Coppock Curve Analysis and Coppock Curve Signals

Edwin Sedgwick Coppock is the author.

Initially conceived for technical examination of equities and raw materials, this indicator later found application in Forex trading.

This is based on the idea of trading psychology, assuming that people's behavior is predictable, and that price movements always happen in a back-and-forth, or zigzag, way.

Adaptation levels explain price reactions at key points. Stocks and currency prices often match past setups.

Forex Analysis and How to Generate Trading Signals

In Forex trading, the MA is the most basic way to adjust levels, and the price will go up and down around it. This is the simple idea behind this tool, which is a longer-term tool that shows how high or low something is based on these adjusted levels (moving average), but in a different way.

Oscillators calculate the percentage change of the current price compared to a previous reference price, referred to as adaptation levels.

Edwin Coppock, the creator of this particular indicator, held the view that the prevailing emotional state of market participants during trading could be assigned a measurable value and estimated. This estimation is achieved by aggregating the percentage changes across recent historical price periods to derive a broad gauge of the momentum in the longer-term market trend.

For instance, if we evaluate the current prices compared to a year prior and find that this month, the market has risen by 20 percent in contrast to the same time last year, and last month it increased by 15 percent in comparison to over a year earlier, we can infer that the pricing is gaining traction in its trend.

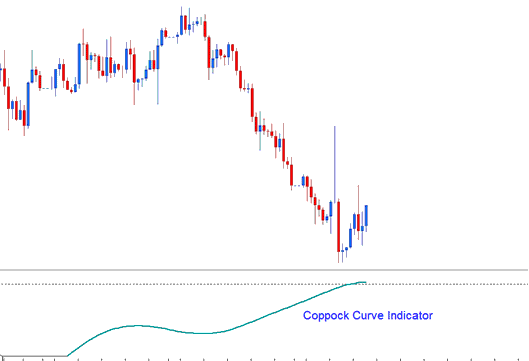

Fundamental signals can also be extracted from the Coppock Curve to trade market price reversals occurring at extreme price values. Furthermore, searching for divergences and trend-line breaches can be combined with these signals for added confirmation.

Implementation

The input parameters of this indicator may need modifications to align better with the dynamic character of trading in currency markets.

The Coppock Curve includes a zero mark to use as a reference, but this mark only offers a simple way of seeing data and not adaptation-levels.

More Tutorials: