Nikkei225 Index

Nikkei225 Index is a market indexes for the Tokyo Bourse in Japan. This Index tracks the shares & stocks of top 225 corporations displayed in the Tokyo Stock Exchange Market.

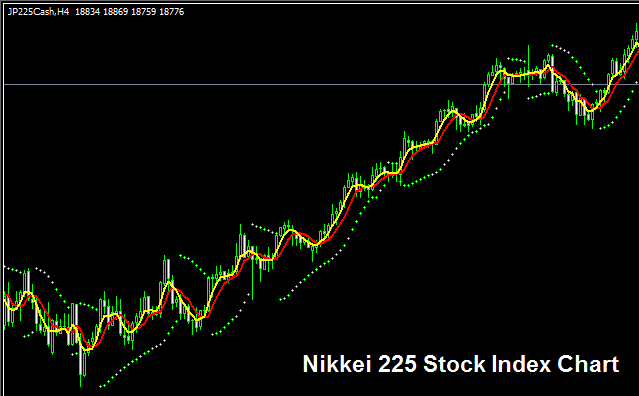

The NIKKEI 225 Index Trade Chart

The NIKKEI 225 index chart appears above. In this example, the index is named JP225CASH. Find an online broker that provides the NIKKEI 225 index chart so you can trade it. The example shown above is the NIKKEI 225 index on the MT4 Forex platform software.

Other Data about NIKKEI 225 Index

Official Symbol - NKY:IND

The 225 stocks that make up the NIKKEI 225 Index are chosen from the most successful Japanese companies. The NIKKEI 225 stock market index is closely watched as a sign of how well Japanese businesses are doing. The index is calculated using a simple formula based on the value of the companies in the market.

Strategy of NIKKEI 225 Index

The NIKKEI 225 tracks Japan's top 225 stocks. It follows 225 firms. This makes it more volatile than the DAX 30, which covers just 30 companies.

If you're a trader wanting to trade this Index, keep in mind that it's generally more up and down, and while its trend is usually up over time, it will move more than other Indexes. Your plan should consider this higher movement when trading this stock index.

When the Japanese economy is performing and doing good (most times it is performing well) this upwards trend is more than likely to be the one present. A good stock indices trading strategy would be to buy dips.

During Economic SlowDown & Recession

During economic slow-down and recession times, firms start to report slower revenues, lower profits and lowers growth projections. It's because of this reason that traders start to sell shares of companies which are reporting and recording lower profits & therefore the Index tracking these specified stocks will also begin to move downward.

During times when markets trend downward, traders should adjust their strategies to align with the prevailing bearish trends of the index they are trading.

Contracts and Specifications

Margin Required Per One Lot - JPY 90

Value per Pips - JPY 0.1

NB: Even though the main and overall trend usually goes upward, as an investor you need to think about and include the daily market price changes, on some days the Index might move back and forth or even go down & pullback, market move back might also be a big one sometimes & so as the investor you have to time your start exactly using this plan: Index plan & also use correct and good money handling ways and advice if there is more surprise movement in the market. About stock handling rules and advice in stock indices trade lessons: What is Index stock handling & money handling system/plan.

Discover Additional Classes and Courses:

- How to Identify Hidden Bullish Divergence and Hidden Bearish Divergence

- Trailing Stop Loss Levels Trading Indicator

- How Do You Analyze Reversal Pattern Setups for Beginner Traders?

- Multiple XAU USD Strategies That a XAU USD Trader Can Trade XAU USD with

- How to Place Zigzag Indicator in FX Chart on MT4 Software

- DeMarks Range Extension Stock Index Indicator Analysis

- Meaning of Forex Pips & Explanation Examples of a Pip

- Analysis of Trading Strategies Centered Around the Moving Average (MA) Convergence

- Setting Up a Relative Vigor Index Expert Advisor