Participants in the Forex and The for Profit Speculators

FX Market Participants - Participants Who Trade the Market

The currency market is traded for various reasons, each and every participant is in it for their own purpose. Shown Below is the list of the various players and the purpose of each of them:

- Governments

- Central Banks

- Banks

- Interbank Dealers

- Commercial Companies

- Retail Online Brokers

- Hedge Funds

- Speculators and Investors

There are 3 main reasons to take part in trading the market

The role of each market participant is:

- One is to facilitate international commerce and actual transactions, where governments and international corporations convert and cash in the profits made in the foreign currencies into their local domestic currency and exchange currencies to facilitate international business by trading in the market and thus becoming participants.

- Corporate treasurers & money managers also take part in trading in market transactions so as to hedge against unwanted exposure to future price action movements.

- The third and most popular reason to trade the market is based on speculation for profit. In fact, it's estimated that less than 5% of the total transaction activities is what actually facilitates commercial transactions, the other 95% is speculation based trading. The role of this group of traders is what we are most interested to cover on this site. Speculators are also popularly referred to as Day Traders.

About Various Market Participants

To learn more about market players, we will review the groups in Forex. We will also cover how each group affects the market.

- Governments

Governments participate in market for the purpose of settling payments from goods and services procured from other countries. A Government will have to first convert its countries currency into that of the country that it wants to do business with and it has to do this through the online trading market. Sometimes governments may also take part in Forex so as to influence the value of their currencies.

Governments are important participants when helping business happen with other countries or governments. When a government gets goods and services, it might use a different currency than its own, so the government might need to change its money first to get the right currency for the deal.

- Central Banks

National central banks carry significant responsibility through the regulation of the money supply, the establishment of domestic monetary policy, and the management of inflation via fiscal measures: they also engage in purchasing currency to augment their official reserves.

Central banks are also major participants when it comes to market trade positions as they may take part so as to either stabilize the exchange rate of their money in accordance with their monetary policy or even to carry out their specific monetary policy goals at a particular specific time.

For instance, central banks might lower the value of their money to make it simpler for other countries to do business there, because their goods will be cheaper than if their money had a high value. This is done to manage how much of their money is available and wanted.

- Banks

These big banks handle billions of dollars every day for businesses, their clients, and individual traders. Some of this trading happens for business clients, and some happens in the bank's treasury area, where dealers trade to try and earn money.

Banks primarily conduct their transactional operations to facilitate the movement of funds between various corporations and individual parties.

- Interbank Dealers

These traders handle large amounts of business, making interbank deals easier and connecting unknown parties for relatively small fees. Because more people are using the Internet, much of this business happens on electronic systems that are very good at connecting many regular banks.

These intermediaries facilitate transactions for financial institutions or retail brokerage firms, supplying institutional-grade liquidity to such entities.

Interbank dealers drive Forex action. They handle investor trades. Brokers send orders to them. Dealers match these in the interbank market. This provides steady liquidity.

- Commercial Companies

Large global and commercial companies that trade internationally use Forex to help with their international business activities.

Companies get involved to complete deals between them and other companies around the world.

- Retail Online Brokers

The internet has led to the creation of retail brokers. These give clients platforms, analysis, and strategy advice and will make trades for them and help investors who do not have much money. They will then give money to these retail investors as leverage. This group only helps by making trades for speculators.

Most banks do not handle Forex trading for retail customers. They lack the resources or desire to support these clients well.

Brokers will give prices for buying and selling, based on whether a regular investor wants to buy or sell: the trader then buys or sells the currency at the provided prices (bid price - the buyer buys at this price: ask price - the seller gets the currency at this price).

The role of this group is to only facilitate transactions between the market and the traders for a small markup called spread. The group does not therefore hold any orders of their own, they just facilitate the trading.

- Hedge Funds

Hedge funds use aggressive speculation methods to make profits. Hedge funds are investments that are under the management of experts & professional money managers, the size and liquidity of forex is very appealing and the leverage available in these markets also allows such funds to invest in with billions of dollars at a time.

Investors and Speculators - The Majority Participants

This group represents the majority of the transactions in the market, making them significant players in the industry. They account for 95% of the daily turnover in the trade market.

The Forex market stands as the largest and least strictly regulated global venue, offering investors unparalleled liquidity. Its daily trading volume approximates $7.2 trillion, contrasting sharply with the New York Stock Exchange (NYSE), which averages daily trade volumes of around $500 billion.

The spot market boasts the highest degree of liquidity. "Spot" implies that transactions are finalized within one business day. This market lacks a centralized exchange or physical location: trades occur over-the-counter, continuously (24 hours a day), directly between two parties via telephone or computer linkage.

Key players are central banks, firms, retail investors, and hedge funds. Online platforms now let small traders and firms tap the same deep markets as big ones.

Speculation accounts for 95% of the trading volume each day. The other 5% of the daily volume is from governments and businesses changing one currency into another when buying and selling items and services. This makes the traders together become the most important participants. Speculators offer lots of available cash, so if a government, business, or person wants to change their money for another, someone is always ready to buy anytime, and since trades are completed in the online interbank exchange, all trades are done without revealing identities.

In a theoretical scenario without digital execution, should there be no counterparty willing to purchase the currency you wish to sell, you would attempt the transaction only to be informed that you must await an interested buyer willing to exchange their funds for yours before the trade can settle. However, due to the nature of the current electronic, continuously fluctuating exchange market, there is perpetually a ready participant across the globe eager to trade currencies with you, provided they maintain connectivity to the interbank network.

Most of these people who bet on prices will trade currencies not to help trade, but to make money from the changes in the prices.

The speculators accomplish one of the most important functions of the online market, & that is to provide liquidity and thus play a crucial role of taking over the risks that other commercial participants hedge. The speculation activities aren't clearly defined because most of the players like banks also have speculative interests same as those of the retail traders.

FX is very popular with investors and speculators due to and because of the liquidity with which positions can be opened and closed & also because of the big amount of leverage which can be obtained and gotten from the online brokers thus increasing the profit margins for these participants.

The structure of the online exchange is:

The flow of transactions usually proceeds as follows: Interbank Market >>> Interbank Dealer (FX Liquidity Provider) >>> Broker >>> Individual Traders.

Retail investors utilize trading platforms that link them with their broker over an internet connection to trade currencies through online brokers. The traders may log in and trade from anywhere in the globe as long as they have an online internet connection, thanks to these online platforms.

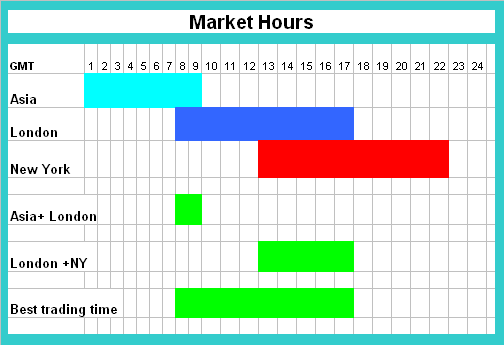

Most investors only trade during the busiest hours and stick to the major currency pairs: EURUSD, USDJPY, GBPUSD, and USDCHF.

Best Hours - How to Trade the Market

Brokers give new traders a free demo account to practice. No risk or money needed. It teaches how the forex platform operates.

About Learning for Speculators and Day Traders

To also help newbie investors to learn how buying and selling works, we've provided a group of gaining knowledge of publications and strategies that may assist the beginners to learn how to trade marketplace currencies and get the understanding required to make money. these kind of lesson may be found in this web page: analyze topics for beginner buyers and you as a foreign exchange dealer can also discover a list of all of the famous techniques that you may use to investigate currency charts on this page: forex strategies That work.

Study More Tutorials and Guides & Lessons:

- Need to add EU50 in the MT5 app? Let me walk you through it.

- Understanding USDHKD Bid Ask Spreads

- Understanding What a 100% XAU/USD Margin Means

- Adding the NZD/CHF symbol or quote to MetaTrader 4 - here's how

- How to Undergo a Transformation in Trading Psychology and Mental Conditioning

- Price Action Trading – Hands-On Lessons and Tutorials

- Analyzing the Kurtosis Indicator for Trading Strategies

- Choosing an Online Broker for Trading the CAC 40 Index

- Trading SX5E Index on MetaTrader 4 & 5 Platforms