Reversal Candles Confirmed: Hammer and Hanging Man - Bullish and Bearish Examples

Bullish Hammer Candle Setups - Bearish Hanging Man Candlestick Setups

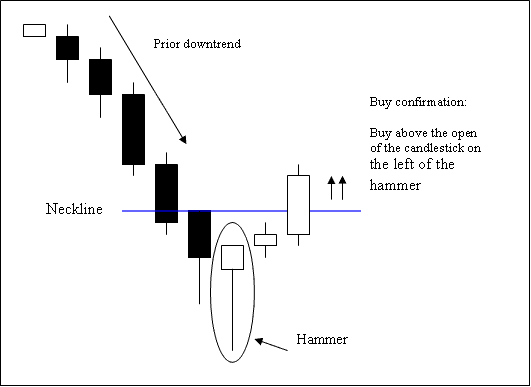

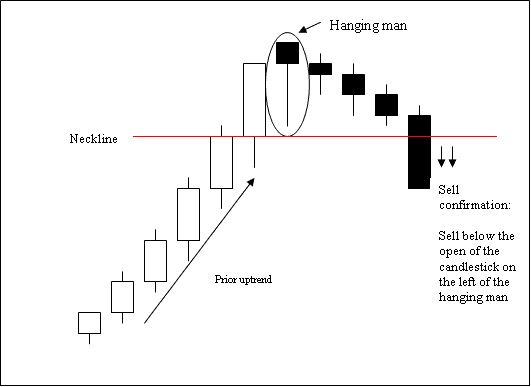

Reversal candle patterns are only valid if they emerge following a significant, established trend in the market. Therefore, a prerequisite for any candle formation to qualify as a reversal pattern is the prior existence of a trend.

The reversal candle patterns are:

- Hammer Candle Pattern and Hanging Man Candle Trading Pattern

- Inverted Hammer Candlestick Pattern & Shooting Star Candlestick Pattern

- Piercing Line Candle Pattern & Dark Cloud Candlestick Pattern

- Morning Star Candlestick and Evening Star Candles

- Engulfing Candles Patterns

Understanding Hammer and Hanging Man Candlestick Patterns

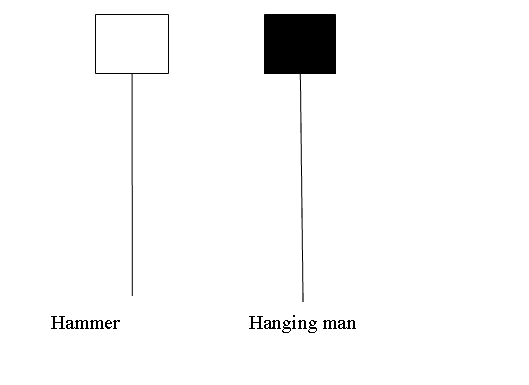

Hammer Candlestick Setup & Hanging Man Candle Setup candlesticks look similar but hammer is bullish reversal pattern and hanging man candlestick is a bearish reversal pattern.

Hammer Candle Pattern and Hanging Man Candle Pattern Candlesticks

Hammer Candle

A Hammer is a bullish setup that forms during a forex downtrend. They call it that because it looks like the market's hammering out a bottom.

A hammer has:

- A small body

- The body is at the top

- The lower shadow is 2 or three times the length of the real body.

- Has no upper shadow or has a very small upper shadow if present.

- The color of the body isn't important

Hammer Candle

Technical Analysis of Hammer Candle Pattern

The buy signal confirms when a candlestick closes above the open of the candle next to the hammer setup on the left.

Stop orders should be set a few pips just below low of the hammer candle.

Hanging Man Candle

This pattern formation is a potentially bearish reversal signal which occurs and forms during a forex uptrend. It is named & called so because it looks like a man hanging on a noose up high.

A hanging man candlestick has:

- A small body

- The body is at the top

- Lower shadow is 2 or 3 times length of the real body.

- Has no upper shadow or very small upper shadow if present.

- The color of the body is not important

Hanging Man Candle

Analysis of the Hanging Man Candles Pattern

Sell signal gets confirmed when a bearish candlestick closes below the open of the candle on left side of this hanging man candle setup.

Stop orders should be set a few pips just above the high of the hanging man candles.

Get More Lessons: