Moving Averages (MAs) respond more slowly to price changes.

For example, if a trader uses the 14 day MA(Moving Average), the average won't be as likely to have false signals, but it will respond slower.

The 14-Period Moving Average (MA) - An Illustrative Trading Strategy Example for Indices Using the MA

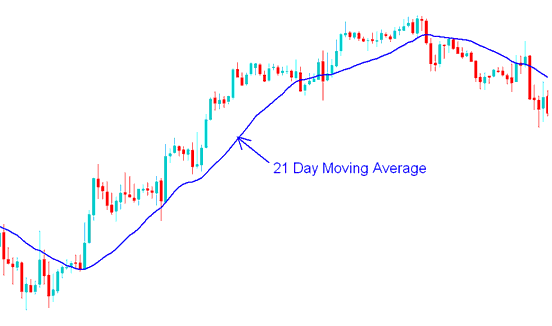

21 Day Moving Average(MA) - MA(Moving Average) Indices Strategies Example

Get More Topics:

- MetaTrader FTSE MIB 40 Indices FTSE MIB 40 MT4 FX Trade Software/Platform

- Setting a XAU/USD Schedule

- How do you look at a FX trade on MT5 software?

- Simple Pivot Points Tool Training Course

- XAUUSD Platform/Software MetaTrader 5 Gold

- Three Stochastic Types for XAU/USD: Fast, Slow, and Full Formulas

- Setting Up Forex MACD EA

- Learn Index Forex Trade Guides

- S&PASX 200 MT4 and How It Appears in MT4

- Where is JP 225 on MT5 Platform/Software?