How to Set Bollinger Band on MT4 Charts

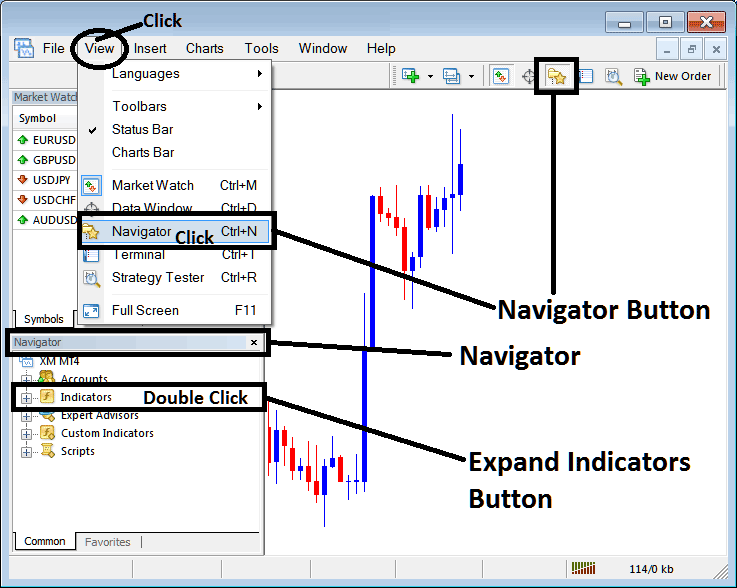

Step 1: Open Navigator Window on Platform Software

Open the Navigator panel like is shown & displayed: Navigate to "View" menu (press on it), then choose & select the "Navigator" window (press), or From Standard Tool Bar click "Navigator" button or press key board short cut keys "Ctrl+N"

On the Navigator panel, pick Indicators. Double click on it.

Adding Bollinger Bands to MT4: Guide to the MT4 Bollinger Band Tool

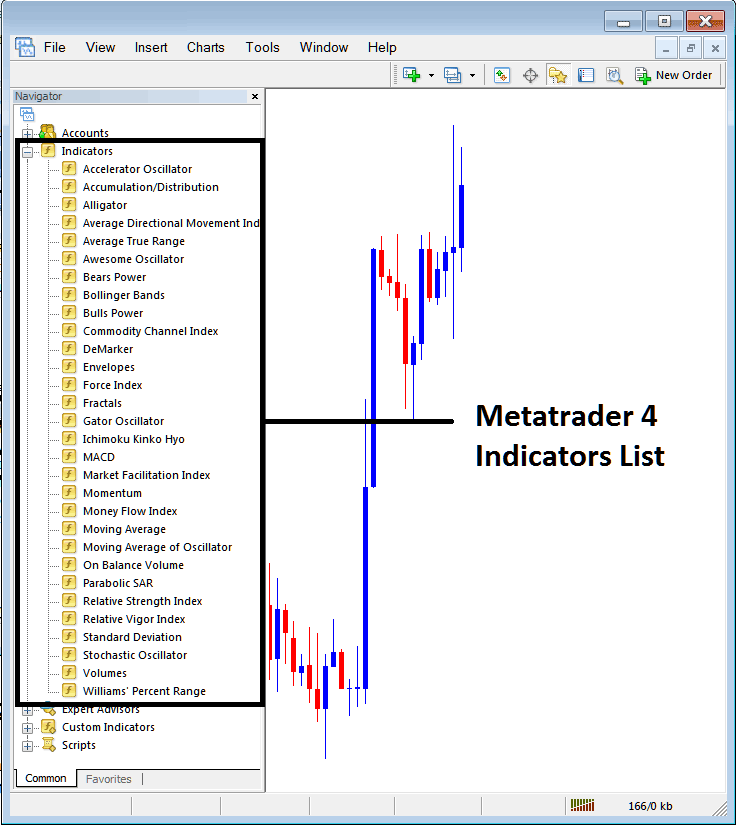

Step 2: Open Indicators in Navigator - Add Bollinger Bands to MT4

Expand the menu by clicking the expound button/tool initial ( + ) or double click the "indicators" menu, & after which this button will be shown as (-) & will now display a list just as illustrated and shown below - choose the Bollinger Band chart indicator from this list of indicators so that to add the Bollinger Band on the chart.

Adding Bollinger Bands: From the window above, you can place the desired Bollinger Band on your chart.

How to Set Custom Bollinger Bands Indicator to MT4

If the technical technical indicator you want to add is a custom indicator - for example if the Bollinger Band you as a trader want to add is a custom indicator you'll need to first add this custom Bollinger Band on the MetaTrader 4 software & then compile the custom Bollinger Band so that the newly added Bollinger Band custom technical indicator pops up on the list of custom technical indicators in MT4 software.

To learn and know how to install Bollinger Band indicators in MT4 Platform, how to add Bollinger Band window to MT4 and how to add Bollinger Band custom indicator in the MT4 Software - How Do I add a custom Bollinger Bands forex indicator on MT4 Platform.

About Bollinger Band Tutorial Explained

Bollinger Bands Analysis and Bollinger Bands Signals

Engineered & Built by John Bollinger

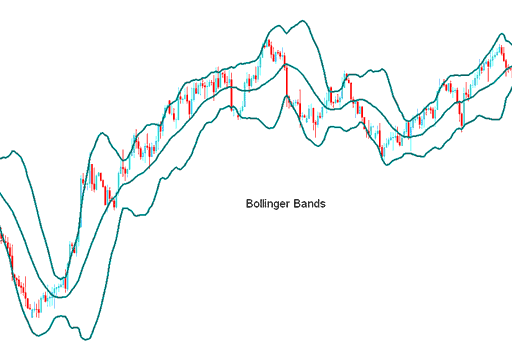

Bollinger Bands consist of three lines. The central line represents a 20-period Simple Moving Average.

Subsequently, these bands are drawn at a specific deviation away from the central Moving Average, forming the identifiable upper and lower boundary lines.

The precise placement of these bands is governed by another technical indicator known as the standard deviation. Standard deviation serves as a metric to quantify and assess the market's level of volatility, or the volatility pertaining to a specific forex currency pair.

Price swings change often, so standard deviation shifts too. Bollinger bands use this method, so they adjust their width to match current volatility.

As market instability increases, the bands expand, and conversely, they contract during periods of lower volatility.

The three bands of this indicator are designed to contain most of the currency's price action. The middle band is usually a simple moving average over 20 periods and serves as an indicator of trend direction.

This line also works as the starting point for the lines above and below it. How far apart the upper and lower lines are from the center line is based on how much the price changes. The upper line is marked at +2 standard deviations over the center line, while the lower line is marked at -2 standard deviations under the center line.

FX Analysis and Generating Signals

- Bands provide a relative meaning of high and low

- Used to identify periods of high and low market volatility

- Used to identify periods when the prices are at extreme levels

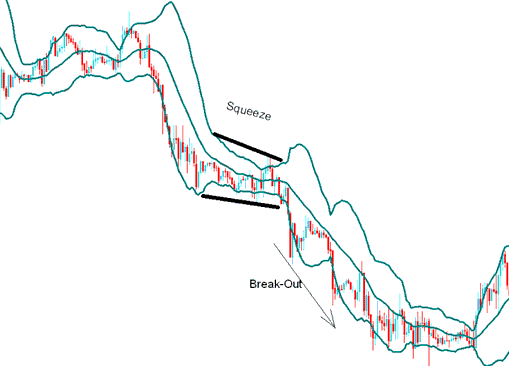

Consolidation - the Squeeze

When the price doesn't change much, the bands get closer together, showing a time of stability. Big price changes often happen after the bands get tight.

Consolidation Chart Pattern

Continuation Signal - the Bulge

If the price action penetrates either the upper or lower band and moves outside these boundaries, the continuation of the current prevailing trend is anticipated.

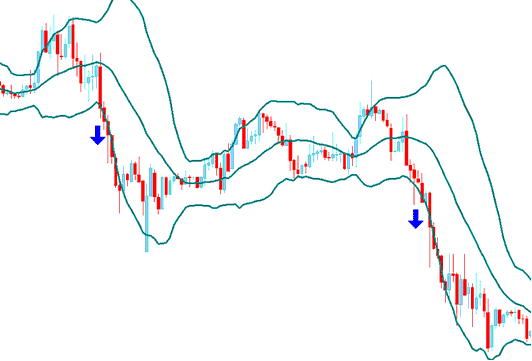

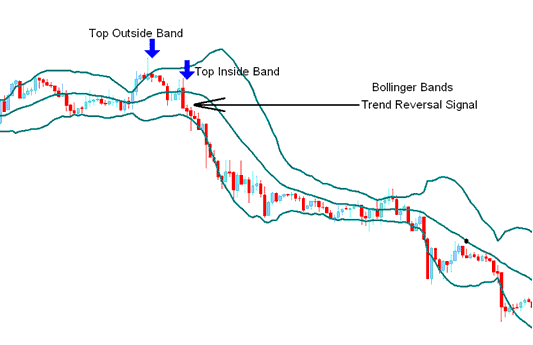

Reversal Patterns: Double Top and Bottom Trades

When price extreme points (tops and bottoms) occur outside the bands, followed by new extremes forming back inside the bands, this signals an imminent shift or reversal in the ongoing trend.

The Head Fake - Forex Whipsaw

Watch for fake breakouts in trading. They go by names like whipsaws or head fakes.

Price often breaks out in one way right after the Squeeze Pattern, which makes many traders think that the market breakout will keep going that way. But it quickly turns around and makes the real and bigger market breakout in the opposite direction.

Traders who react quickly on the initial breakout commonly get caught up on the wrong side of the price action, while those traders expecting a "false breakout" can quickly close out their original position & enter a trade in the direction of the reversal. It is always good to combine Bollinger bands with other confirmation Trading Indicators.

Learn more lessons and subjects: