Gold Market Hours and the 3 Major Gold Trading Sessions

Online gold trading runs 24 hours. It starts Sunday night at 5 p.m. EST and ends Friday at 4 p.m. EST, open five and a half days.

Although the gold market operates around the clock, gold traders must recognize that certain times of day present more advantageous trading windows than others to effectively develop an efficient and timely XAUUSD trading plan.

To boost trading chances during busy times, know when markets see the most action. That's when most deals happen.

The trading day can be divided into three main market sessions: the Tokyo, London, and New York sessions, despite the fact that there is no formal opening or closing time throughout the week.

Though it might not seem that important when you begin, knowing when to trade is essential if you want to trade successfully.

The best time to trade Gold is when lots of buying and selling happens, meaning there are many financial trades. An active online market makes it easier to potentially earn money, but a slow market is a waste of time, so close your computer and don't trade XAUUSD then.

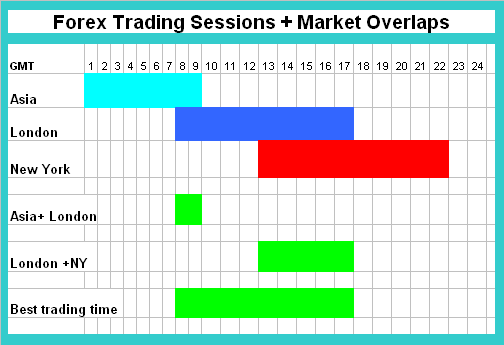

Not all hours of the market are equally suitable, as volatility fluctuates significantly across the 24-hour market cycle. A guide detailing the schedule of the Trading Sessions is provided below, using GMT 0 as the reference time.

Online Financial Market Hours

These are the busiest trading times in trading financial instruments because these are the times when the major financial institutions and major banks in these large cities are open for business. Because of major financial transactions carried out by these major financial trading institutions the online trading markets also becomes very busy because of this huge turnover of trades.

Trading gold at this time is the best thing to do as a gold trader because prices of investments are moving up and down a lot.

The three major trading sessions are:

Asia Market Session Hours (Tokyo): 00:00 - 9:00 GMT

European Session Hours (London): 7:00 - 17:00 GMT

U.S. Market Session Hours (New York): 13:00 - 22:00 GMT

Market Sessions Overlaps - Best Trade Times

Sometimes there are hours when two sessions overlap:

Overlapping trading periods: London merges with Tokyo from 07:00 to 09:00 GMT: New York and London overlap between 13:00 and 17:00 GMT.

During these times when markets overlap, trading happens the most, and you have better chances to make successful trades.

For example, XAUUSD trades well from 13:00 to 17:00 GMT when European and US markets overlap.

This means that the lion share of financial transactions is happening between the London session and US sessions. Naturally this is the best time to earn profits trading the online gold markets.

Gold prices change a lot during the New York and London times because big companies, investment groups, managed accounts, and banks are ready to trade things like gold, currencies, and CFDs.

Large companies exchange currencies at this time to support global business deals and trade. Hedge funds and investment groups buy and sell currencies, gold, oil, and CFDs to grow their money. Banks swap big sums for clients. They also trade tools like currencies, gold, oil, and CFDs to invest or take risks.

Furthermore, financial institutions facilitate currency exchanges for tourists planning international travel or for any individual needing to convert funds to purchase goods abroad or conduct cross-border commercial transactions.

The online market stays very liquid then. High trade volume moves gold prices a lot. Prices often trend short-term in one direction.

Join in when orders flow heavy and liquidity is high. This gives better shots at gains in XAU/USD. Moves feel steadier then. Low liquidity brings wild swings and no clear path.

After trading XAUUSD for some time, you will realize that it is easier to generate profits when the market is trending upward or downward, as opposed to when it is moving sideways. The market tends to trend during peak trading hours, making these periods the most advantageous for trading XAUUSD.

Asian Session Characteristics:

- Least volatile of the 3 sessions

- Account for 15 % of daily trade turnover

- Typical 20 -30 pip(point) moves

European Session Characteristics:

- Most volatile of the 3 market sessions

- 35 % of daily trade volume

- Typical 90 -150 pip(point) moves

US Market Session Characteristics:

- 2nd most volatile of the 3 sessions

- Accounts for 25 % of daily trade turnover

- Focuses on AUS economic news

US and Europe Session Over-laps Characteristics:

Combines the two most volatile market sessions

The turnover of financial trading operations accounts for 60% of all transactions made in a day.

Focuses on US and European economic/fundamental news

Fast moving XAUUSD prices & XAUUSD pair trends in a particular direction

Typical 100–150 pip moves for the major Gold pair:

More Guides & Courses:

- Top Brokers for XAUUSD EAs and Trading Bots

- FTSE MIB 40 Index Strategy

- Introduction To XAU/USD Online

- How Can I Include Fibonacci Projection Levels Indicator?

- Commodities Channel Index Tool Analysis for Trading

- How to Execute Index Trades on the MT5 Platform?

- UsTec 100 Trading Software on MT4

- EURNOK Opening Hours and EURNOK Closing Time

- Indices for Beginner Traders: What You Need to Know to Find and Get Started Lesson

- Introduction to Foreign Exchange Pairs and How They are Quoted