Support & Resistance Areas

This is a commonly used idea in gold trading referring to certain levels on a chart that tend to serve as barriers, preventing the price of an asset from moving beyond a specific limit in any direction.

Support

This specific threshold prevents the valuation of an asset from descending further and is thus perceived as a floor, effectively halting the market from breaching a set lower boundary.

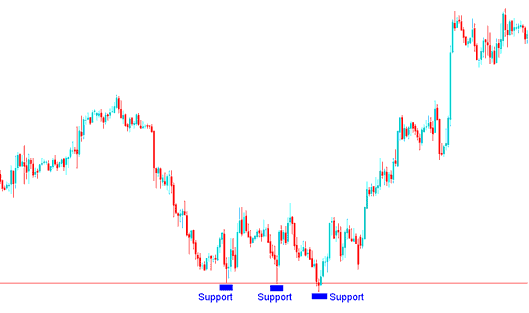

Example:

On the example shown below you can see that price moved down until it hit a support

After the price reached that specified point, it rose slightly, but then kept dropping until it got to the support level again.

The act of reaching a level and then rebounding is known as testing the support.

The more times a support level holds and the market bounces up, the stronger that support becomes. In the example below, the market tested the same level three times without breaking it. Eventually, the trend flipped and headed the other way.

Once this level has been determined traders use it to place their orders to buy the at the same time putting a stop loss a few pips just below it.

In the preceding market scenario formation, the price failed to drop below this identified level: it represents an area where downward price movement was rejected.

These areas are good spots where the price trend moving downward may change direction, get support, and begin going upward again now.

The desire to purchase at this point will be bigger, hence it provides a good place to start a buy trade, while placing stops a few pips just below.

This support is also utilized by short XAUUSD sellers as a target for setting their take profit on short sell trades.

This is another reason why the price trend is likely to reverse or consolidate at this particular point because once the sellers close their sell trades then energy of the downward trend reduces and a consolidation will happen after which the trend direction is likely to reverse.

Resistance

This level acts as a ceiling, preventing the price of an asset from surpassing it. Such technical levels restrict upward movements in the market.

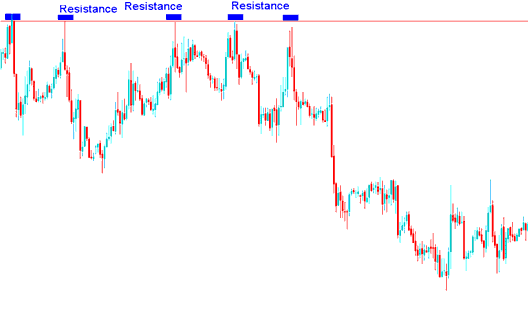

Example:

In the example illustrated below, the price increased until it encountered a resistance level.

After the price reached this level, it went back a bit, and then it continued to move up until it reached the resistance level once more.

The resistance holds and is tried and tested for 5 times without breaking.

The more times a resistance area is tested the stronger the it is.

Once this level has been found, traders place their orders to sell at this level, and at the same time, they put a stop loss a few pips above it.

In the example from earlier, the market didn't go higher than this point. This area shows where the price can't go past.

These levels create strong spots for reversal. In an uptrend, price hits resistance, pauses, then drops the other way.

This scenario highlights a strong selling demand at specific price levels, offering an opportunity to initiate sell trades while placing stop losses slightly above critical technical areas.

Buyers also use this resistance area as a place to put their take-profit orders for when their bullish trades are successful.

This provides an additional rationale for expecting a trend reversal at this precise juncture: once buyers covering their long positions exhaust the upward momentum, the drive supporting the ascent diminishes, leading to a phase of market consolidation, after which a downward shift in the direction becomes probable.

Learn More Topics and Guides:

- How Do I Add Hang Seng on MetaTrader 5 Hang Seng Trading App?

- Nasdaq Trading Strategy Guide: A Lesson on Stock Index Trading

- How to Draw Trendlines and Channels in Gold Charts

- Bollinger Bandwidth: Using the MetaTrader 4 Indicator

- How the US500 Stock Index is Traded Utilizing Both MetaTrader 4 and MT5 Platforms

- Example of Margin Calculation