RSI Indicator Overbought & Oversold Levels

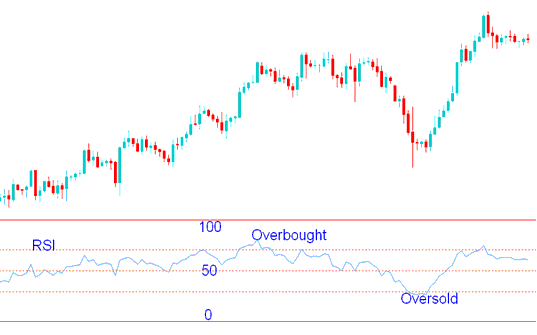

RSI values exceeding 70 indicate overbought conditions. Index traders often view levels above 70 as market tops, making it an ideal point for capturing profits.

RSI readings below 30 are considered oversold. For index traders, values under this threshold are regarded as potential market bottoms and often serve as opportunities to book profits.

These overbought & oversold Indices levels should be confirmed by RSI center line crossovers signals. If these regions give a market top or bottom, this signal should be confirmed using RSI center line cross-over signal. This is because these overbought & oversold levels are prone to giving whip-saws in the market.

In the example, RSI at 70 signals overbought conditions. It hints at a possible trend reversal.

The market trend initially reversed downward after a brief upward movement, eventually reaching oversold levels. At this point, the indices market bottom was identified, leading to a subsequent upward reversal.

Overbought & Oversold Levels - RSI Strategies

Over Extended Over-bought and Over-sold Levels

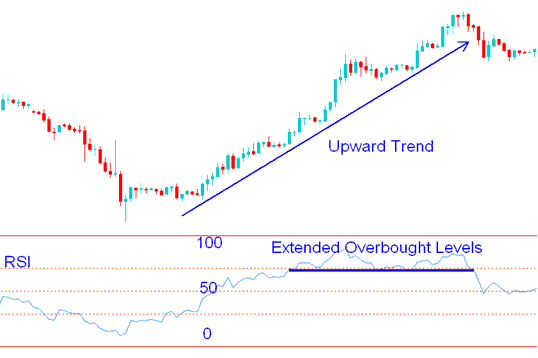

When the market maintains a strong upward or downward trajectory, the RSI indicator will frequently remain situated within these identified overbought and oversold reference zones for prolonged periods. Under such conditions, these overbought and oversold regions become unreliable indicators of market peaks or troughs because the RSI indicator can persist at these technical levels for extended durations. This explains why we assert that over-bought and over-sold readings are susceptible to generating trading whipsaws, making confirmation via the RSI center-line crossover strategy advisable.

Over Extended Over-bought and Over-sold Levels - RSI Indicator Strategy

Check Out Extra Subjects and Lessons: