RSI Divergence Setups for Indices: Recognizing Classic Bullish and Classic Bearish Divergences

Index classic divergence is used as a possible sign for a trend reversal. Classic divergence trading pattern is used when looking for an area where the price could reverse & begin going in the opposite market direction. For this reason forex classic divergence is used as a low risk entry method/technique & also as an accurate way to exit of a trade.

- Classic divergence setup is a low risk method to open sell near the top or buy near the bottom of a market trend, this makes the risks on your positions are very small relative to the potential reward.

- Classic divergence setup is used to predict the optimum ideal level at which to exit a trade

Two Kinds of Classic RSI Divergence Patterns Exist

- Classic Bullish Divergence Setup

- Classic Bearish Divergence Setup

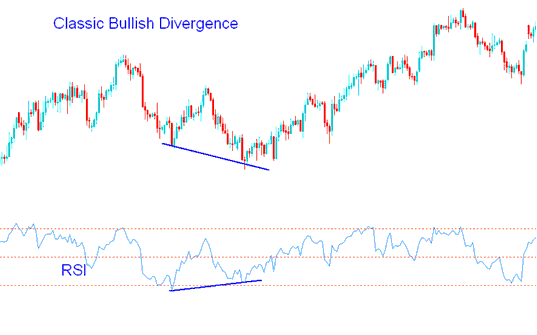

Classic Indices Bullish Divergence

A typical Index bullish divergence happens when prices reach new lows (LL), but the oscillator shows higher lows (HL).

Classic Indices Bullish Divergence - RSI Strategies

A classic bullish divergence suggests a potential shift in market direction from declining to advancing. This occurs because, despite the appearance of lower price highs, the downward price movement was supported by a diminished selling volume, as observable via the RSI technical indicator. This indicates underlying weakness in the prevailing downward trend.

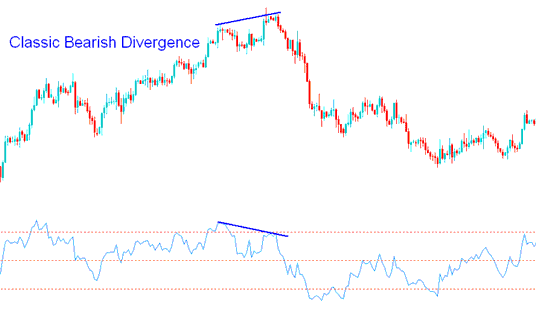

Classic Indices Bearish Divergence

Bearish divergence on Classic Indices occurs when the price establishes a higher high (HH), while the associated oscillator registers a lower high (LH).

Classic Bearish Divergence Trade with RSI Indicator Index Strategies

Classic Indices bearish divergence warns of a possible change in the trend from upward to downward. This is because even though the price headed higher the volume of buyers that moved price higher was less just as is shown by the RSI indicator. This indicates underlying weakness of the upwards trend.

Learn extra guides and topics

- Support & Resistance Levels MT5 Technical Analysis

- Time Frame Chart Index Trade Chart Time-frame Indices

- Setup Procedure for an FX Trade Moving Average (MA) Crossover Expert Advisor (EA)

- Forex EURO STOXX 50 in MT4 Index EURO STOXX 50 Quote in FX MT4 Platform

- RSI Overbought and Oversold Levels: RSI 70 and RSI 30 Levels in FX

- How to Use MT4 Aroon Oscillator Indicator

- How Can I Add SX 5E in MT5 PC?

- CHFJPY Spread Described

- Learn XAUUSD Basics

- Trailing Stop Loss Levels Indicator