Forex News Strategy - Example illustration of News Trading

Economic news releases shake up forex markets and spark strong price moves. Breakout traders find plenty of short-term opportunities here.

But not every economic report about Forex is good for trading. Some economic news has a big impact on Forex currency pairs, but other news does not affect currency pairs at all. By checking the economic calendar, traders can see how important the upcoming Forex reports are and decide if the economic report is worth trading or not when they are studying Forex currency pairs.

The Forex FX news data reports are marked in terms of significance. There are three levels of significance: RED, ORANGE, GREEN. The most significant news reports for Forex are marked in red: the least significant for Forex are marked in green, while those marked and tagged in color orange are in between.

Forex News Trading Strategies:

Trading the breakout channel - News Strategies

Traders simply set Buy & Sell stop orders on both sides of price channel, so when the news data comes out one of the orders will probably be hit. Although this method is very simple, it also carries risks of potentially hitting the two orders: Buy & Sell trade orders as the market is volatile because of the economic reports. In such a double-hit situation traders will face losses on one or sometimes even both trades.

By analyzing the news report - Forex NEWS Trading Strategies

Traders can forecast the likely outcomes of news by examining the economic calendar sections marked as Forecast and Previous. These news statistics are then evaluated against the actual economic data released, providing insights into the existing economic climate, which aids in determining trading strategies for the Forex currency pair.

Traders trading watch the news report and pay attention to the actual numbers released. If the numbers come as a surprise meaning the reports are not close to what was expected or forecasted, then fundamental analysts opening positions will do so in accordance to the economic reports - If the news report is better than expected then fundamental traders open long buy positions. If the reports aren't favorable traders open short sell positions.

The most crucial thing you have to learn about Forex fundamental analysis is the market expectation of an economic indicator. Economic analysts provide prediction of a probable number or data of the economic indicator to be announced. This has an impact to the market and traders are positioned accordingly to trade Forex currency pair. When the economic report is released it impacts the market only when the report is different from what the market originally expected. That happens because every available economic indicator available to the public information is already taken into account when trading Forex.

Example of News Trading

The best news strategy, is one that is based on the economic news calendar used to time when the news releases are to happen so as to trade these data reports. A trader will keep a schedule of these economic new times and prepare how to trade the data before & after the data is released for the Forex currency pair.

A trader can get the times of when the economic data for Forex currency pair are to be released by observing an economic calendar. The economic news calendar contains the time-table of when news data for Forex are bound to be released. The economic news calendar is compiled by Financial Analysts and Economist who study the fundamental news reports and economies of the world. This News Calendar will show the timetable for all the news releases scheduled for the next 30 days for the Forex currency pair.

With this calendar, a trader can plan when to trade based on these economic data reports ahead of time. To get a copy of this calendar, a trader can search for "Forex Calendar," and you'll find several of these calendars online on different websites.

An Economic Calendar will generally have three readings:

- Previous Reading

- Forecast

- Actual News

Previous Reading - This piece of the data shows the previous value/data of a previous news data reports. Most fundamental news data reports are in the style of numeric numbers or percentages.

The forecast shows what experts predict for a report's value. They make these guesses well before release day. Analysts share their views on the economy.

- If the fore-cast number is better than the prior, traders will buy the currency associated with the good forecast

- If the fore-cast number is worse than the previous, traders will sell the currency associated with the bad forecast

Actual News Data Report Announcement

This specific factor will ultimately determine whether a substantial price movement materializes or remains absent.

If real data matches the forecast, markets stay calm. Traders already priced in the news before release.

If the actual news release isn't the same as the fore-cast, this will come in as a surprise to the FX traders, if the forecast and actual info release isn't the same then, the FX traders will have to adjust their trades accordingly & this will cause a price reversal in the opposite market direction of the Forex Currency.

In the same way, if the real info and number is much better than what people thought, the market will keep going the way it is and get even more push in that direction. Also, if the news is worse than what was expected, the price will still move the way it was before the news, but this time it will move with more strength and go even further.

Example:

The market is only impacted by the new information if it differs from what was predicted. The data has no effect on the Forex currency pair since it is already in the public domain and has already been considered if it is as anticipated.

For fundamental analysis, learn key market indicators first. Economists build the economic data calendar with all reports. They use it to forecast news. Analysts share these views. Such news can shake forex pairs hard. Traders track big announcements that hit financial markets.

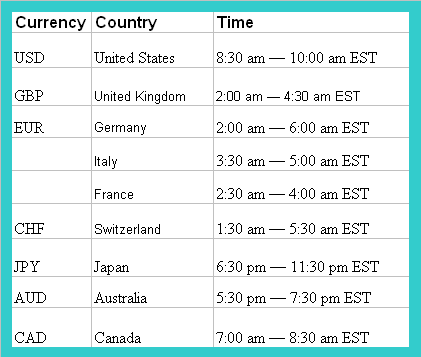

When are economic news released? - News Trading Strategy

Timetables for Economic Reports Announcements across major economies and the most frequently traded major forex pairs.

Explore More Lessons and Classes:

- Best ECN Brokers Ranking List

- How to Set S&PASX 200 in MT5 PC

- Use Moving Average Envelopes Indicator on MT5 Trading Platform

- Moving Average Strategy XAUUSD Indicator Technical Analysis

- Gann HiLo Activator Forex Trading Signals for Buying and Selling

- SMI (Stochastic Momentum Index) Signals for Buying and Selling Trades

- FX Trading Coppock Curve EA Expert Advisor Setup

- Participants Involved in the FX Trading Market

- Understanding the Average Directional Movement Index on MT4 Software

- Gold Leverage Meaning in XAU USD