Accumulation Distribution Technical Analysis Trading Signals

Conceived and Built by Marc Chaikin

This indicator helps evaluate the cumulative money flow into and out of a currency pair.

Originally used for stock trading, when it comes to stock "volume" is the number and amount of stocks traded and transacted for a given stock, this volume is a direct reflection of the money that's coming into and out of a stock.

The basic idea behind AD is that volume, or money flow, leads the market price. Volume comes before price.

In Forex, there's no central exchange - unlike stocks, which have places like the NYSE for trading.

Since there is no true measure of volume (actual money) that's flowing into and out of a currency market, brokers have come up with a substitute for actual money volume, this substitute is known as "tick volume".

The measurement known as tick volume represents the quantity of price fluctuations (ticks) transmitted to a broker over a defined timeframe. Many brokers integrate tick volume data into their charting software solutions.

Interpretation

This volume indicator is used to figure out if volume is increasing or decreasing as the price of a forex pair is rising or falling.

UpTrend

Should a currency pair's price ascend, a corresponding upward trajectory in the Accumulation/Distribution line is expected. This correlation validates that trading volume underpins the price increase, indicating a robust and sustainable upward movement.

If prices rise but volume does not, the move loses power. This forms a divergence between price and volume. It signals a potential shift to the other direction.

DownTrend

When the price of a currency pair declines, the Accumulation/Distribution indicator should also decrease. This relationship underscores that the downward price movement is supported by volume and is robust.

Conversely, if the price moves downward while volumes do not align, it indicates weakening momentum. This divergence between price and AD suggests a potential trend reversal in the opposite direction.

FX Analysis and How to Generate Trading Signals

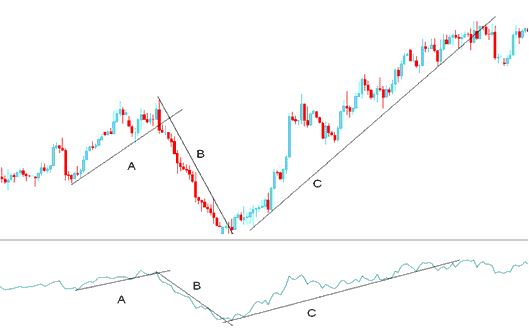

Illustrated Below is example illustration of a chart & the analysis explanation

From chart above we can separate the trading chart in to 3 parts, part A, B and C.

A - Upward trendline on chart & also on the Accumulation Distribution

B - Downwards trendline on chart & also on the Accumulation/Distribution

C - Upward trendline on chart & also on the Accumulation/Distribution

Provided that the price movement and the indicator are tracking in unison, this confirms that the price action possesses sufficient momentum to sustain its current directional path, as illustrated above.

Trend Line Break

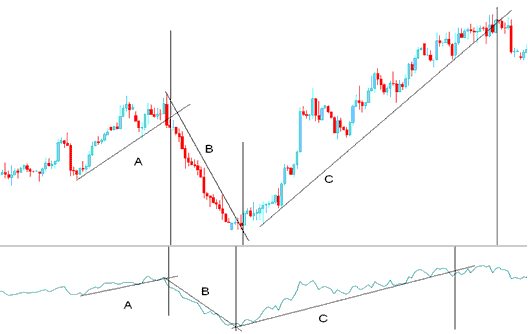

Looking at the chart above, we can see that when the trend line on the AD indicator broke, the price trend line also broke.

On the chart below, vertical lines mark where trend lines broke. This shows on both price and the indicator.

A comparison reveals that the trend lines derived from the indicator were violated by the price movement sooner than the actual chart trend lines. This observation is rooted in the principle that trading volumes consistently precede price action.

Signals

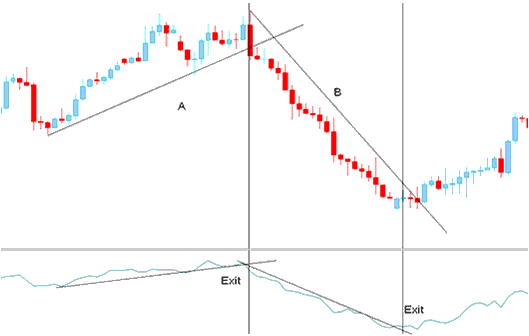

Exit

Exit signals come when the Accumulation Distribution trend line breaks. Such a break signals a potential shift.

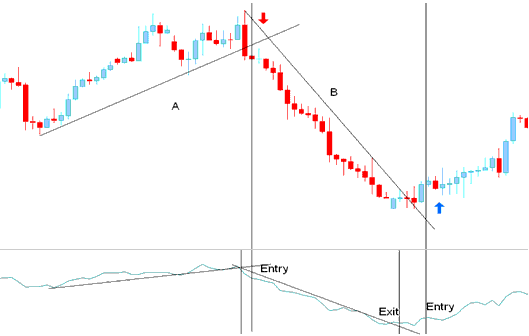

Entry

A break in the trend line on the AD signals a potential reversal in market direction.

But if we want to trade against the market trend, it is always better to wait and relax until we get a signal that confirms it.

A definitive confirmation signal is achieved when both the indicator and the price action successfully breach their respective trendlines.

Entry Trading Signal Derived/Generated by Trend Reversal

More Topics and Courses available:

- How Can I Add WallStreet 30 Index in MetaTrader 5 Platform?

- What is US100 Spreads? US100 Index Spread

- Alligator Gold Indicator Analysis in XAU USD

- Bollinger Band and Forex Price Volatility, High Volatility Markets and Low Volatility Markets

- Key Foundational Concepts for Trading XAU USD

- How to Trade Forex Using News FX Trading Strategies?