Recursive Moving Trend Average Technical Analysis & Signals

This indicator is figured out using a math formula that fits, and the formula is known as a Recursive Moving Polynomial Fit.

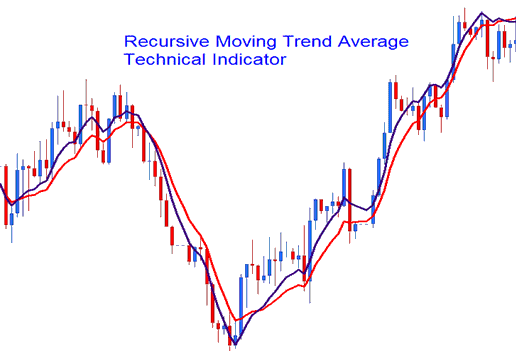

The calculation used for this trading tool only needs a small amount of past information to figure out and guess the next direction of price movement. The example below shows two Recursive Averages combined to create a crossover system method.

Technical Analysis & Generating Signals

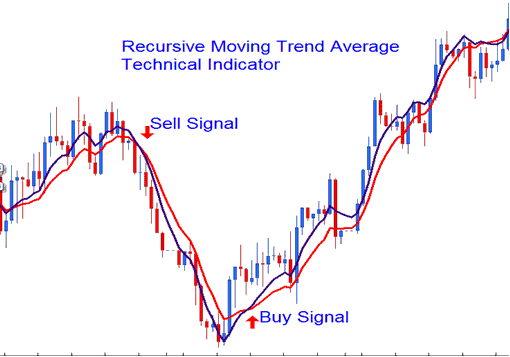

The best way to analyze trading is to use the cross over method, where you, as a gold trader, combine two moving averages, such as 14 and 21. If they cross each other going up, that's a sign to buy, and if they cross going down, that's a sign to sell.

Buy Sell Signal

Recursive Average is similar to the usual moving average, but it is much smoother because of how it's calculated, and it is also less likely to have sudden, sharp changes.

Obtain Further Programs and Subject Areas:

- Indicators for FX Explained

- Where is Nasdaq in MT5 Platform?

- What's WallStreet 30 Index MT4 Chart?

- Desktop Trade Platforms, Web Traders, Phone Apps

- How to Add MT4 Bollinger Band Size Trading Indicator

- Support & Resistance Levels on Index Trade Charts

- What Is the Easiest Way for New Forex Traders?

- MetaTrader 4 Chande DMI Technical Indicator Analysis Described