What's Kase Peak Indicator? - Definition of Kase Peak Oscillator

Kase Peak Oscillator indicator - Kase Peak Oscillator indicators is a popular technical indicator which can be found in the - Indicators List on this site. Kase Peak Oscillator indicator is used by the traders to forecast price movement based on the chart price analysis done using this Kase Peak Oscillator indicator. Traders can use the Kase Peak Oscillator buy & Sell Trading Signals explained below to identify when to open a buy or sell trade when using this Kase Peak Oscillator indicator. By using Kase Peak Oscillator and other indicators combinations traders can learn how to make decisions about market entry and market exit.

What's Kase Peak Indicator? Kase Peak Oscillator Indicator

How Do You Combine Forex Indicators with Kase Peak Oscillator? - Adding Kase Peak Oscillator on the MT4 Software

Which Indicator is the Best to Combine with Kase Peak Oscillator?

Which is the best Kase Peak Oscillator indicator combination for forex trading?

Most popular indicators combined with Kase Peak Oscillator are:

- RSI

- Moving Averages FX Indicator

- MACD

- Bollinger Bands

- Stochastic Trading Indicator

- Ichimoku Indicator

- Parabolic SAR

Which is the best Kase Peak Oscillator indicator combination for Forex trading? - Kase Peak Oscillator MT4 indicators

What Indicators to Combine with Kase Peak Oscillator?

Find additional indicators in addition to Kase Peak Oscillator indicator that will determine the trend of the market price & also others that confirm the market trend. By combining forex indicators that determine trend and others that confirm the trend & combining these indicators with Forex Kase Peak Oscillator indicator a trader will come up with a Kase Peak Oscillator based system that they can test using a demo account on the MT4 software.

This Kase Peak Oscillator based system will also help traders to identify when there is a market reversal based on the technical indicators signals generated and thence trades can know when to exit the market if they have open trades.

What is Kase Peak Indicator Based Trading? Indicator based system to analyze and interpret price and provide trade signals.

What's the Best Kase Peak Oscillator Forex Strategy?

How to Select and Choose the Best Kase Peak Oscillator Forex Strategy

For traders researching on What is the best Kase Peak Oscillator forex strategy - the following learn forex guides will help traders on the steps required to course them with coming up with the best strategy for forex market based on the Kase Peak Oscillator indicator system.

How to Make Kase Peak Oscillator Forex Systems

- What is Kase Peak Indicator Strategy

- Creating Kase Peak Oscillator Forex Strategy Template

- Writing Kase Peak Oscillator Forex Strategy Trading Rules

- Generating Kase Peak Oscillator Forex Buy & Kase Peak Oscillator Sell Trading Signals

- Creating Kase Peak Indicator System Tips

About Kase Peak Indicator Described

Kase Peak Oscillator & Kase DevStop 2 Analysis & Signals

Created and Developed by Cynthia Kase

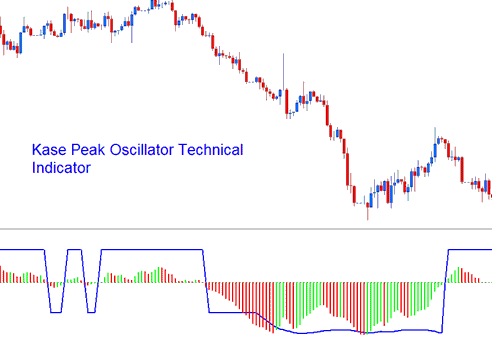

Kase Peak Oscillator indicator is used in the same way as the other traditional oscillators indicators, but the oscillator is derived from a statistical evaluation of the FX trend: this statistical evaluation evaluates over 50 different trend lengths. The oscillator is capable of automatically adjusting itself to the cycle length and volatility changes of the trend.

Kase Peak Oscillator Indicator

Histogram values/readings below the center-line signify bearish market trends while values/readings above the centerline signify bullish values. Crossover signals are used as both entry and exit points.

Kase DevStop 2 Indicator

Developed by Cynthia Kase

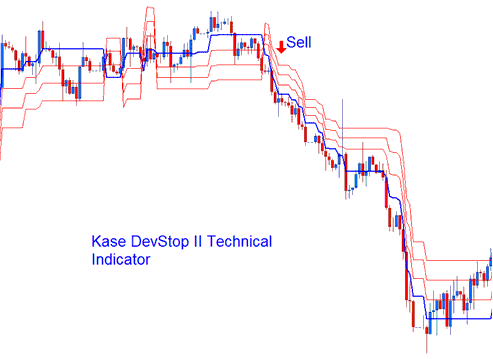

The Kase DevStop II calculates an average range, and the 3 standard deviations of this range.

FX Analysis of the Kase DevStop II Indicator

This Indicator is used to identify the realistic exit points for trade transactions based on volatility, variance of the volatility and the volatility skew. This indicator plots 4 lines. 4 lines are described as a Warning Line and 3 Standard Deviation Lines of 1, 2 & 3. These lines allow traders to take profit order or cut losses at the levels where the probability of a trade transaction remaining profitable is very low, at same time without taking more of a loss or stopping profit at any time sooner than it's necessary.

Kase DevStop 2

The 3 red lines are used by the FX traders to set the exit levels or stop loss levels. The DevStop 2 is a trend following trading indicator.

Get More Tutorials and Lessons: