Forex Trend Line Break

Following an extended period where price movement remains confined within a defined channel, the price eventually reaches a point where it ceases to respect the channel boundaries. This event signifies the breach of the trend-line.

Since the line is point of support/resistance then we expect the market to move and head towards the in the opposite market direction. When this happens traders will close out the open orders which they had bought or sold. This is referred to as profit booking.

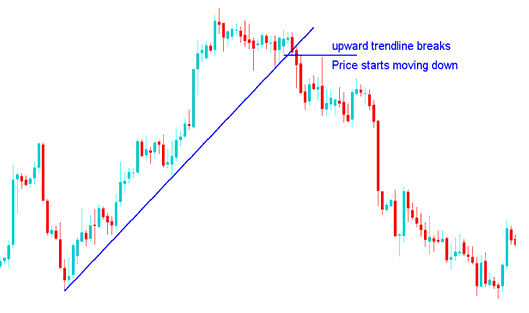

Forex Uptrend Reversal - Forex Upward Trend Reversal

When price breaks-out upward line (support) the market then will move down

This trend reversal signal confirms with a lower high or lower low. It opens a chance to short when the uptrend line breaks. Look for that lower high or low as proof.

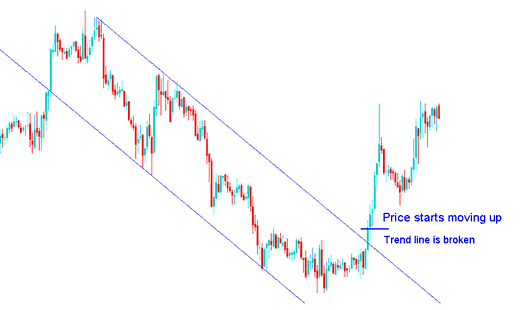

Forex Downtrend Reversal - Forex Downward Trend Reversal

When price breaks downwards line (resistance) the market then will move up

Downward Channel break

This signal confirms with a higher low or higher high. A trendline break offers a long buy chance. Wait for the break and a higher low or high pattern.

Note: Price may consolidate after breaking a trend before shifting direction. Still, always use a take-profit order when the market turns.

Traders use this trendline break setup to enter positions. Once you open a trade along the market's trend reversal, prices should move right away in that direction. It happens as a clear breakout. The market pushes forward without facing much pushback.

If the market doesn't move right away after a breakout, just close the trade. It usually means the current trend isn't done yet, and there's still some momentum left. And if the trend does stall, you're probably looking at a consolidation phase, which can drag on for a while.

Waiting for the market to close above or below the trend line after it has been broken will help to confirm this trendline break reversal signal.

Many forex traders enter positions too soon. They wait for a trend to reverse before the trend line breaks. But the price just touches the line. The trend keeps going with the forex pair.

For trend reversal trades, wait for price to close above or below the trend line. This confirms the breakout based on the price direction.

- Upwards Market Direction Reversal - this upward trend reversal signal gets to be confirmed once the price closes below this up-ward trend line, this should be the right time to execute a sell short trade position, so that to avoid a fake out.

- Downward Market Direction Reversal - this downward trend reversal signal gets to be confirmed once the market closes above the downwards trend-line, this should be the right time to open a buy long trade position, so that to avoid a whipsaw.

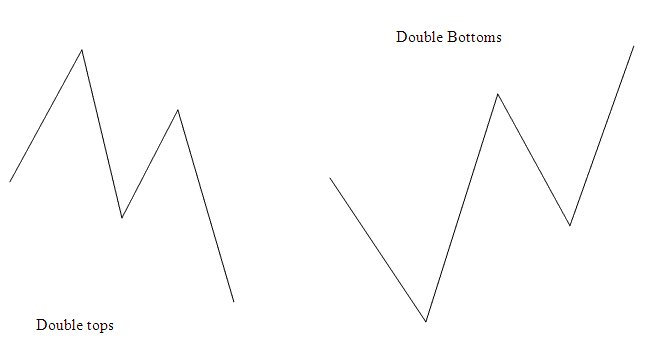

Integrating Double Tops or Double Bottom Formations with Trend Reversal Signals

A solid trade setup is to pair this trendline reversal with double tops or double bottoms patterns. Check out the Double Top Chart Setups and Double Bottom Setups Guide for more details.

These double tops or double bottoms chart patterns should already have formed before the trend-line break reversal setup. Because these double tops and double bottoms charts patterns are also reversal signals, then combining these 2 setups will give the trader good probability of avoiding a whipsaw signal.

The chart images above show double tops and double bottoms forming before the reversal from the trendline break.

The initial illustrative example of a Trend Line Break Reversal Signal in an Upward Direction preceded by a Double Tops chart pattern, which had completed its formation before the trend break reversal signal manifested on the chart.

Second example of a down trend line break reversal signal. The double bottom pattern formed first. Then the trend line break showed on the chart.

Double Tops or Double Bottoms Combined with Other Trend Reversal Signals

Get More Courses and Tutorials:

- Forex Account Deposit Bonus Including Lot Rebates and Forex Cash Back

- List of Strategies for DAX and List of DAX Trading Methods

- Forex Hammer Bullish Candle Patterns

- Technical Analysis Review of Recommended Indicators for XAU/USD Trading

- Tutorial on Installing the Forex Trading Software MetaTrader 4

- What You Should Know About FX: Advantages and Disadvantages

- How to Generate Signal Free with Trading Strategies

- Bollinger Band Automated FX Trading Strategy

- FX Robots That Use Williams Percent R to Trade Automatically