How Do You Setup For Stock Indices Trade?

Indices are new products that let you trade with borrowed money online. People who want to start trading these indices should spend some time learning how the markets work first. Traders should learn about using borrowed money - this is when you get $100 to trade with for every $1 of your own money. For example, if a trader has $20,000, then with borrowed money from their brokers, they can control $2,000,000 and trade with that much. That's what using borrowed money is - it gives traders more money to invest. This is why online stocks indexes are so popular.

Nevertheless, employing leverage necessitates that a trader master the methods of equity management to maintain control over it. Techniques focused on money management will instruct traders on how to govern their leverage, enabling them to utilize it advantageously for profit generation.

fine way to learn about the indices is to open a practice buying and selling account, that manner as a trader you will learn about Index making an investment with out depositing money. The demo account is a practice account in which a dealer can practice with digital forex - the whole thing else about the demo account is just like the stay account except for the virtual forex used in a demo account. The demo account will offer novice buyers with get right of entry to to the real market. A dealer can practice with this demo trade account until they're equipped to open a stay account and begin buying and selling the marketplace with invested capital, wherein income may be withdrawn and losses deducted from their capital.

Below is a listing of guides containing all the info that beginner traders require to begin.

- EURO STOXX 50 Index

- DAX30

- Dow Jones 30 Overview

- FTSE100

- Nikkei225

- S&P ASX200

- FTSEMIB40

- S & P 500 Index

- NASDAQ 100 Overview

- CAC40

- SMI20

- AEX25

- Hang Seng 50 Overview

- IBEX35

Three: General Market Operating Hours

How to Start

The first thing that a trader has to do so that as to begin & start is to download the platform and then install this trade software on their computer so that as to get access to the online market.

After getting and setting up the platform, you should create a demo trading account, then you will be all set.

To further your knowledge in online trading, familiarize yourself with various stock index instruments available on different platforms.

- EUROSTOXX 50

- DAX30

- DowJones30

- FTSE100

- Nikkei225

- S&P ASX200

- FTSEMIB40

- S & P 500

- NASDAQ 100

- CAC40

- SMI20

- AEX25

- HangSeng50

- IBEX35

Only the most popular indices are made available for online trading within the market, totaling the 14 selections displayed above.

Where to Find these Index on Software

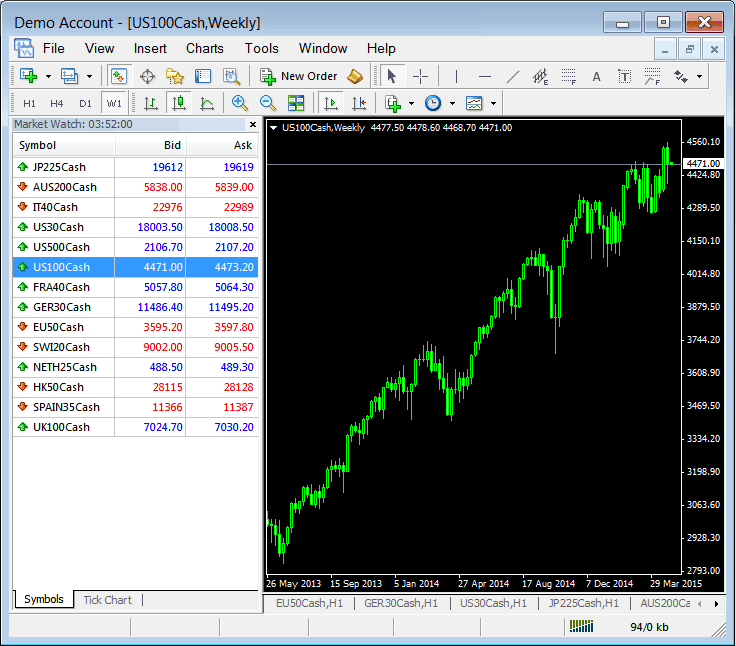

For those new to trading, knowing the location of these financial products within your platform is crucial: this is visually demonstrated below.

Index Instruments on Software/Platform

A trader can find these instruments from the "Market-Watch" window that is illustrated above. To find the market watch window popup on the platform above a trader can follow these steps: click "View" next to "File" at the top left corner, from the drop down menu select "Market-Watch", the above Market Watch pop up window will popup displaying a list of these Indices. Alternatively use the key board short-cut keys - CTRL+M.

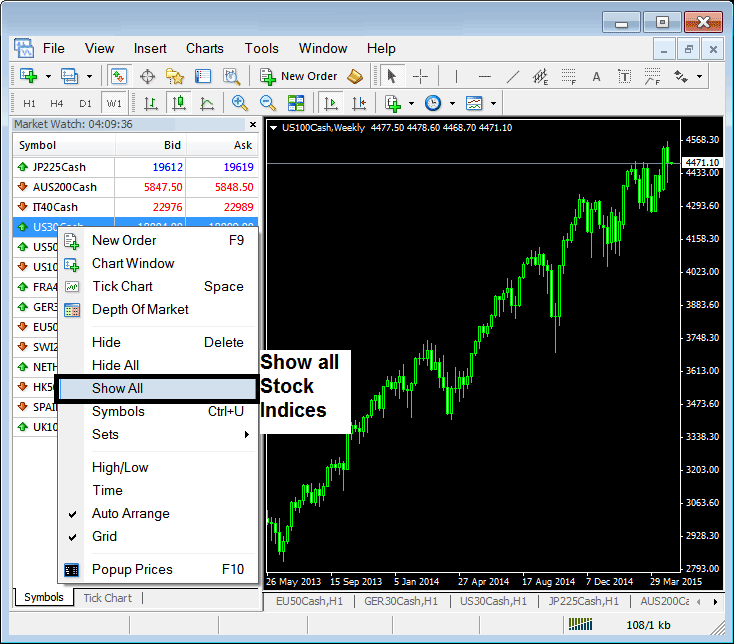

Should certain financial assets not appear in the platform's display, a trader can execute the subsequent procedures to ensure these instruments become visible in the aforementioned market watch window.

Right-click in the Market Watch area, then pick "Show All" from the menu.

Display all Index on Platform Software

You can choose to open charts by selecting a particular Indices & open its chart.

Once you've opened all the trading instruments you need, you might want to click "Hide All," as shown earlier. This helps you hide any instruments you're not actively trading, reducing bandwidth usage by prioritizing only the real-time data of your selected instruments.

After you pick all 14 indexes just like in the example above, you're all set to start practicing how to trade them on your demo account.

Trade Charts

Traders study stock indices with charts. They plot index values on graph lines and treat these charts as tradeable items to guess price moves and gain profits.

As an example the US 100 weekly chart is shown above. The movement is measured in points. The above stock index current value is 4471.10 - One can buy this financial and trading instrument and if its value appreciates and then goes up to 4471.50, the Stock Index trader will have made a profit of 40 points. A trader can also sell the financial instrument & if the value moves down to 4470.50, the Stock Index trader will have earned a profit of 60 points.

For Indices, traders have the opportunity to gain profit whether the market appreciates or depreciates. Purchasing an index position is termed going long, while selling is referred to as going short.

Brokers

Traders get access to the Online market through brokers. These online brokers are the ones that provide platforms, practice demo trade accounts, real accounts, trading charts & all the technical analysis tools required for Index.

Brokers take a small fee for each trade, known as the spread. For example, a broker might charge 3 points as their spread, so in the example above where the profit is 40 points, an indices trader must also consider the three points charged by the broker for the Stock Index trade, meaning the profit would be 37 pips after broker fees.

How Much Money to Start?

The suggested minimum amount to begin trading is $10,000. Starting with less means you won't have enough capital. Most traders start with $10,000, $20,000, or $50,000, giving them a good capital base and a better chance to earn profits.

Traders commencing with smaller amounts of capital are considered undercapitalized, and this shortage of capital is a primary factor contributing to the failure of most traders. Analogous to any other business venture, launching an enterprise without adequate funding significantly increases the likelihood of failure compared to starting with sufficient capital - the same principle applies directly to online indices trading.

How Do You Use Practice Accounts?

Practice accounts allow traders to practice indices without having to invest or deposit money, this way a trader can learn & decide if indices trading is appropriate for them or not. If as a trader once you have practiced & are making profits on your demo practice account then you can open a real account, deposit money as capital & begin trading these instruments for profits.

It's a good idea to practice with a demo trading account for 30 days. During these 30 days, you will keep learning about indices trading so you can get better at trading. At the same time, you can practice trading on the demo account.

Technical Analysis & Strategies

The subsequent step involves diligently learning the diverse technical analysis concepts utilized for examining and interpreting Index fluctuations, along with associated trading methodologies. This website furnishes all necessary information regarding these strategies and technical analysis tutorials, designed to enhance your proficiency, thereby expanding both your understanding and your potential for generating profits within this electronic marketplace.

More Topics:

- Overview of Expert Advisors (Automated Forex Bots/Robots) Based on the Williams Percent R Indicator

- Forex Ehlers Fisher Transform: Technical Analysis

- Method for Crossover at the RSI 50 Center-Line

- Understanding a Forex Candle Chart Guide

- Setting Up the MT5 Gold Platform

- How Can I Trade Bollinger Bands Squeeze Pattern?

- Learn to Trade XAU/USD: Step-by-Step Guide

- How Do I Trade Piercing Line Candles?

- Forex Brokers Offering FTSEMIB 40

- Calculating Pips for US TEC 100 Indices