Leverage Example and Margin Example and Examples

Margin required: This refers to the amount of money your trading broker necessitates from you to open or execute a position, expressed as a percentage.

Equity : It's the total sum of capital you have in your account.

Used margin is cash from your account tied up in an XAUUSD deal. That contract shows in your open trades. You can't touch this money after you place the trade. It's already in use and out of reach.

In other words, when your broker uses borrowed money to open a trade for you, you need to keep some money in your account as a safety net, so you can keep using the leverage they gave you.

Free margin : amount in your account which you can use to execute new trades. This is the sum of money in your trading account that hasn't yet been xauusd gold trading Leverage Examples because you've not yet opened a trade using this money - this money is also very important for you as a investor because it facilitates you to continue holding your open trades as explained below.

However, if you use xauusd trading Leverage too much, for example, this free margin will fall below a certain point, and your online broker will have to close all of your trade positions automatically, causing you to have a big loss. The xauusd broker closes all your positions at this time because if your trade positions were left open, they would lose the money that you borrowed from them.

This underscores the importance of maintaining ample free margin. To achieve this, never commit more than 5% of your account capital: in fact, an allocation of 2% is the recommended ceiling.

Differentiating Between Leverage Set by the Broker for XAU/USD and the Leverage Actually Utilized

If the gold trading Leverage Example is 100: 1, it means you can borrow as much as 100 dollars for every 1 dollar you have, but you don't need to borrow the full $100 for every dollar, you can choose to borrow 50:1 or 20:1. Even if the leverage is set to 100:1, the leverage you use will be the 50:1 or 20:1 that you borrowed to trade.

Example:

You have $1000 (Equity)

Set 100:1

Leverage Example Used = Amount used /Equity

If you buy xauusd trading lots equal to 100,000 dollars that you will have used

= 100,000/1000

= 100:1

If you buy lots equal to $50,000 dollars you'll have used

= 50,000/1000

= 50:1

If you buy lots equal to $20,000 dollars you'll have used

= 20,000/1000

= 20:1

In these three cases you can see that although the set is 100:1

The leverage ratios applied are 100 to 1, 50 to 1, and 20 to 1, depending on the volume of contracts or lots traded.

So Why not just pick and use the 10:1 choice as the highest amount of borrowing? Because to stick to the rules of using the correct amount of money it is even suggested that traders use less than this?

This might seem like a simple question, but it is not. When you trade, you are using borrowed money known as Leverage. When you borrow money from someone or a bank, you must put up something of value as collateral to get the loan. This is true even if the collateral is a monthly payment from your paycheck, just like with XAU/USD.

In XAU/USD, the security is referred to as margin. This represents the capital you deposit with your broker.

This number changes in real-time as you trade. If you want to keep the borrowed money, you must have enough capital available (your deposit) as a trader.

Now if Your Leverage Example is 100:1

When trading, suppose your account balance is $1,000 and you employ a leverage ratio of 100:1 to purchase a standard contract valued at $100,000. In this case, your margin for that trade would be $1,000, meaning this is the amount you would lose if the trade moves unfavorably. The additional $99,000 would be borrowed, and should your balance of $1,000 be depleted by the market, your open trades will close automatically.

This condition, however, is only valid if your broker has stipulated a 0% Margin Requirement before automatically liquidating your open positions.

If you want your trades to automatically close when you only have 20% of your money left, your positions will stop when you have $200.

If this level needs to be at 50% before your trades close automatically, your positions will be stopped once your account balance reaches $500 as a result of those trades.

If they set 100% requirement of this level before closing your execute positions automatically/mechanically, then your trade position will be liquidated once your balance gets to $1,000: Explanation the trade will closeout as soon as you execute it because even if you pay 1 pips spread your account balance will get to $990 & the needed % is 100 percentage i.e. $1,000, thence your open positions will immediately get liquidated.

Most brokers do not set 100% requirement, but there are those who set 100% aren't appropriate for you at all, select those set 50 percent or 20% margin requirements, in fact, those brokers that set their trading margin requirement at 20% are some of the best since due to the likely-hood they liquidate-out your trade is minimized just as is illustrated and shown on examples revealed above.

To find out about this amount, which your platform figures out for you, MetaTrader 4 calls it "Gold Margin Requirement." This is shown as a percentage: if the percentage is higher, your trades are less likely to be shut down.

For Example if

Using 100:1

If the trading leverage for XAUUSD is 100:1, and you trade in lots worth $10,000

$10,000 divide by 100:1, used capital is $100

Calculation:

= Capital Used * Percent(100)

= $1,000/$100 * Percentage

Gold Margin Requirement = 1000%

Trader has 980% above the requirement amount

Using 10:1

If the trading leverage for XAUUSD is 10:1 and you trade contracts/lots equivalent to $10,000.

$10,000 divide by 10:1, used capital is $1000

Calculation:

= Capital Used * Percent

= $1,000/$1000 * Percent(100)

Gold Margin Requirement = 100%

Trader has 80% above the required sum

A higher xauusd gold trading Leverage Example means someone has a higher percentage than needed (More "Free Margin"), so their open xauusd deals are less likely to be closed. This is why investors pick the 100:1 option for their trading account, but they only trade up to 5:1 based on their risk management rules.

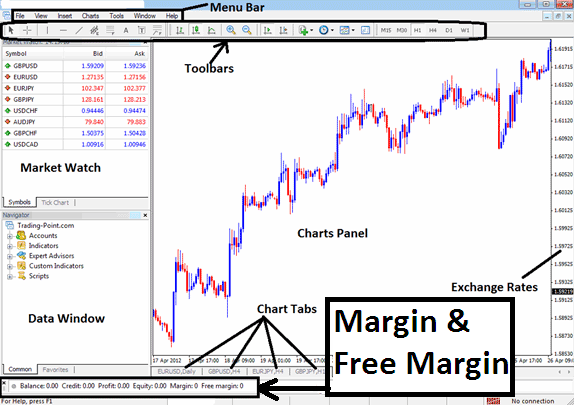

These Zones are Shown on the Platform Software Image Below as an Example:

MetaTrader 4 Software

More Guides:

- What is the Way to Set T3 Moving Average?

- Comprehensive Forex Manual

- How Do I Place Forex Currency to MT4 Software/Platform?

- A Lesson on How to Trade JP225 You Can Download

- USD vs DKK Exchange Chart

- GBPCAD Currency Pair

- Trading Divergence with RSI Index

- A Detailed Explanation and Description of the Process for Registering a Real XAUUSD Account.

- How to Trade a Stock Index on MT4 Platform

- Forex Automated EA Setup for DeMarks Range Expansion Indices