Comparing Hidden Bullish vs. Hidden Bearish Divergences: Effective Trading Techniques

Hidden Bullish Divergence vs Bearish Divergence

The hidden divergence pattern is often viewed as an indicator for trend continuation after a price retracement. It suggests that the original trend is resuming, making it an ideal setup for traders looking to trade in line with the prevailing market trend.

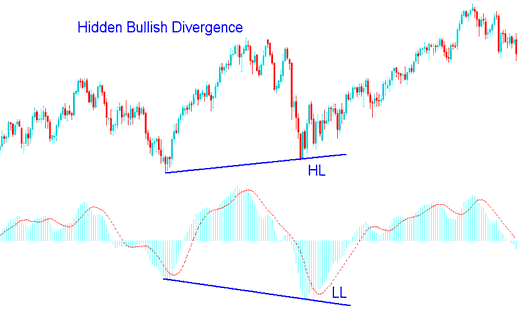

Hidden Bullish Trade Divergence

This happens when the cost is creating a higher low (HL), but the oscillator technical indicator shows a lower low (LL). To easily remember these setups, think of them as W-shapes on charts. It happens when the price goes back a bit in an upward trend.

The screenshot below shows this setup. Price formed a higher low, but the indicator made a lower low. This shows divergence between price and indicator. It signals the uptrend will soon continue. In short, it was just a pullback in an uptrend.

This confirms that a retracement move is exhausted and reflects the underlying momentum of an up-trend.

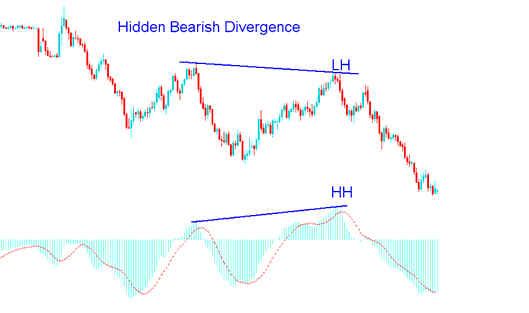

Hidden Bearish Trade Divergence Setup

This divergence occurs when the price forms a lower high (LH) while the oscillator indicator shows a higher high (HH). These setups resemble "M" shapes on charts and typically form during retracements in downward trends.

The exemplification below illustrates and shows an image screen-shot of this setup, from the screen-shot price made lower high (LH) but the indicator made a higher high (HH), this shows that there was a divergence pattern between the price and indicator. This highlights that soon the market downtrend is going to resume. In other words it portrays this was just a retracement in a downward trend.

This observation confirms that a retracement move has reached its limit and signals the inherent strength of the prevailing downtrend.

Other popular trading indicators used are CCI indicator (Commodity Channel Index (CCI) Indicator), Stochastic Oscillator Indicator, RSI & MACD. MACD and RSI are the best technical indicators.

NB: Hidden divergence trade setup is the best type divergence to trade because it generates a signal that's in the same direction with the present market trend, thus it has a high risk : reward ratio. It provides for best possible entry.

Forex traders are advised to complement this trading setup with other indicators, such as the stochastic oscillator or moving averages (MA). Buying when a currency is oversold and selling when it is overbought can enhance trading success.

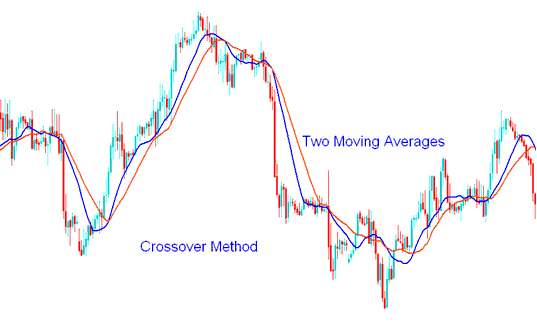

Pair Hidden Divergence with Moving Average Crossovers

A good indicator to combine these setups is the Moving Average using MA cross over trading method. This will create a good strategy.

Moving Average Cross-over Technique

In this approach, a trader waits for the moving average crossover after a signal appears. It must match the signal's direction. For a bullish divergence between price and the indicator, look for an upward crossover. For a bearish divergence, wait for a downward crossover from the moving average system.

Pair this alert with more tools to dodge false moves in your trades.

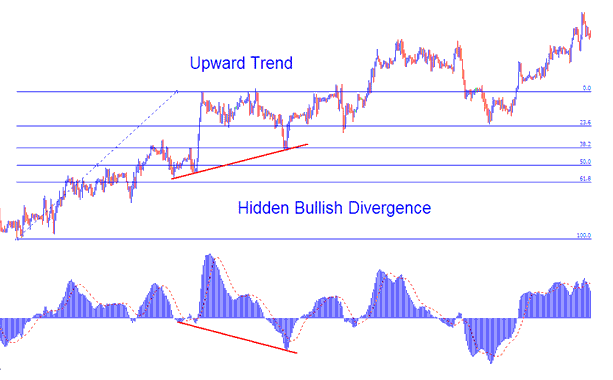

Combining Together with Fib Retracement Levels

For this example, we will consider an upward trend using the GBPUSD currency pair and the MACD indicator.

Because the hidden divergence pattern is just a retracement in an upward trend we can combine the trading signal with the most popular/liked retracement indicator that is the Fibo retracement levels. The exemplification below shows that when this setup appeared on the trading chart, price had just hit 38.20% level. When price tested this level, this would have been a good level to open/execute a buy order on the GBPUSD forex currency.

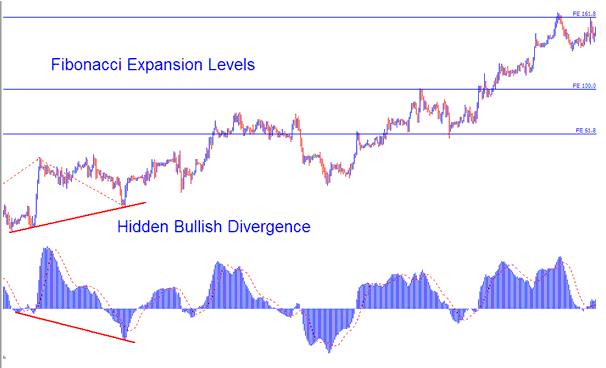

Combining with Fibo Expansion Levels

In the above exemplification once buy trade was placed, a forex trader would then need to calculate where to set the tp order for this position. To do this one would need to use the Forex Fibo Expansion Levels.

The Fib extension was drawn just as illustrated on chart such as illustrated below.

For this exemplification there were 3 tp order areas:

Expansion Level 61.80 % - 131 pips profit

Expansion Level 100.00 % - 212 pips profit

Extension Level 161.80% - 337 pips profit

Using this strategy with the Fib indicator could have made a good plan with a good amount of profit by setting the take profit order amounts well.

Get More Lessons:

- Explanation of 1:400 Leverage with a Concrete Illustration

- How do you analyze candlestick strategies?

- How to Use MetaTrader 5 McGinley Dynamic on MT5 Program

- How to Access the EURPLN Chart on MetaTrader 4

- Stop Loss Settings for XAU/USD Orders

- How do you use buy and sell indicator signals?

- Calculating and Understanding Pips for SGDHKD Currency Pairs

- How to Locate and Access the SP 500 Index within the MetaTrader 4 Platform