Strategy Guide for Trading the HANG SENG 50 Index - Educational Material for HANGSENG 50 Trading

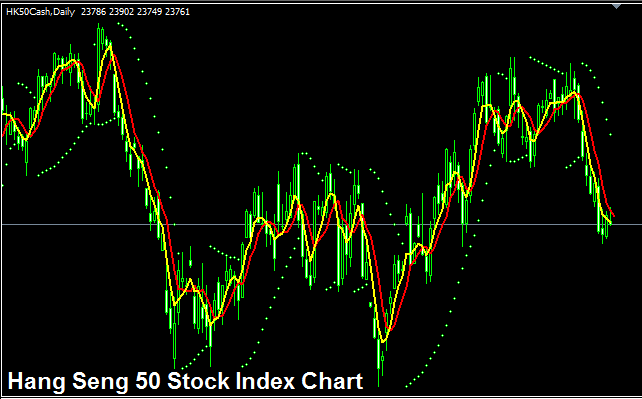

The HANGSENG 50 Trade Chart

HANGSENG 50 chart is shown and displayed above. On above example this Stock Index is named HK 50CASH. The example Which is shown above is that one of HANGSENG50 Index on the MetaTrader 4 FX and Platform.

Strategy to HANGSENG 50 Stock Index

HANGSENG50 Index keeps track of capitalization of top 50 firms in Hong Kong. This Index in general moves upwards over long term but it is more volatile in its trend movement. When compared to other indexes such as EURO STOXX & the DAX30 which have lower volatility in their trend movements, this index has wider swings(more volatile swings) in its trend movement.

Over a long time, this index will usually go up, so you should favor buying and keep buying as the index rises and continues moving upward.

A smart strategy is to buy market dips. Just be ready - this index swings a lot, so expect some wild moves.

During Economic SlowDown and Recession

In slow economies and recessions, companies report less revenue and earnings. Profits drop, and growth looks weaker. Traders sell shares of these firms. So the stock index tracking them heads down too.

At these times, market trends often head down. As a trader, you should change your plan to match the down trends in the index you trade.

Contracts and Details

Margin Required Per 1 Contract - HKD 450

Value per Pips - HKD 1

NB: Despite a general upward bias, traders must account for daily price volatility. On certain days, indices might trade sideways, consolidate within a range, or even experience pullbacks or retracements, which can sometimes be significant. Consequently, precise entry timing, utilizing this trading strategy, is essential, coupled with the strict application of sound money management principles and guidelines to manage unforeseen market fluctuations. Regarding money management in the context of indices: review "What's Stock index money management principles and guidelines and money management techniques."

More Topics: