SMI20 Index

The SMI20 Index tracks the top 20 companies on the Swiss Exchange. These blue-chip shares are the busiest ones traded there.

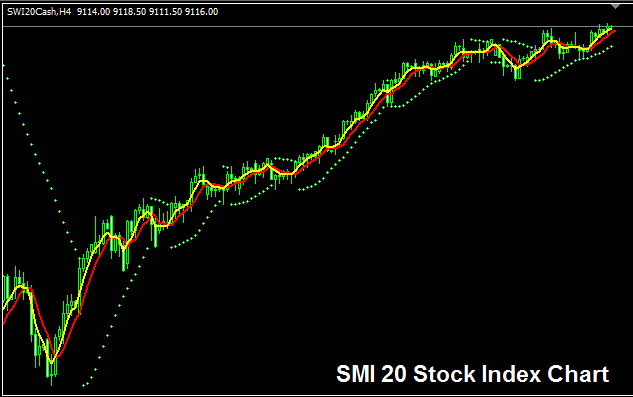

SMI 20 Chart

The SMI20 chart is presented and displayed above. In the example above, this Index is referred to as SWI20CASH. You should search for a broker that provides the SMI 20 chart to initiate trading. The example shown above pertains to the SMI20 Stock Index on the MetaTrader 4 FX Platform.

Other Info about SMI20 Index

Official Index Identifier - SMI:IND

The SMI20 Index picks its 20 stocks from France's leading companies. These shares cover most of the trade volume on the SIX Swiss Stocks Market. It gets checked each year.

Strategy for SMI20 Index

SMI20 Stock Index keeps track of capitalization of top 20 corporations in Switzerland. This Index in general moves upwards over longterm because the Swiss economy also shows strong growth. Swiss economy also has one of the strongest banking system in the globe - making Swiss economy one of the most solid economy.

As a indexes trader you want to be biased & keep on buying as the index heads and moves upward. When the Swiss economy is performing well most of these top shares will continue to move up & hence this index will also move in an upward market trend. A good stock index trading strategy would be to keep buying and buy the market dips.

During Economic SlowDown and Recession

Throughout periods marked by economic deceleration and recession, businesses tend to report subdued profitability and less optimistic growth projections. This dynamic leads traders to divest from the shares of corporations that are posting lower earnings, resulting in a corresponding downward movement in the indices that represent these particular stocks.

Hence, during these times, market trends are a lot more likely to be heading downwards and you as a trader should also adjust your trading strategy accordingly to fit the ruling downwards trends of the index which you as a trader are trading.

Contracts and Details

Margin Required for 1 Contract - CHF 100

Value per Pips - CHF 0.5

Important: Although the general direction is usually upwards, as someone who trades, you need to think about and include how much the market changes each day: on some days, the Indices might stay within a certain range or even go back and forth, and sometimes this pullback can be big, so you as a trader need to time when you get in very carefully using this plan: trading strategy, and also use good money management rules and ways to handle your money if the market changes unexpectedly. About ways to handle your stock investments. in stock market topics: What is managing stock investments and ways to manage money in stock market.

Get More Guides & Guides:

- AUS200 Indices Strategy

- Benefits of Hosting XAU/USD EA Bots on Broker-Provided VPS Services

- How to Add the Standard Deviation Indicator to MT4 Charts

- How to Calculate Pips Profit in Trading for 100 Pip

- Learn XAU USD Basics and Gold Market Basic Concepts

- How to Master Course Tutorials Key Concepts

- Factors to Consider When Setting XAU USD Stop Loss Order

- Which Broker is Best for Opening and Sign Up Mini Account?