Choppiness Index - what does it actually tell you, and how do you spot its signals?

Built and made by E.W. Dreiss

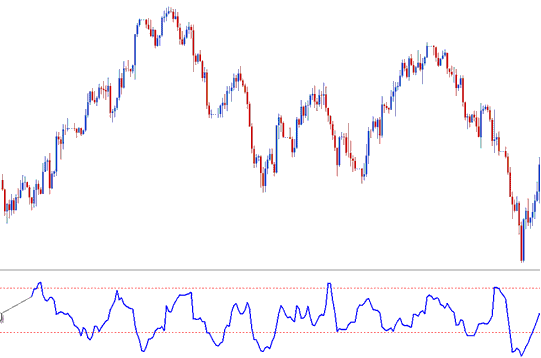

The Choppiness Index is a simple tool that helps FX traders know if prices are going in a direction or staying in one place.

This indicator works like ADX, which also helps to measure how strong a market trend is and to tell if the market is trending or staying in one place.

The Choppiness Index tool uses a scale from 0 to 100. It also usually has lines at the top and bottom at 61.8 and 38.2 respectively.

Tutorial Lesson for Trading the SWI 20 Index - Comprehensive Guide and Training for Executing Trades on the MT4 SWI 20 Instrument.

Secondly, it computes the maximum attained value and the minimum value across 'n' defined periods and determines the differential between them.

Thirdly, it aggregates the totality of the true range figures and subsequently computes the base-10 logarithm of that resultant sum.

Finally, this calculated figure is divided by the base-10 logarithm of the 'n' number of periods and then multiplied by 100.

Technical Analysis and How to Generate Trading Signals

The Choppiness Index does not indicate market direction but measures the trend's activity level instead.

The Choppiness Index works on trends over n periods. Strong trends pull it near zero. Sideways chops or ranges push it close to 100.

Indicator values exceeding 61.8 suggest that the market is currently in a ranging or choppy state (moving sideways and consolidating).

Higher values often occur following a strong consolidation phase. These values may signal a potential breakout is imminent after prolonged price consolidation in the trading market.

Choppiness The market is trending if the index values are below 38. 2.

Lower values happen during/after a strong trending period. Lower values could also be interpreted as a signal of a potential incoming consolidation and choppiness after a strong trend phase has occurred.

Access Extra Tutorials and Lessons

- What are Bollinger Band Width Signals to Buy & Sell FX?

- How to Analyze/Interpret Analysis Trade Charts Using Trend

- How Do I Place Indicators in Forex Charts on MetaTrader 4 Platform/Software?

- Is Acceleration/Deceleration: AC Leading or Lagging Indicator?

- Utilizing MT4 Volume Trading Indicators for XAUUSD Day Trading

- Moving Average Signal in Range Indices Market

- Forex Platforms MT4 Forex Software

- How to Develop a USD HKD Trade Strategy

- Buy Entry Limit Order and Sell Entry Limit Order

- How Does Forex Demo Trading Account Work in Forex Trading?