Stochastic Momentum Index Technical Analysis Trading Signals

Created by William Blau.

The Stochastic Momentum Index, or SMI, is a version of the Stochastic Oscillator that makes the stochastics movement smoother.

Construction of SMI Indicator

This indicator is calculated by comparing the price compared to the average/mean of an n No. of price periods.

Instead of just plotting the raw values, we smooth them out with an Exponential Moving Average, then use those smoothed values to draw the SMI.

If the close beats the range's average, the SMI heads up.

If the closing price registers below the calculated average or midpoint of the price range, the SMI indicator will demonstrate a downward trajectory.

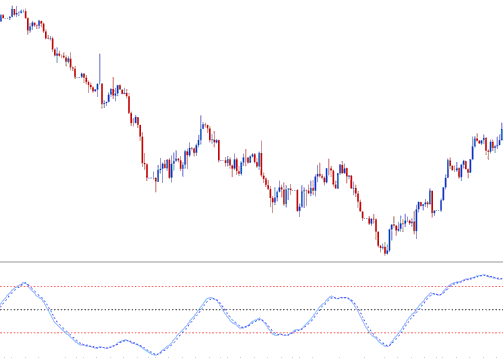

This oscillator ranges between values of +100 and -100 and demonstrates greater resistance to false signals compared to the stochastic oscillator indicator.

Technical Analysis and How to Generate Trading Signals

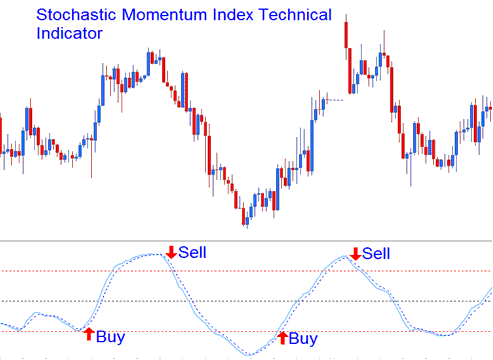

Buy and Sell Signals/ FX Crossover Signals

The SMI can be employed to generate both buy and sell trading signals using the technique illustrated beneath: initiate a buy action when the SMI displays an upward trajectory, and institute a sell action when it moves downward.

Buy and Sell Signals/ Forex Cross over Signals

Overbought/Oversold Level Crossovers

- Overbought levels above +40

- Oversold levels below -40

A signal to buy happens when the oscillator goes below the level where it's considered oversold, then climbs back up past that point.

A Sell Signal occurs when the oscillator goes above the overbought level, then drops below it and begins to head downward again.

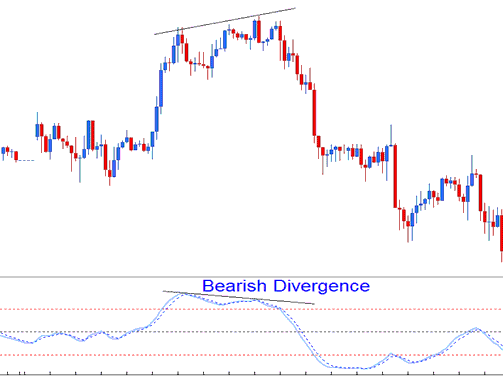

Divergence Trading

The exemplification laid-out below indicates a bearish classic divergence between price & the SMI. When the Stochastic Momentum Index showed this divergence the trend reversed & started to move in a downward direction.

Bearish Trading Divergence

More Courses & Topics: