How to Draw Trendlines and Channels on Charts

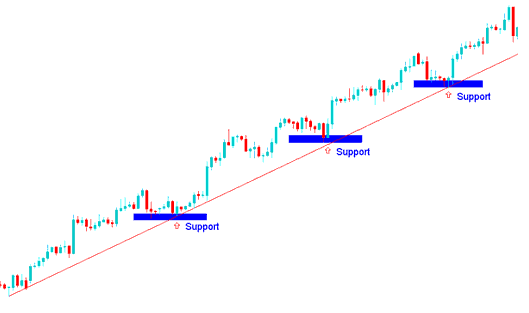

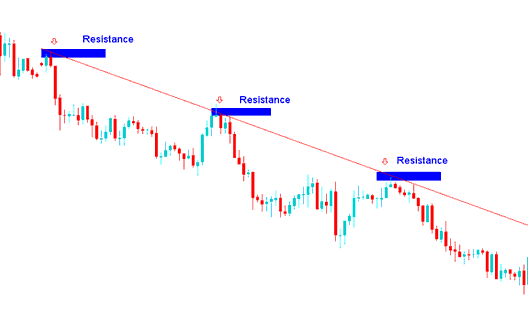

Occasionally, support and resistance levels are established diagonally, resembling a staircase configuration. This pattern creates a sustainable XAUUSD trend characterized by continuous movement in either an upward or downward path.

A trend line shows where the price finds support and resistance, depending on the market's direction. For a rising xauusd market trend, the trend line will indicate support levels, and for a falling xauusd market trend, the trend line will indicate resistance areas, and many traders primarily use trend lines to identify these resistance and support levels on charts.

A Trend line is a slanting straight line which connects 2 or more price points and extends in to the future to act as a zone of support or resistance for the price movement. There are 2 types of xauusd trend lines: upward xauusd trend line and downward xauusd trend line. Trend-line is an aspect of analysis that uses xauusd line studies to try & predict where the next price move will head to. A trader must know how to draw and interpret signals derived & generated by this trend line tool.

This analysis is based on the idea that gold markets move in trends. Trendlines are used to show three things.

- The general direction of market - upwards or downwards.

- The strength of the current xauusd trend - and

- Where future support & resistance will be likely located

When XAUUSD trend lines form in a certain direction, the market usually follows that path until the trend line finally breaks.

Drawing these lines on a xauusd/gold chart shows the overall direction of the xauusd price, which could be going up or down.

Below is an example of how to draw these trend lines on charts

Guide: Draw and trade upward trend lines.

Guide: How to Draw Downwards Trend-Line & Trade Downwards Trend Move

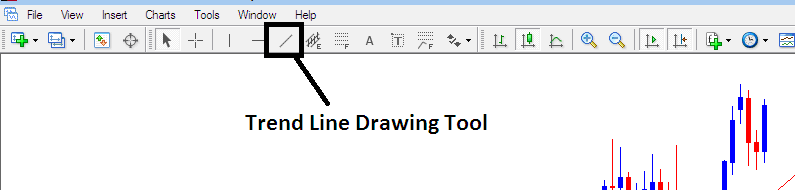

The MetaTrader 4 software gives gold traders tools for xauusd charts and trading to draw trendlines. To put trend lines on a xauusd chart, gold traders can use the tools in the MetaTrader 4 platform software, as shown here.

To draw trend lines on an XAUUSD gold chart, click the XAUUSD MetaTrader 4 draw tool as shown on the MT4 trading software. Pick point A to start the line, then point B where it should end. You can right-click the trend line. In properties, check the ray box to extend it. Uncheck if you want it short on your MT4 software. Change color or width in that properties window too. Download MT4 software to learn XAUUSD trend line work.

The XAUUSD trend acts as your top guide. Traders often say this because you must not fight it. It stands as the surest way to trade XAUUSD. Prices lock into one path and stay there for a while. So, this trend-following approach lets you grab gains from the market.

Guide-lines of How Do You Draw XAUUSD Trend-Lines

Use candle charts

- The points used to draw the trend-line are along the lows of price bars in a bullish market. An upward bullish xauusd trend move is defined by higher highs & higher lows.

- The points used to draw the trend-line are along the highs of price bars in a falling downwards market. A downward bearish xauusd gold trend move is defined by lower highs and lower lows.

- The points used to draw trendlines are extremes points - the high or the low gold price. These extremes points are important because a close beyond the extreme tells investors the trend of xauusd might be changing. This is an entry or an exit signal.

- The more often a xauusd trend line is hit but it is not broken, the more powerful its signal.

There are 2 main ways of trading this xauusd trend line analysis set-up:

- The Trend-Line Bounce - Trend Line Bounce

- The Trend Line Break - Trend Line Break

Analysis Methods of Trend lines

When the gold price bounces off the xauusd trend line, it means the price will likely keep moving in the same direction. If the xauusd trend is going down, the price will bounce down after hitting the xauusd trend line, which acts as a resistance level. If the xauusd trend is going up, the price will bounce up after hitting the xauusd trend line, which acts as a support level.

A break in the gold trend line serves as a reversal indicator, signaling that the market has crossed the trend line and is now heading in the opposite direction. If the XAUUSD uptrend is violated, market sentiment shifts to bearish. Conversely, a break in the XAUUSD downtrend leads to a bullish market sentiment.

In strong XAU/USD trends, after the trendline break signal, prices often consolidate before shifting to an opposing trend direction. For short-term trends, this signal might indicate an immediate price reversal.

In gold charts, trend-line bounces and breaks act as support or resistance. They rely on these key levels.

Entry, Exit and Setting stops:

This gold trend line approach serves to determine optimal points for trade entry and exit, with protective stop-loss orders strategically placed proximal to or beyond these trend lines. The xauusd trend line bounce is a low-risk entry tactic employed by traders to set opening positions subsequent to a price retracement. Trades are structured around these trend-line boundaries, with a protective stop order positioned just above or below the line itself.

When the xauusd trend line breaks, it could mean the xauusd trend is changing. When the line breaks, the price usually starts moving in the other direction. This tells traders to close their trades early and take their profits. If the price goes past these trendline levels, it's a sign that the price might start moving in the opposite direction.

In contrast to other xauusd analytical instruments, the trend line requires no underlying calculation formula: its construction involves merely connecting two identified points on the chart itself.

Get additional tutorials and lessons at:

- What Kind of Buy and Sell FX Signals Come From Chaikin Money Flow?

- How to Add the S and P ASX200 Index on the MT5 Platform

- Guide to Trading HANG SENG 50 Index Course

- Learn About Different & Many Kinds of Gold Charts

- USDJPY Bid Ask Spread Described and Explained

- What's EURCHF Spreads?

- Understanding Entry Stop Orders: Buy Stop and Sell Stop in Forex

- How to Create a CAD CHF System