What is EU50 System? - Learn EU50 Index

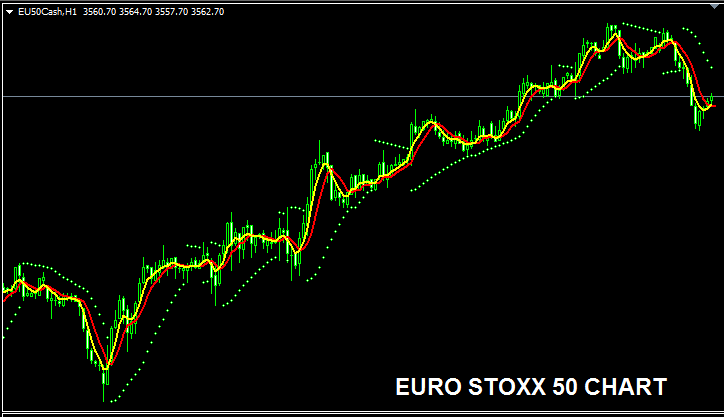

EU 50 Chart

EU50 trading chart is illustrated and illustrated below. On example laid-out below this instrument is named EU50CASH. As a trader you want to find a broker that provides EU50 trading chart so that you as a trader can start to trade it. The example That is shown/illustrated below is that of EU50 Indices on MT4 FX Platform Software.

System For Trading EU50 Stock Indices

EU50 Stock Indices is made up of blue chip stocks choosen from best performing sectors in the EuroZone: hence a good stock index trading strategy to trade EU50 Index is to trade long majority of the times. This is because generally the best stocks in Europe will in general keep heading up & up because the companies behind these stocks are among some of the best & most profitable companies in Europe.

EU50 Indices is also reviewed on a yearly basit so that if one of the Stock is not doing very well then it is swapped and replaced with another Stock that is doing well. This ensures that most of the times EU50 Index will keep going upward.

As a stock index trader you want to be biased & keep on buying as the index heads and moves upward. When European based economies are doing/performing well this upwards market trend is much more likely to be the one ruling. A good trading strategy to use when trading this index would be to keep buying and buy the dips.

During Economic Slow-Down & Recession

During economic slowdown and recession periods, corporations begin and start to report slower earnings and lowers growth projections. It is due to this reason that investors begin to sell stocks of companies that are recording and announcing lower profits & hence Indices tracking these specified stocks will also start and begin to move downwards.

Therefore, during these times, market trends are a lot more likely to be moving downward & you as a trader should also adjust your strategy accordingly to suit the prevailing downwards trends of the index which you as a trader are trading.

Contract Specifications

Margin Requirement for 1 Lot - € 40

Value per Pips - € 0.1

Note: Even though general and overall trend is generally move upward, as a trader you've got to consider and factor on daily market price volatility, on some of the days the Indices might move in a range or even retrace & retracement, the market retracement/pullback move may also be a significant one at times and therefore you as the trader you need to time your trade entry strictly using this trade strategy: index trading strategy & at same the time use appropriate/proper money management techniques/guidelines just in case of more unexpected volatility in the market. About indices equity management guidelines courses: What's Stock equity management and indices equity management system.

Get More Topics and Courses:

- What is Margin Requirement for 1 Lot of AEX25 Index?

- How to Open Terminal Window MetaTrader 4 Platform

- How to Register with MT4 Broker

- XAG/USD Chart

- NETH25 Lot Size Calculator NETH25 Position Size Calculator NETH25 Risk Calculator

- MT4 XAUUSD Platform ADX XAU/USD Indicator Guide for Beginner Traders

- How to Develop a CAD CHF Trade Strategy

- Bullish Divergence XAU/USD Bullish Divergence Setups

- List of the Different Types of Trade Accounts Explanation

- Moving Average(MA) Resistance Turns Support in XAU USD Charts