How to Calculate Leverage (Gearing) and Margin

Leverage lets you control large sums with small funds by borrowing the rest. This draws many investors to the currency market.

Example:

We'll use this example to explain. If your broker offers 100:1 leverage, pick that as the max for any account.

This means you borrow $100 for every one dollar you have on your trading account.

Your broker lends $100 for every $1 in your account. This boost is called leverage or gearing.

This setup means that with a $10,000 account and 100:1 leverage, each $1 you put in controls $100. So you handle a total of $1,000,000.

If for 1 dollar the online broker gives and provides you 100

Then if you have 10,000 you will get a total of:

$10,000 * 100 = 1,000,000 dollars

Now you control 1,000,000 dollars of Investment

Most new traders ask what leverage is best for 10,000 dollars, or 20,000 dollars, or 50,000 dollars account? - The best option to choose when opening a live account is 100:1 & not 400:1.

What's Margin?

Brokers demand this margin amount to let you keep trading with borrowed funds.

In other words the question what is margin in Forex? can be explained as the money required to cover open currency trades and is denoted in percentage. For 100:1, the amount you'll control is 1,000,000 dollars as presented in the above exemplification.

Now can you compare someone investing $10,000 with another one investing $1,000,000? Obviously You Can't. This is how it works, it takes you from that guy investing $10,000 to that one investing $1,000,000 or that one investing $50,000 to that one investing $5,000,000. Where does this extra money come from? You borrow from your broker in what is simply referred to as Leverage or Gearing. This funds that you borrow, you borrow it against the $10,000 dollar of your own which you deposit with your broker. If you were to describe what this means - then it is the ability to control a big amount of money using very little of your own money & borrowing the rest. Otherwise, if you were to trade without this gearing it would not be as profitable as it is, in fact you can still choose not to use it, using the 1:1 option but you wouldn't make money it would take too long to make any profit.

Explanation of how to calculate:

The margin necessary in this situation is 10,000 dollars of your money, if that is shown as a percentage of the 1,000,000 dollars you are controlling:

If leverage = 100:1

10,000 / 1,000,000 * 100= 1%

Required margin is 1 percent

(1/100 *100= 1%)

"Trade Forex Trading - Simplify a little bit please because I am a Beginner Trader'

You have a $10,000 capital after gearing, which gives you control over $1,000,000. The amount of your account margin need is 1% of $1,000,000, or $10,000. (Simplify).

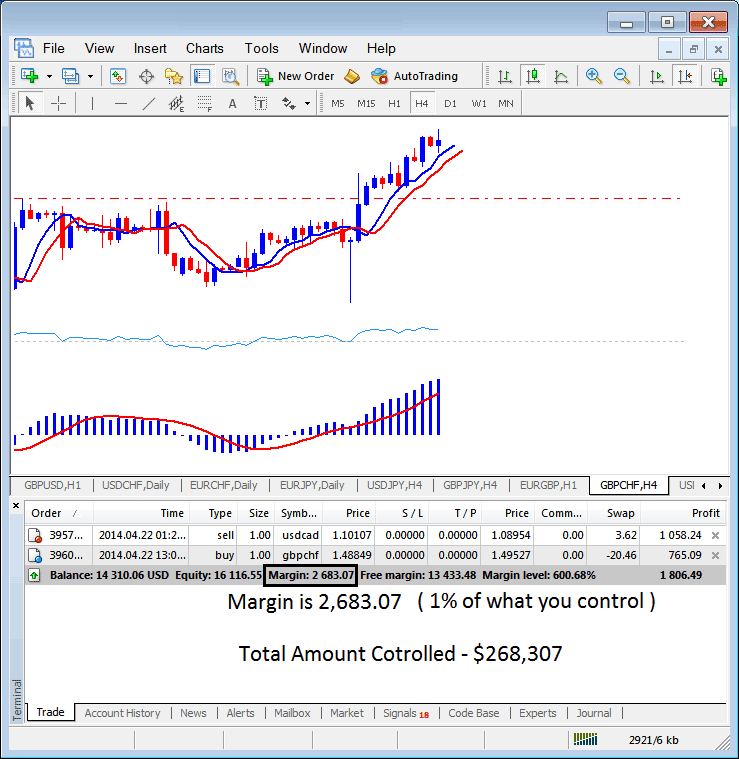

The illustration below, the set leverage is 100:1 ratio option, the margin which is 1 % is $2683.07 dollars, hence the total sum controlled by the trader is: $268,307 - this is because with this leverage option a trader has used little of his money and borrowed the rest of the amount, with this set at 100:1 option, the trader is using 1 percent of their trading account capital, this 1 % is equivalent to $2683.07, if 1 percent is equivalent to $2683.07 dollars then 100 % is $268,307 dollars

MT4 Transactions Window

- If = 50:1

Then margin requirement = 1/50 *100= 2 %

If you've got $10,000,

10,000* 50 = $500,000.

10,000 / 500,000 * 100= 2%

(Simply put, with $10,000 and gearing, you manage $500,000: $10,000 is what percentage of $500,000? It's 2%): that's your account's margin requirement.

- If = 20:1

Then margin requirement = 1/20 *100= 5 %

If you've got $10,000,

10,000* 20 = $200,000.

10,000 / 200,000 * 100= 5%

(Simplify - your capital is $10,000 after gearing you control $200,000 - $10,000 is what percent of $200,000 - it is 5%)

- If = 10:1

Then the requirement is = 1/10 *100= 10 %

If you've got $10,000,

10,000* 10 = $100,000.

10,000 / 100,000 * 100= 10%

Simple math: $10,000 becomes $100,000 with gearing. That means 10% of the total.

The Distinction Between Maximum Available Leverage and Leverage Currently Utilized in a Trade

However, you should note that there is a difference between maximum (leveraging given by your broker which is the highest leverage you can trade with if you select to) & used (leveraging depending on the lots you have opened/open trades). One is broker's (Max) and other is trader's (Used). To explain this concept we will use example above:

Should your broker offer a maximum leverage of 100:1, but your actual trade size is only $100,000 in lots, your Used Gearing will be calculated as:

100,000 compared to 10,000 (your capital).

10:1

You are currently employing a 10:1 leverage ratio, even though your maximum permitted leverage stands at 100:1. Consequently, whether your account allows a 100:1 maximum or even a 400:1 maximum, you are not obligated to utilize the full extent of that capacity. It is advisable to keep your actual utilized leverage around the 10:1 mark, yet select the 100:1 maximum option for your trading account. This additional gearing creates what we term Free Margin. As long as a trader maintains Free Margin in their account, their trade transactions will not be subject to forced closure (stop out) by the currency broker, as the required margin level will remain above the necessary threshold.

In trading currencies one of your rules: equity management rules on your trade plan should be to use below 5:1.

In this screenshot, the trader risks $2683.07. Total control hits $268,307. Equity sits at $16,116.55. So the ratio is $268,307 divided by $16,116.55, or 16.64 to 1.

16.64 : 1

Margin trading involves allowing participants to control substantial currency volumes using only a small fraction of their own capital, with the remainder being borrowed funds.

Obtaining this account will enable you to borrow money from the broker to trade currency lots with: the lots are worth $100,000.

The amount you can borrow with your account is known as "leverage", and it is usually shown as a ratio - a 100:1 ratio means you can control things worth 100 times the amount of money you put down.

In Forex terminology, this implies that holding a 1% margin in your account grants control over one standard lot/contract valued at $100,000, secured by an initial deposit of $1,000.

However, Trading this account increases both potential for earning profits and also losses. In you can never lose more than what you invest, losses are limited to your deposits and generally brokers will close out a trade position which extends beyond your deposit amount by executing a margin call. Traders must therefore try to keep their trading margin level above that which is required. By using money management principles & keeping your used leverage below 5:1, then as a trader can learn how to manage this.

Update: in Forex you can lose more than you deposit with some brokers, that's why when opening an account you should look for a Negative Balance Protection Policy(NBP), this policy means you can not lose more than you deposit.

Benefits

Like I said earlier, this kind of account lets you buy more and possibly make more money or lose more money. Here is how it works: a 1% margin lets you control a $1,000,000 position with $10,000. When you start a trade with $1,000,000, even small changes in the price of the currency can lead to big gains or losses.

Currencies movements are measured using points known as pips. For illustration, America dollar, is transacted in units down to 4 decimal places, the last decimal point is called a pip. Instead of $1.4 quotes like in Forex bureaus, the price is seen as $1.4012. When you are $1,000,000 then each pip is worth $100 profit. So if this price moves up 1 pip to $1.4013 you'll make $100 profit. 1 cent is equal to 100 pips, if a currency moves 1 cent you make $10,000, if this move is against you, then you lose all your capital. That it is not best to open positions with $1,000,000 just because you can, but you can open transactions of $50,000 or $100,000 as the maximum so that a 1 cent move you'll make $1,000 dollars and if the move is against you only lose $1,000 dollars and not your whole account equity. There is also the technique of money management and risk management.

Should the price move from 1.4012 to 1.4062, representing a 50-pip shift, this translates to a $5,000 profit. Without leveraging, dealing with $10,000 of the currency, the identical price change from 1.4012 to 1.4062 would yield a profit of only $50. Therefore, the advantage of this form of online trading is the amplified profit potential, where your profit factor is multiplied by a factor of 100, 50, or 20, dependent on the total leverage employed.

You do not need a calculator for pivot levels. Most platforms compute and show them. In MT4, find them in the trade window. Hit CTRL+T to open it, right below your positions.

Explore Additional Tutorials and Courses:

- GBP USD Spreads Explained

- What is GBP SEK Spread?

- DJ 30 Trade Strategy Example

- Applying Ichimoku Indicators on MT5 Chart Analysis

- How Can You Place S&P ASX in MT5 S&P ASX App?

- Trading Indices Utilizing Moving Averages: Practical Examples with MAs

- SPAIN 35 MT4 SPAIN35 Name on MetaTrader 4

- Utilizing the MetaTrader 5 Triple Exponential Average (TRIX) Indicator