What is NIKKEI 225 Strategy? - Guide Tutorial for Trading/Transacting NIKKEI 225 Index

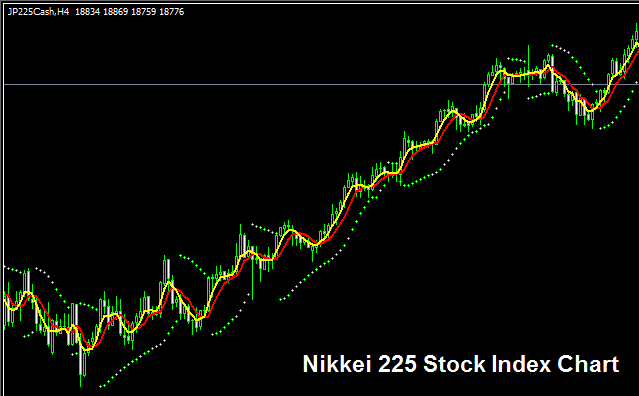

NIKKEI 225 Chart

The NIKKEI 225 chart appears above. In this case, the index shows as JP 225CASH. This example covers the NIKKEI 225 Index on the MetaTrader 4 FX platform.

Strategy to NIKKEI 225 Index

NIKKEI 225 Index represents relative trend movement of the top 225 shares & stocks in Japan. Because this stock index tracks 225 corporations it-will be more volatile when compared and analyzed to an index like the Germany DAX30 that only tracks 30 corporations.

Get More Lessons:

- How Can I Use MT5 Alligator Indicator?

- Explanation of the USDJPY Bid Ask Spread

- Choosing and Selecting the Right Analysis XAU/USD Strategy for Beginner Traders

- How to Draw Downwards Gold Trend-lines on Gold Charts

- How to Avoid Index Whipsaw Fake-outs when using MACD Stock Indices Trade Indicator

- Best Time to Trade EURNZD GMT

- INFO: Getting Best Results of XAU/USD Ways of Trading

- Comprehensive Tutorial and Guide for Trading the Nasdaq 100 Stock Index