NETH25 INDEX - Amsterdam Stock Exchange Index

NETH25 Index is a Indices market indices used to keep track of the performance of the top 25 stocks on NYSE Euronext Amsterdam Stock Exchange Market in Netherlands. The NYSE Euronext Amsterdam Stock Exchange Market was formally known as Amsterdam Stock Market.

The 25 firms used to calculate this stock index are revised quarterly each year. This Stock Index tracks on the capitalization of top 25 firms.

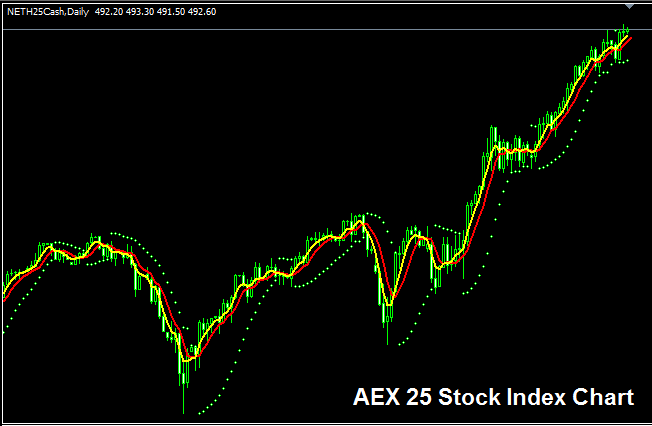

NETH25 Chart

NETH25 chart is illustrated and illustrated above. On the above example this Stock Index is named NETH25CASH. As a trader you want to find a broker that provides NETH25 chart so that you as a trader can begin to trade it. The example That is illustrated above is that of NETH25 Index on MT4 Forex Platform Software.

Other Data about NETH25 Indices

Official Indices Symbol - NETH25

The 25 component stocks that makes up the NETH25 Indices are selected from top companies in Netherlands. The 25 stocks make up most of the total trading turnover volume in the NYSE Euronext Amsterdam Stock Exchange Market. The calculation is revised quarterly every year.

Trading System to Trading NETH25 Index

NETH25 Index tracks capitalization of top 25 firms in Netherlands. This Stock Index in general moves upwards over long-term because Netherlands economy also shows strong economic growth.

As a stock index trader you want to be biased and keep on buying as the index heads and moves upwards. When Dutch economy is doing well most of these top 25 stocks will continue to move up and threfore this stock index also will move in an upwards trend. A good Indices trading strategy would be to keep buying and buy the dips.

During Economic Slow-Down and Recession

During the economic slowdown & recession times, corporations begin reporting slower revenues and lowers growth projections. It is due to this reason that investors begin to sell stocks of companies that are posting & reporting lower profits and hence Indices tracking these specific stocks will also start heading and moving downward.

Therefore, during these times, trends are a lot more likely to be going & moving downwards & you as a trader should also adjust your strategy accordingly to suit the prevailing downwards trends of the index which you as a trader are trading.

Contract Specifications

Margin Requirement for 1 Lot - € 5

Value per Pips - € 0.1

Note: Even though general and overall trend is generally move upward, as a trader you've got to consider and factor on daily market price volatility, on some of the days the Indices might move in a range or even retrace & retracement, the Indices market retracement/pullback move might also be a big one at times & hence you as the trader you need to time your trade entry strictly using this trade strategy & at same the time use suitable/proper money management guidelines and strategies just in case there is more unexpected market volatility. About indices equity management guidelines courses: What's Stock equity management and indices equity management system/plan.

Get More Lessons and Courses:

- Forex Accumulation/Distribution Automated Expert Advisor Setup

- US100 Trade Signal Strategy

- How Do I Set FX Trade Pending Trading Orders in MT5 Platform?

- Gold Information Guide Website

- IT40 Indices Strategies List and Best IT40 Indices Strategies for IT40

- Can you Download MT4 XAU/USD Platform on Mac?

- How to Use MT4 Ehlers Fisher Transform Technical Indicator on MT4 Platform

- MACD XAU/USD Classic Bullish Divergence and Gold Classic Bearish XAU/USD Divergence

- What are McClellan Histogram Buy and Sell Forex Signals?

- What's a XAU USD Stop Loss