MACD Whipsaws and Fake Signals in Bearish or Bullish Index Markets

Given that the MACD functions as a leading indicator capable of occasionally producing false signals or whipsaws, we will examine a specific instance of a fake-out generated by this system to underscore the importance of patience and awaiting a confirmed trading signal.

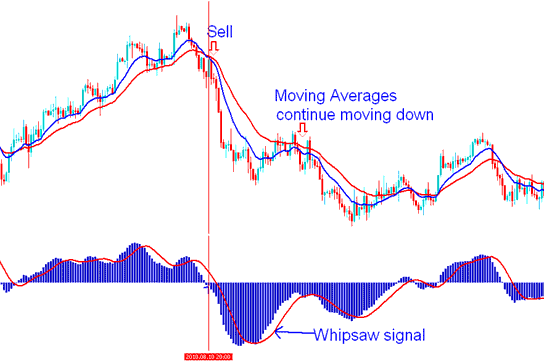

MACD Indicator Whipsaw - Indices Whipsaws

The MACD gave a buy Indices signal, when this buy Indices signal was generated & the MACD line was still below the zero center-line mark. At this point the buy Indices signal had not been confirmed & it resulted into a whipsaw just as is illustrated by the moving averages which continued to move downwards.

An indices whipsaw signal happens when the price quickly goes up and down in a short period, which messes up the information used to figure out the moving averages that make the MACD data. These false signals usually happen because of news announcements that can cause confusion in the market.

Traders need to spot a whipsaw and handle it well. A whipsaw can shift from up to down in sessions. To cut indices whipsaw risk, wait for signal proof. Let MACD cross above or below the zero line.

Preventing Whipsaw False Signals by Harmonizing the MACD Crossover with the Centerline Cross-over

Buy signal - The buy signal from Indices is verified when lines cross, the price sharply increases, and then a line crosses the center again.

Sell signal happens when a crossover occurs. Then price drops sharply. After that, a center-line crossover confirms the sell signal.

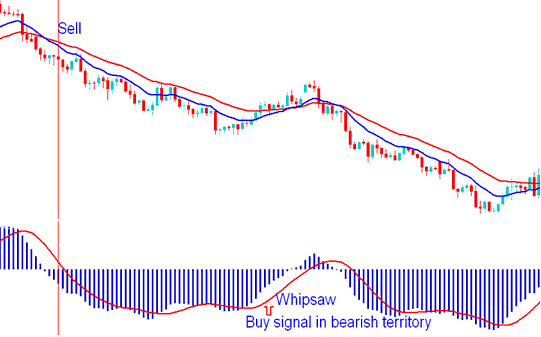

1. Buy Signal in Bearish Territory Whipsaw

If a signal to purchase Indices happens when the market is going down, it might be a false signal, especially if the MACD doesn't cross the center line soon after.

In the example below, MACD creates a buy signal for indices. This happens even in bearish area. Then MACD turns down and drops. This leads to an indices whipsaw. Wait for a centerline crossover to skip the fakeout whipsaw.

But, in this case, the centerline was briefly crossed: this quick signal would have been hard to trade using just the MACD, so it's helpful to use the MACD technical indicator with another indicator. In the example below, the MACD is used together with Moving Average trading indicators in a technical analysis.

MACD Indices Whipsaw - Buy Trading Signal in Bearish Territory

2. Sell Signal in Bullish Territory Whipsaw

When a sell signal shows up in a rising market, it might be false if the MACD doesn't soon cross the center line.

In the example illustration below, the MACD gives a sell signal even though it is in bullish territory, the MACD then turns up & starts moving upward again resulting into a whipsaw. By waiting for center line cross-over it's possible to avoid the Index fake out. In the example below by combining this MACD with the Moving Average Cross over Strategy you'd have avoided this whipsaw.

MACD Indices Whipsaw - Sell Signal in Bullish Territory

To entirely circumvent whip saws when employing the MACD Indicator for market trading, it is advisable to utilize the Center-line Crossover Signal exclusively as the authoritative Buy or Sell signal generated by the MACD Indicator.

Get More Topics and Courses:

- Index Trading Strategy and Signals Overview

- Steps to Open a Managed Forex Account

- Clarification of 1:200 Leverage When Trading XAU/USD

- How to Build a XAG/USD Trading Strategy

- Gold Technical Indicator Analysis Through TTF

- Leverage Example: What 1:20 Really Looks Like

- What is the Optimal XAUUSD Leverage for $1000 in XAU USD?

- UKX100 Strategy Guide: Build Trading Plan for UKX100 Indices

- Forex Parabolic SAR in Bullish and Bearish Trade Market

- What is SMI 20 Spreads? SMI20 Stock Indices Spread