What is SMI20 Trading Strategy? - Course for SMI20 Index

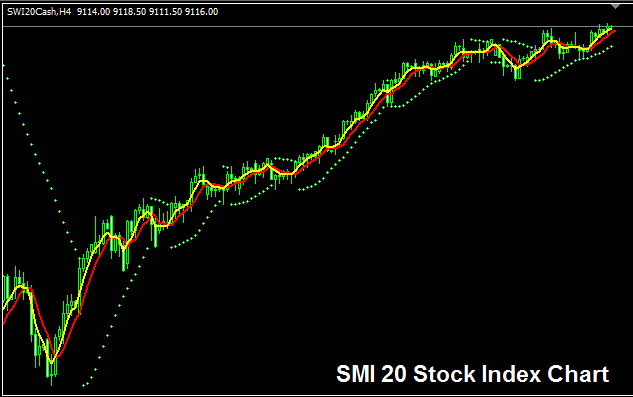

The SMI 20 Trade Chart

The SMI20 chart is displayed & shown above. On above example this Index is named SWI20CASH. You want to search, look for & find a broker that offers SMI 20 trade chart so that you can start & begin to tradeit. Example displayed and illustrated above is of SMI20 Stock Index on MetaTrader 4 FX & Index Platform.

Strategy for SMI20 Stock Indices

The SMI20 Stock Index tracks the top 20 companies in Switzerland by market cap. Over time, it usually heads up because Switzerland's economy is pretty strong. Their banking system is one of the world's best, and that helps keep the whole economy solid.

As an index trader, stay bullish and buy when prices rise. A strong Swiss economy lifts top stocks. That pulls the index up too. Buy the dips in a solid index plan.

During Economic Slow-Down & Recession

During economic slowdown and recession times, corporations start and begin reporting slower revenues, slower profits and lowers growth projections. It is due to this reason that traders begin to sell stocks of companies which are announcing & reporting lower profits and therefore Indices monitoring these specified stocks/shares will also start and begin to move downwards.

Market trends during certain periods often lean downward, and traders should revise their strategies accordingly to align with the current downward movement of the index they're trading.

Contracts and Specifications

Margin Requirement Per 1 Contract - CHF 100

Value per Pip - CHF 0.5

Note: Even if the general trend is usually upwards, as a trader, you must think about daily market price changes, because on some days, the Indices might move within a range or even go back & retrace, and the market's move back might sometimes be big, so you, as the trader, need to time your trade entry correctly when using this strategy: indices strategy & also use good & proper money management rules in case of unexpected market changes. About stock index money management rules & methods courses: What are Index equity management and Index money management plans.

More Guides and Courses: