DeMark Analysis and Range Extension Index Signals

Made by Tom DeMark.

DeMarks used the Range Expansion Index to trade options in his plan. This trading tool is a type of indicator called an oscillator.

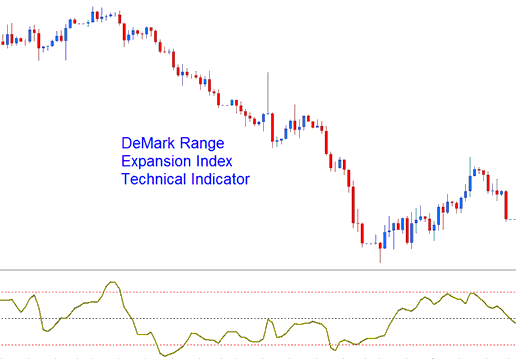

DeMark Range Expansion Index

The Oscillator Indicator functions as a timing tool in trading. It addresses challenges associated with exponentially calculated oscillators, which often lag due to their arithmetic-based computation. This indicator seeks to provide more accurate market signals.

FX Analysis and How to Generate Trading Signals

This Oscillator generally oscillates between the values of -100 to +100.

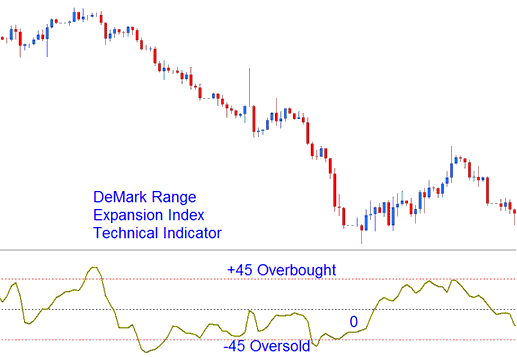

Overbought Zones - Readings of +45 or higher indicate overbought conditions.

Oversold Zones - Readings of -45 or lower reflects over-sold conditions.

Overbought & Over-sold Levels on Indicator

Exit signals, as per DeMark's guidelines, discourage trading during extreme overbought conditions signified by six or more bars above +45. An exit for buy signals is triggered six bars after the price reaches +45.

Exit signals come from extreme oversold spots. Six or more bars below -45 trigger shorts to close.

Explore Additional Tutorials and Courses:

- Aroon Trade Forex Robot Expert Advisor

- How Can I Trade SX 50 Method?

- Understanding the Basics of Forex Trading

- List of Top Australia Forex Trading Brokers

- MetaTrader FRA 40 Index FRA 40 MetaTrader 4 Forex Trading Software/Platform

- Transforming Your XAUUSD Psychology and Mindset When Trading

- What is a Gold Margin Trade Account?

- How to Set Zigzag Technical Indicator in XAUUSD Chart on MetaTrader 4 Software

- MACD Technical Analysis Summary

- How to Find and Open the NOK/JPY Chart on MT4