Recursive Moving Trend Average Technical Analysis & Signals

This Indicator is calculated using a mathematical polynomial fit, the formula is referred as a Recursive Moving Polynomial Fit.

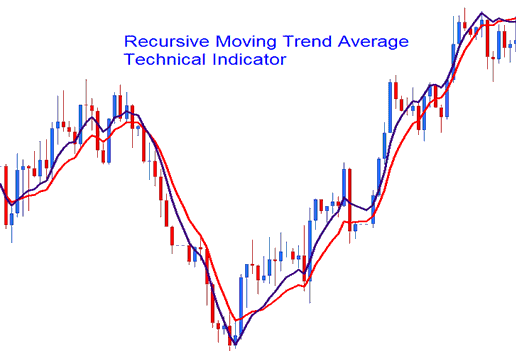

This formula used to calculate this indicator only requires a small set of previous data to calculate and predict the next direction of price movement. The example below shows two Recursive Averages combined to form a crossover trading system method.

Forex Technical Analysis & How to Generate Signals

The best technical analysis method is the cross over method where you can combine two recursive averages, such as the 14 and 21. When the two cross overs each other upwards then that's a bullish signal while a downwards cross-over is a bearish signal.

Buy Sell Signal

The Recursive Average looks similar to the traditional moving average, the only difference is that is much smoother due to the technique of calculation that it uses & much less prone to whipsaws.