MACD Bullish and Bearish Divergence - Classic MACD Divergence Guide

MACD classic divergence spots potential trend turns. It flags areas where price might flip direction. Traders use this for safe entries. It also helps time exits well.

This low-risk approach sells near peaks or buys near lows. It keeps trade risk small versus possible gains.

An entry sell limit order of this nature is employed to initiate a short sale at a price point above the current market level (effectively trading a pullback within a declining market trend).

There are 2 categories of Classic Divergence:

- Classic Bullish Divergence Trading Setup

- Classic Bearish Divergence Trade Setup

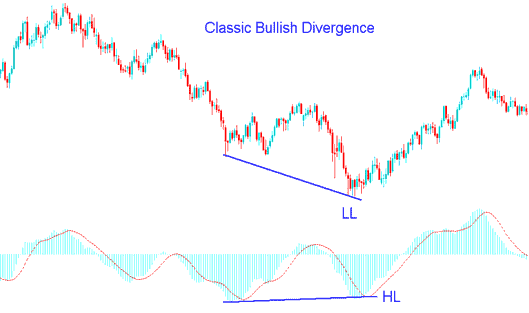

Classic Bullish Divergence in Forex Trading

Classic bullish divergence in forex trading occurs when price is making/forming lower lows (LL), but the oscillator indicator is forming/making higher lows ( HL ).

MACD Classic Bullish Divergence in Forex Trading - A method for trading MACD Divergence.

Classic bullish divergence in forex warns of a possible change in the trend from downwards to upwards. This is because even though price headed lower the volume of sellers which moved price lower was less such as displayed and illustrated by MACD indicator. This demonstrates underlying weakness of the downward trend.

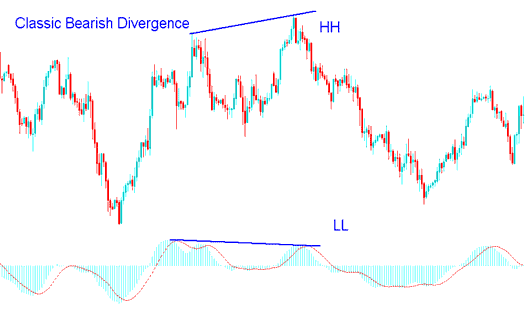

Classic bearish divergence in Forex Trading

Classic bearish divergence in forex trading happens when the price is making a higher high (HH), but the oscillator technical indicator is making a lower high (LH).

MACD Classic Bearish Divergence in Forex Trading - MACD Divergence Trading Method

Classic bearish divergence signals a possible shift in the market trend from upwards to downward. This is because even though price headed higher the volume of the buyers(bulls) who moved price higher was less just as is shown by MACD indicator. This reflects underlying weakness of the upwards trend.

Explore Additional Tutorials and Lessons: