How to Set Ichimoku Kinko Hyo on MetaTrader 4 Charts

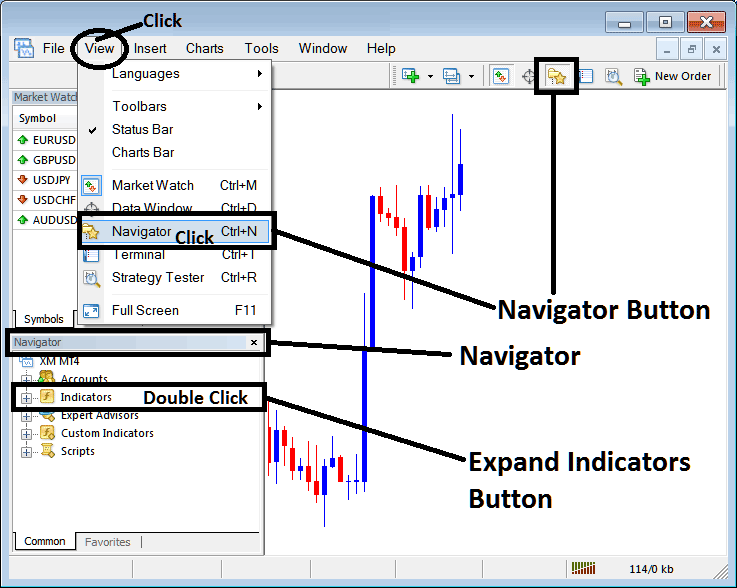

Step 1: Access the Navigator Window in the Trading Software Platform

Open Navigator window just as illustrated below: Navigate to 'View' menu (press on it), then select 'Navigator' window (press), or From Standard ToolBar click the 'Navigator' button or press key board short-cut keys 'Ctrl+N'

On Navigator panel, choose 'Indicators', (DoublePress)

How to Add Ichimoku Kinko Hyo in the MT4 - MT4 Ichimoku Indicator

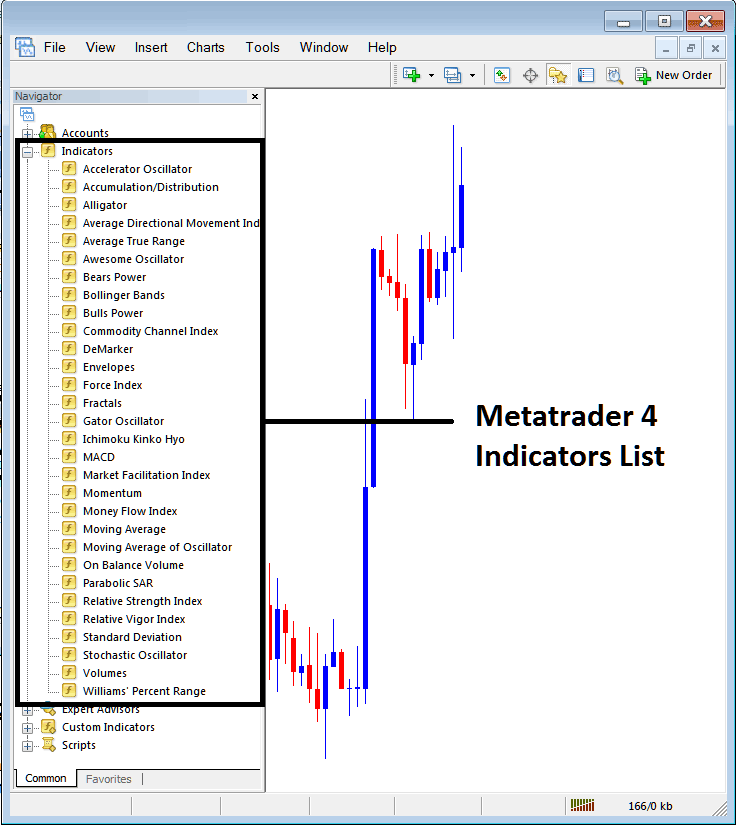

Step 2: Open Indicators in Navigator - Add Ichimoku to MT4

To expand the menu, click the '+' button or double-click the 'indicators' menu. This will change the button to a '−' sign and display the list below - select the Ichimoku technical indicator to add it to the chart.

Incorporating Ichimoku Kinko Hyo: Within the window shown above, you can then apply the desired Ichimoku indicator onto your Forex chart display.

Configuration Instructions for Setting a Custom Ichimoku Indicator on the MT4 Platform

If the indicator is custom, like a special Ichimoku tool, add it to MT4 first. Then compile it. This way, the new Ichimoku Kinko Hyo shows up in the custom indicators list on MetaTrader 4.

To learn how to install Ichimoku indicators on MT4 Platform, how to place Ichimoku indicator window to MT4 and how to add Ichimoku Kinko Hyo custom indicator on the MT4 Software - How to add a custom Ichimoku indicator in MT4 Platform.

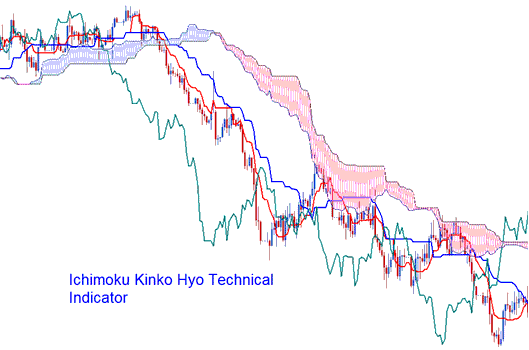

About Ichimoku Indicator Explanation

Ichimoku Indicator

Ichimoku Kinko Hyo represents a Japanese way of charting, which was developed by a Japanese journalist under the alias Ichimoku Sanjin.

- Ichimoku means: 'a glance' or 'a look'

- Kinko means 'equilibrium' or 'balance'

- Hyo is a Japanese word/term for "chart"

Ichimoku translates to "a glance at an equilibrium chart." This indicator helps traders predict potential price direction and determine optimal entry or exit points within the market.

Calculation

This indicator consists of five lines plotted using the midpoints of previous highs and lows. The 5 lines are calculated as follows:

1) Tenkan Sen: Conversion Line: Red Line (Highest High + Lowest Low) / 2, for last 9 price periods

2) Kijun-Sen: Also known as the Base Line, calculated as the average of the Highest High and Lowest Low over the last 26 price periods, represented by the Blue Line.

3) Chikou Span: This lagging span, colored green, plots today's closing price 26 periods behind the current time.

4) Senkou Span A (Leading Span A) is calculated as the average of (Tenkan-Sen + Kijun-Sen), projected 26 price periods into the future.

5) Senkou Span-B: Span B that Leads: (Highest High + Lowest Low)/2, from the last 52 price times, shown 26 price times in the future

Kumo: Cloud: area between Senkou Span A & B

Technical Analysis and Generating Signals

Bullish trading signal - Tenkan-Sen crosses the Kijun-Sen from below.

Bearish trading signal - Tenkan-Sen crosses the Kijun-Sen from above.

However, there are different areas of strength for the buy and sell trade signals generated.

Technical Analysis in FX Trading

Bullish crossover signal occurs and happens above the Kumo (clouds),

Very strong buy trade signal.

Bearish cross-over signal occurs and happens below the Kumo (clouds),

Very strong sell signal.

If a signal to buy or sell happens inside the Kumo (clouds), it is seen as a medium strength signal to buy or sell.

A bullish crossover below the clouds signals a weak buy. A bearish one above signals a weak sell.

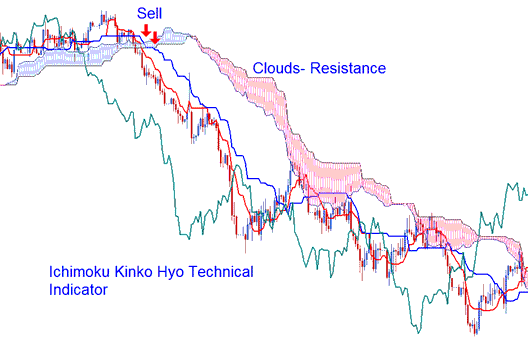

Support and Resistance Areas

You can guess where support and resistance levels are by looking at Kumo (clouds). The Kumo can also show you what the current market trend is.

- If the price is above Kumo, ruling trend is said to be upward.

- If the price is below Kumo, ruling trend is said to be downwards.

Chikou Span or Lagging Span is also used to measure the energy of the buy/sell signal.

- If the Chikou Span is below the closing price of the last 26 periods ago & a sell short signal is given/generated, then the momentum of Forex trend is downward, otherwise the signal is considered to be a weak sell signal.

- If there a bullish signal and the Chikou Span is above price of the last 26 periods ago, then the momentum of the trend is to the up-side, otherwise it is considered to be a weak buy signal.

Get More Tutorials:

- Identifying Forex Trading Setups Using Hidden Bullish and Hidden Bearish Divergence with MACD

- Setup for Gold Trading on MetaTrader 5

- SPAIN 35 Trading Indicator MetaTrader 4 Technical Indicators

- MetaTrader 4: Platform Training Guide

- How to Study XAU/USD Trading Platforms for PC

- How to Write Your Own Plan for Forex Trading?

- IT40 Strategy List

- Where to Find a List of Major and Minor Forex Pairs

- How to Draw Trend-lines that Go Down on XAUUSD Charts