Moving Average (MA) Technical Analysis and the Signals Generated by MA Crosses

A indicator that calculates the average value of prices (or any specified data sequence) over a pre-determined time period.

The variation in Moving Averages (MAs) lies primarily in how weight is assigned to recent data. Simple MAs apply equal weight across prices, while exponential and weighted averages prioritize more recent data.

Explanation

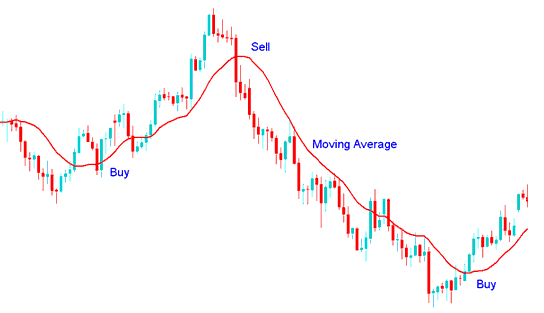

The most popular technique of interpreting the Moving Average is to compare the relationship between the MA(Moving Average) of the price with price itself. A buy signal gets generated/derived when the price rises above its MA and a sell trade signal gets derived and generated when price falls and drops below its MA.

Moving Averages(MA) Indicator

Buy and Sell advisories generated from the interaction where a Moving Average crosses above or below the prevailing price action.

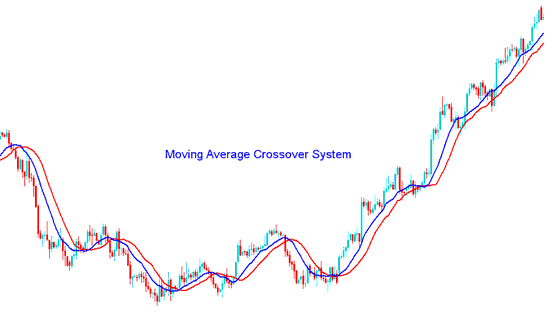

Moving Average Cross-over Strategy

Also widely employed are various trading systems based on MA (Moving Average) crossovers. Such systems frequently involve two or more MAs crossing paths above or below each other, often supplemented by the use of other indicators to provide additional confirmation signals for both trade entry and exit. The potential combinations and conditions for these types of systems are virtually endless.

Moving Average Cross-over System

More Lessons: