What is NASDAQ100 Strategy? - Tutorial Guide for Trading/Transacting NASDAQ100 Stock Index

NASDAQ 100 Chart

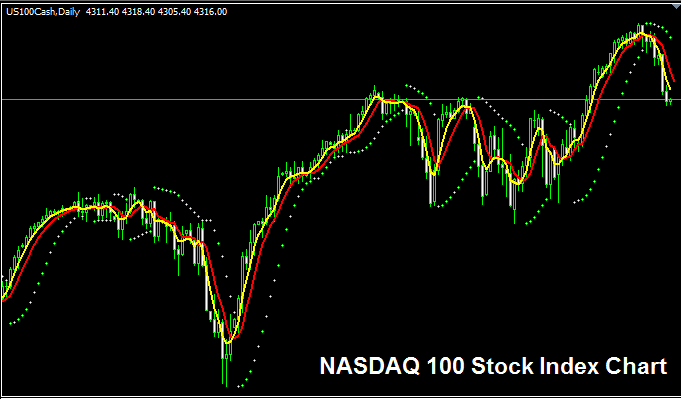

The NASDAQ100 chart displays above. In this example, it appears as USA 100CASH. It shows the NASDAQ 100 index on the MT4 forex platform.

Strategy to NASDAQ100 Stock Index

The NASDAQ 100 Index calculation boosts its ups and downs. This leads to big price shifts. Each stock in the index has its own weight. Over time, the index climbs. That matches the strong U.S. economy.

Check Out Extra Subjects and Lessons:

- What's EURSEK Spreads?

- Understanding Bearish Power Signals: What are Bears Power Buy and Sell Forex Signals?

- MACD Index Trading Strategies Guide Tutorial

- Guidance on Applying the Ichimoku Kinko Hyo in Forex Markets.

- Explain Forex Market

- Instructions for Loading the SP 500 Index Chart on the MetaTrader 4 Platform