MACD Hidden Bullish and Bearish Divergences in Forex - MACD Hidden Divergence Guide

Forex traders often incorporate MACD hidden divergence as a potential indication that a trend will persist.

MACD hidden divergence happens on price pullbacks to old highs or lows. Two types exist for forex trades.

1. Hidden Bullish Divergence

2. Hidden Bearish Divergence Trading Setup

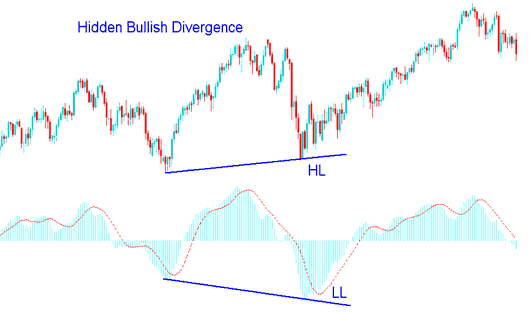

Hidden Bullish Divergence in MACD Indicator

The MACD Forex Hidden bullish pattern happens when prices are making a higher low (HL), but MACD trading shows a lower low (LL).

Hidden bullish divergence occurs when there is a retracement in an up trend.

MACD Bullish Divergence Strategy - MACD Bullish Divergence Trading Setup

This MACD bullish divergence ends a pullback. It highlights strength in the uptrend.

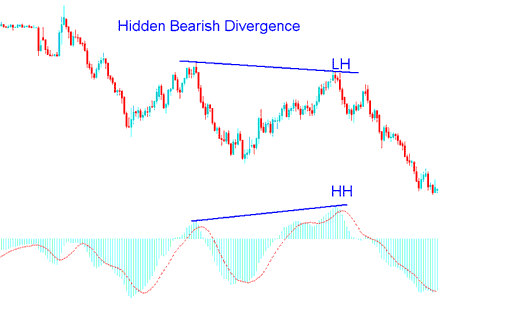

Hidden Bearish Divergence in FX Trading

MACD Hidden Bearish Divergence happens when the price is making a lower high (LH), but the MACD tool is showing a higher high (HH).

Hidden bearish divergence forms on a pullback in a down trend.

MACD Hidden Bearish Divergence Strategy - MACD Bearish Divergence Trade Setup

When you see this MACD hidden bearish divergence, it confirms the pullback is done. It shows there's still downward momentum in the trend.

Forex Hidden Divergence is regarded as the most effective type of divergence for trading because it aligns with the current price trend. This method offers the best entry opportunities and is more precise compared to traditional divergence signals.

Learn More Tutorials & Topics:

- How Demarker Buy and Sell Signals Work

- Course on Trading the NIKKEI 225 Index

- Calculating Mini Trading Account Pips Value for Efficient Trading

- Want to get NIKKEI225 on MetaTrader 4 for PC? Here's how.

- Chaikin Money Flow EA Automation Explained

- How to Open Buy and Sell on MT4 Trading Charts

- Analysis of the Moving Average (MA) Indicator and a Trading Strategy Based on Moving Average Cross-overs

- Bollinger Bands Analysis in MetaTrader 5

- How to Figure Out a Pip in XAUUSD: What a Gold Pip is Worth

- Optimal XAUUSD Leverage Selection for a Thirty Dollar XAUUSD Position