Technical Examination of Bollinger Band Width and Corresponding Trading Triggers

Developed & Created by John Bollinger.

This technical indicator is derived from the original and initial Bollinger technical indicator.

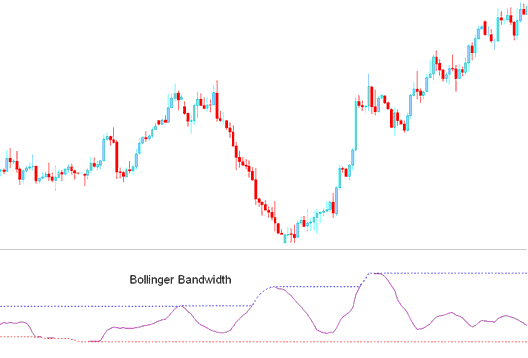

Bandwidth is a measure of width of Bollinger Band

Calculation

Bandwidth = Upper Band - Lower Band

Middle Band

This technical indicator is an oscillator, grounded in the principle that price and volatility fluctuate in cycles.

Periods of high volatility is followed by periods of low volatility.

When volatility is high, bands are far apart, the band-width also will be wide apart.

When market volatility is low, the Bollinger Bands will appear narrow, resulting in a narrow reading for the band-width trading technical indicator as well.

The Blue Line Depicts the Maximum Bandwidth Reading Observed Over a Predetermined Number of Past Periods.

This line also identifies the periods of high volatility

The line colored red indicates the lowest bandwidth reading observed over a specified sequence of preceding time intervals.

This line also identifies periods of low market volatility

FX Technical Analysis and How to Generate Trading Signals

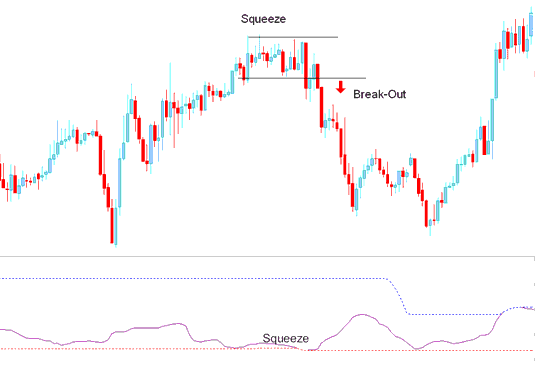

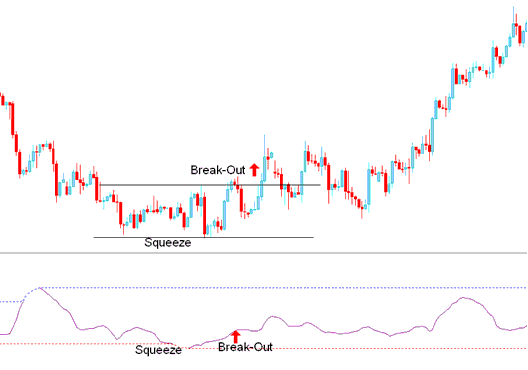

Consolidation - Bollinger Squeeze

Bollinger Bandwidth helps to spot a squeeze, which means the price stays about the same for a time, and then the price suddenly moves strongly in one direction.

When there is a price break out, the Signals are produced and derived. The indicator starts to move upward after contacting the red line, at which point the signal is derived and created. The price is breaking out as the bandwidth line starts and begins to trend upward, which indicates that market volatility is increasing.

Squeeze

Breakout Signal After Bandwidth Squeeze

However, this indicator alone does not convey direction: it requires integration with another technical indicator, such as the Moving Average (MA), to accurately discern the prevailing trend direction or to identify potential breakouts.

More Courses & Courses:

- Moving Average MetaTrader 4 Technical Indicator Example Explained

- Trading FX FTSE 100 Using the MT4 Index FTSE100 Symbol

- Gold Strategy Lesson Tutorials

- Tips for Boosting Your XAUUSD Trading Profits

- Want to get NIKKEI225 on MetaTrader 4 for PC? Here's how.

- How to Trade XAUUSD Trend Lines and Channels on MT5 Charts

- Trading the Hk50cash Index