What's a Margin Account?

A Gold Margin trading account is a facility that permits traders to control substantial trade positions by utilizing only a small portion of their own capital while borrowing the remainder from their brokerage firm.

What's a Margin Account?

Obtaining this margin account will enable you as a trader to borrow money from your broker to trade with.

The amount of borrowing power your account provides you what's called " leverage", and is mostly expressed as a ratio - a ratio of 100:1 means you can control resources that are worth 100 times more than your deposit - leverage 100:1 means you can borrow 100 dollars from your broker for every $1 dollar on your account.

Interpreted for Gold, this means that with only 1% margin in your trading account, you gain control over a full standard lot, equivalent to one contract valued at $100,000, based on a capital deposit of $1,000.

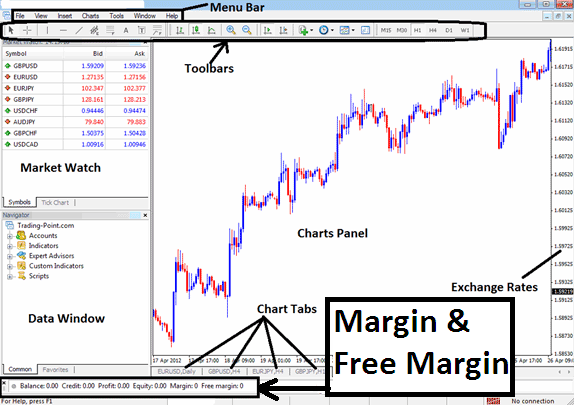

However, Trading this account increases both the potential for profits & also losses. In you can never lose more than you invest, losses are limited to your deposits and generally brokers will close a trade position which extends beyond your deposit amount by executing a margin call. Traders must therefore try and keep their margin requirement level which is above that which is required. By using equity management rules and keeping your used leverage below 5:1.

To Learn and Know More about Leverage and Margin - Learn the Topics Listed Below:

Gold Leverage & Margin Explained with Example

Learn More Guides and Guides: