Account Management

The best way to handle xauusd funds well in XAUUSD is to ensure that any losses are less than the profits that are earned. This is the risk to reward ratio.

Account Management Strategies

This method boosts your investment strategy by only trading when your potential reward is at least three times greater than your risk.

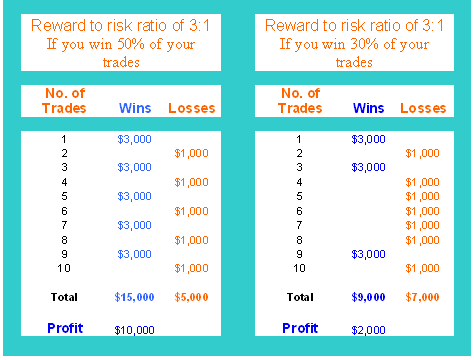

A 3:1 or higher risk-reward ratio boosts long-term profits. The chart below explains how.

In the first examples, you can see that even if you only won half of your trades in your account, you would still make a profit of $10,000.

A 30% win rate still brings profit. Follow account rules for XAUUSD money handling.

Just keep in mind that if the money you could gain is much more than what you risk, you're more likely to make money as a trader, even if you don't win most of your trades.

Never use a risk to reward ratio where you could lose more pips on a trade than you hope to gain. It doesn't make sense to risk $1,000 if you only plan to make $100.

You need 10 wins to recover $1,000 after one loss. That wipes out all profits.

Engaging in this type of investment approach is inherently counterproductive and will result in financial depletion over an extended timeframe.

Account Management Trading Strategies

The percentage risk method involves risking the same percentage of your account's money for each trade - this is part of Account Management Methods.

% risk based method/technique says that there'll be a certain percentage of your equity balance that's at risk per trade. To calculate the percentage risk per each transaction, you need to know 2 things, the percentage risk that you've chosen and contract/lot size of an opened/executed order so that to calculate where to put the stoploss order. Since the percentage is known, we shall use it to calculate the lot and position size of the trading order to be opened and placed in the market, this is known & referred to as position size.

Example

With a $50,000 balance and 2% risk, you manage that per trade.

Then 2 % is the same as $1,000

Other factors to consider include:

Maximum Number of Open Trades

A point to consider is the max number of open trade transactions that is the max number of trades that you as a trader want to be in at any one given time. This is another factor to decide when managing equity.

If you pick 2%, for example, you might decide to have a maximum of 5 trades open at any one time, and if you have 4 open trades that all close at a loss on the same day, your account balance would decrease by 8% that day.

Invest Sufficient Capital

One of the gravest errors investors can commit in xauusd is attempting to open an account without adequate equity.

An investor operating with restricted capital tends to worry excessively, constantly striving to cut losses prematurely, often exiting trades before they have a chance to realize any intended success according to their trading strategy.

- Exercise Discipline

Discipline tops the list for traders to master. It helps them profit by planning trades and sticking to the plan.

Patience means letting a trade grow without pulling out too soon. You might feel uneasy about the risk. But discipline keeps you on track. Stick to your trading plan and its rules. As a trader, build that discipline. It helps you profit from your method.

Account Management Basics

How you handle your xauusd money is the basis of any plan, as it helps traders to have a better chance of making money when trading in the market. It is really important when trading with borrowed money, which is seen as one of the most easily traded markets out there, but also one of the most risky.

If you want to invest well in the market, know that it's very important to have a good plan for handling xauusd money, since you'll use trade leverage to make your trade orders - Account Management Basics.

The difference between average profits and losses should be carefully figured out. When trading, the average profit should be bigger than the average loss, or else there will be no profit. In this case, a trader needs to create their own rules for managing their money, since everyone's success depends on their own qualities. So, each trader makes their own plan and money management rules based on the rules above.

When executing trade orders, ensure that you set stop-losses to prevent significant losses. Stop-loss orders can also help secure profits.

Aim for a 3:1 reward to risk ratio. Make profits outweigh losses.

Keeping these rules in mind, you can use them to make your plan more profitable and try to create your own plan that could possibly make you good profits when you trade with it.

More lessons and tutorials can be found here: