How Currencies are Named in the Market?

To grasp forex pair names in the market, start with single currency labels. Then move to pair formats. Knowing these basics matters. Currency pairs form the core assets in forex trading.

Naming Format of Currencies

Currency names use three letters: here's what each one means:

First two letters - identify name of country

Last letter - identify the currency

Example:

USD= USA Dollar

This currency is commonly referred to by its symbol: for the US Dollar, the currency symbol is USD.

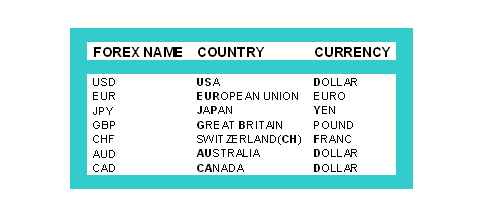

Example of Other Currency Symbols in FX Trading

Explanation of Currency Symbols - Format for Naming Currency Pairs

How Currencies are Transacted in the Market?

Forex trading involves exchanging one currency for another of equivalent market value, facilitated through an intermediary such as a bank or a broker who acts as the custodian of the transaction.

Since the transaction involves exchanging one currency for another, every Forex trade inherently deals with two units, referred to as a currency pair (e.g., EUR/USD). When a trade is executed, it simultaneously constitutes the purchase of one currency and the automatic sale of the other. Thus, if you buy EUR, you are concurrently selling USD, and vice versa.

How do you trade the EURUSD forex pair?

To exchange EUR for US Dollar, we use the EURUSD currency pair - currency symbol

The designation EURUSD is employed to signify the transactional relationship between the European Union and the United States economies. Nevertheless, within the Foreign Exchange Market, these currency pairings are accessible globally for unrestricted speculation and trading by any interested party, owing to their free-floating status within the interbank exchange system. Provided a forex trader possesses the necessary capital for market speculation, they have the ability to engage in the online purchase and sale of these foreign currencies.

In this case The EUR is the base currency and USD is the quote currency.

| Base Currency | Quote Currency |

| EUR | USD |

| 1 | 1.50000 |

The base currency is uniformly assigned a value of 1 unit, while the resulting exchange rate quote reflects the equivalent value in the quote currency.

So, if EURUSD is at 1.50000, that means 1 Euro equals 1.5 US dollars. For every Euro you have, you can buy 1.5 dollars.

When you trade Forex, you can't just buy a small amount like one or two dollars: you have to buy at least 1,000 currency units, called a micro lot. The usual amount to trade is called 1 standard lot or 1 contract. One contract equals 100,000 currency units. The forex contract can also be split into smaller parts: a mini lot is 10,000 currency units, and a micro lot is 1,000 currency units.

The U.S. Dollar (USD) is the most widely used currency in the market, leading most traders to define a standard contract as equivalent to $100,000. Since most forex accounts operated by investors are dollar-denominated, a standard lot of 100,000 units corresponds to $100,000.

FX is traded using currency deals from a online broker. A contract is the standard amount used in forex trades. The Quote Price, which is usually called the exchange rate, is the price you buy or sell at in a trade.

Since 1 contract equals $100,000 of a currency and most can't afford this, a Forex dealer lets you use leverage for trading. If a dealer provides leverage of 100:1, it means someone can trade 1 contract with $1000 of their funds. This happens because forex leverage 100:1 means the dealer provides $100 for each $1 in the account. Therefore, if someone has $1000, with leverage 100:1, they get - 1000100= $100,000 to use in trading.

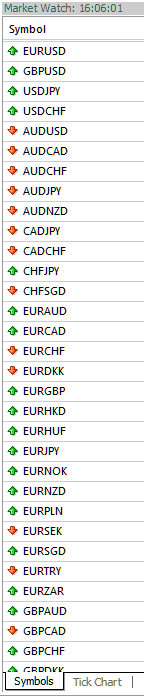

Examples of Currency Symbols/Quotes on MetaTrader 4 Software Platform

Examples of Currency Quotes on MT4 Software Platform

Showing Currency Pairs Quotes in the MT4 Software

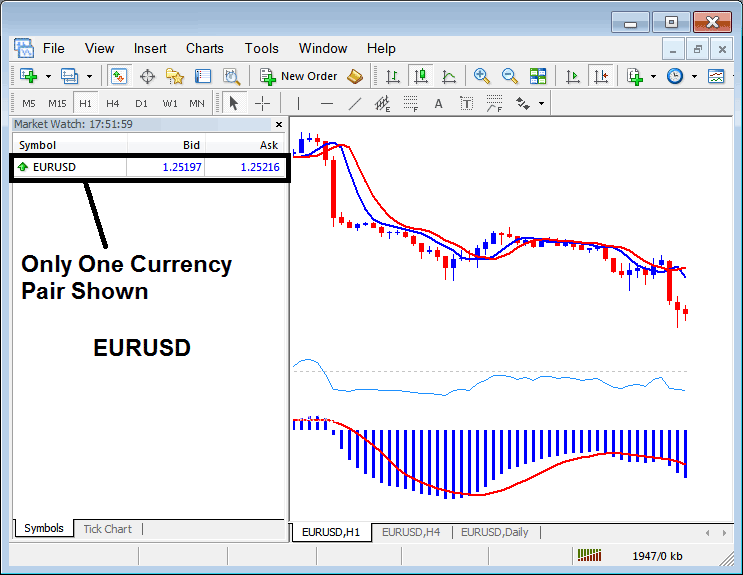

Once you open the MetaTrader 4 platform you may find that some forex currency symbols are not listed on the MT4 Market Watch Panel Window . So, now you'll begin saying - oh, my broker only provides 5 currency symbols, I wanted to trade the EURJPY currency pair which is one of my most popular pairs - but my broker does not provide it on their MT4 platform - well before you change your broker, we will show you where to retrieve that currency pair you want and are looking for, & show you where your broker has hidden it.

MT4 Market Watch Panel Window - (MetaTrader 4 Short-Cut Key CTRL+M) - To see the market watch window on MT4, just press CTRL+M on your keyboard.

For Example you may open the MT4 and only get the EURUSD currency just as is shown:

Information on the EURUSD Currency Pair Symbol - Displaying Currency Pair Quotes Within the MT4 Software.

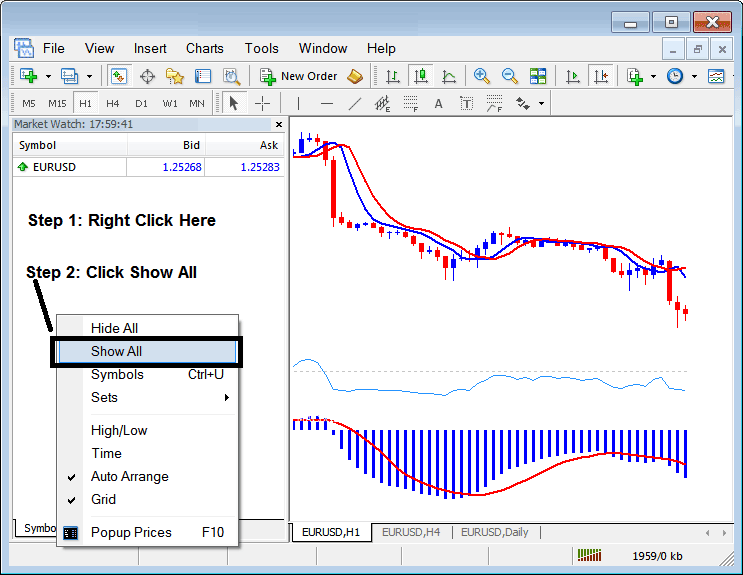

To show a list of all available forex currency symbols on the MT4 platform software follow the steps described below:

How to View All Forex Currency Symbols Available on the MetaTrader 4 Platform

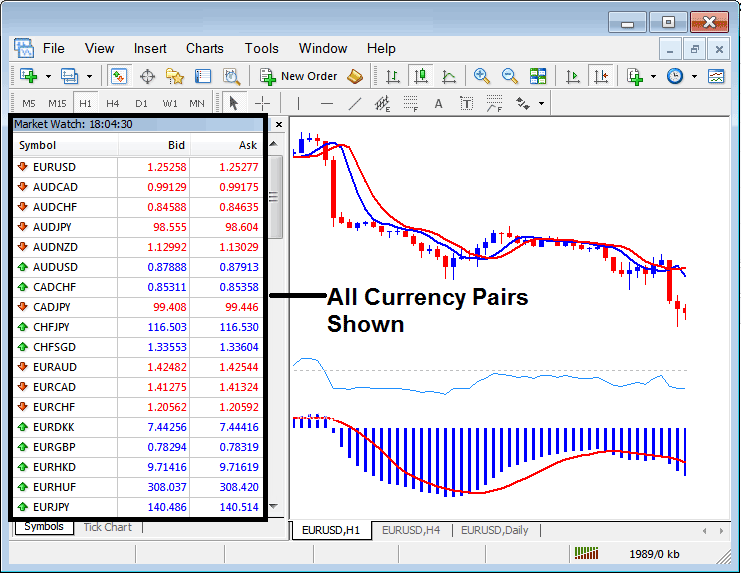

All the forex symbols available will be shown the same way as the MT4 symbols example:

A Comprehensive List of All Recognizable MT4 Symbols Displayed on the MetaTrader 4 Platform Software

From the full list of all forex symbols, a trader can pick the forex currency pair they want to trade by right-clicking on any symbol, then picking "open chart". After the forex chart opens, a trader can then start a trade for that currency using the forex chart that just opened.

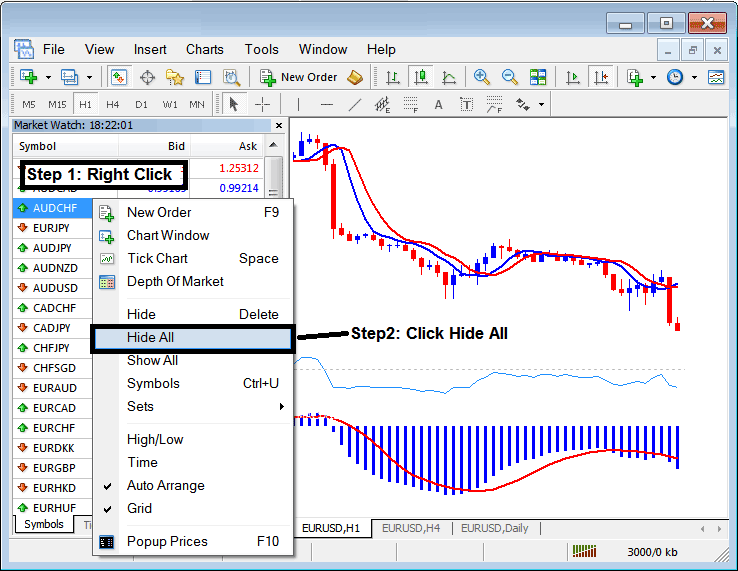

Once you have selected all the forex currency pairs that you want, you may want to hide all the other currency symbols that you're now not trading. To hide those forex currency symbols that you're not interested with, follow the steps shown below:

How to Hide Quotes on MetaTrader 4 To Save Internet Bandwidth

Hiding of currency pairs is done so as to save internet bandwidth that the MetaTrader 4 platform is using. There is no need of streaming price quotes of 50 forex currency symbols if you're only interested in 1 or 2 forex currency symbols, you only need streaming prices for the 2 forex currency symbols only.

For example, if you only trade the main Forex currency pairs, you can choose to see all the forex currency symbols and then pick the four major currency pairs - EURUSD, GBPUSD, USDJPY, and USDCHF. Open their charts and then hide all the other pairs after opening the charts for the currency pairs you want to trade. This way, you will only see the current prices for those four currency pairs.

Calculating FX Profits in the forex market

1 contract gives a profit of $10 for every 1 pip movement.

1 pip is the smallest possible change in the price of exchange rates, and it's equal to one-hundredth (1/100) of 1 cent, or 0.01 cents.

It's important to understand fractional pips, which correspond to the fifth decimal place in a price quote. Unlike traditional pips, which are represented by the fourth decimal point, fractional pips provide more precision.

Thus, if you open one contract and the exchange rate shifts by just 0.01 cents, your resultant profit will be $10.

If the exchange rate moves by 1 cents and you have opened 1 contract, your profit will be $1,000, because 1 cents movement is equivalent to 100 pips and 1 pip profit per lot is $10.

Since the majority of forex currency pairs fluctuate by less than a single cent daily on average, a single contract has the potential to generate earnings slightly under or near $1,000 over one day, contingent upon the exact magnitude of the pip movement observed.

If a currency pair moves 20 pips in your favor, you make $200 with one standard contract. If it moves 50 pips your way, you make $500.

This is how profits are generated in the currency market.

Similarly, if a currency pair goes down 20 pips from your open trade you will lose $200 with 1 standard lot, and if the same currency pair goes 50 pips against your open position you will lose $500.

Learn More Topics & Courses: