Dark Cloud Candlestick Pattern

Piercing Line Bullish Candle Setups

The Piercing Line and Dark Cloud Cover candlestick patterns seem similar. Yet one shows up at the end of an uptrend, which is the Dark Cloud Cover. The other appears at the bottom of a downtrend, the Piercing Line.

Upward Trend Reversal - Dark Cloud Cover Candles

Downward Trend Reversal - Piercing Line Candlesticks

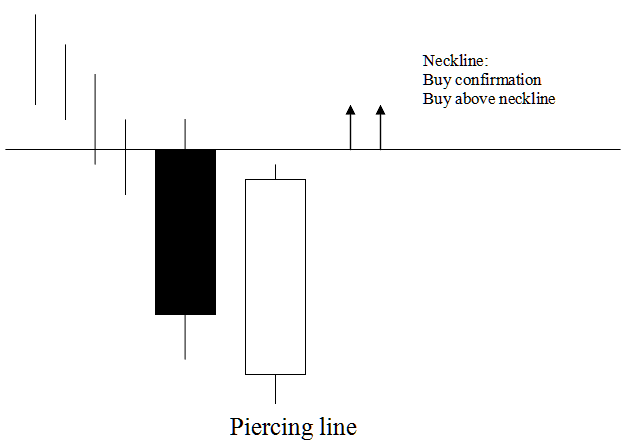

Piercing Line Candle

A piercing line consists of a long black body followed by a long white body candlestick.

White body pierces the mid-point of the prior black body.

This is a pattern that shows the market may go up: it appears when the market is going down. It means the market starts at a lower price but ends higher than the black bar's middle.

This indicates that the momentum of the downward trend is diminishing, and the price trend is expected to reverse and shift in an upward direction.

This pattern, known as a piercing line, indicates that the market is breaking through a bottom, suggesting a market floor for the downward trading trend.

Piercing Line Candle

Analysis Piercing Line Candlestick

You know it's time to buy when the price goes higher than the neckline, which is the start of the candle to the left of the Piercing Line.

This configuration indicates a bullish scenario where the price is anticipated to continue its upward trajectory: a trader entering a buy position should concomitantly place a stop-loss order situated just below the lowest point the price has reached.

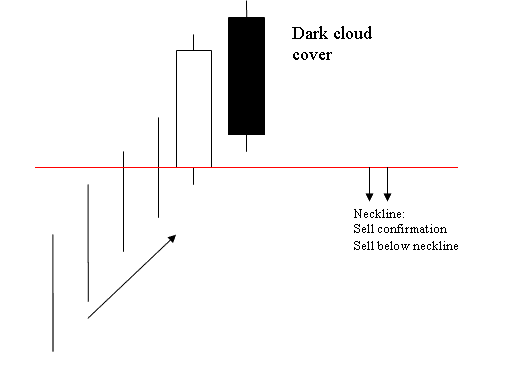

Dark Cloud Cover Candle

Opposite of piercing candle.

This candlestick is a long white body that is followed by a long black body.

The black body pierces the mid-point of previous white body.

that is a bearish market reversal alternate pattern setup that forms at the top of an upward trend.

It shows the market opens higher and closes below the midpoint of the white body.

This shows that the uptrend is losing power, and it might turn around and head downwards in the other direction soon.

This shape shows what's called a cloud cover, meaning the cloud is like a roof for the price going up any further.

Dark Cloud Candle

Analysis Dark Cloud Candle

A sell alert forms when price shuts below the neckline. That's the left candle's open.

This indicates a downward trend, so price should keep going down, and a seller should place a stoploss order slightly above the highest price level.

Study More Lessons & Tutorials:

- Foundations of Technical Analysis

- List of SWI20 Trading System

- How to Calculate Pips For US TEC 100 Stock Indices

- Example of FX Leverage at 1:100

- Lot Size Calculator for SX50

- Bollinger Bands XAUUSD Price Move in Range-Bound Sideways XAUUSD Markets

- How to Use MT4 Ichimoku Indicator

- Trading Mechanics for the CAC40 Index Across Both MT4 and MT5 Software Platforms

- Example Strategy for NETH 25 Stock Index

- Analysis of Gold Indicator Signals Through the Use of Trailing StopLoss Order Levels for Gold.