Defining FX Trading Markets - What Forex (FX) Entails - Venues for Forex Trading and Initiation Steps

A beginner trader who wants to learn about the online forex market can use this learn forex tutorials to learn about: What is the market? - How to trade forex in the online forex market and how to start and begin forex using a trading platform software like the MT4 or MT5 platform.

Many traders are beginning to ask around about what is trading? - Where to Trade Forex - How to Start Trading - the most common questions that most new traders ask are:

- What is FX Trading? - Where to Trade FX?

- What is a Platform Software?

- How to Begin Trading?

- What's a Trading System?

While the majority of these queries are addressed in subsequent lessons, the fundamental question remains: What exactly constitutes Forex?

The forex market is a global online place where $7.2 trillion is exchanged every single day.

The forex market started in 1971 when the system of floating exchange rates was created: unlike stocks, forex doesn't have a central place.

Currency trading is conducted through interbank networks comprising liquidity providers and brokers who connect individual traders to this ecosystem. Trades occur globally via computer and telephone networks across thousands of locations.

This makes the forex is a decentralized market formed by a large network of banks collectively known as the interbank market. These banks determine the exchange rates, based on the supply & demand for the currencies.

People usually call it FOREX, FX, or Spot FX. This is where banks, businesses, investors, and individual traders swap currencies - either for international trade or just to make a profit from changes in exchange rates.

Currencies used in trading are identified by three-letter symbols. The first two letters represent the country's name, while the third letter corresponds to the first initial of the currency's name.

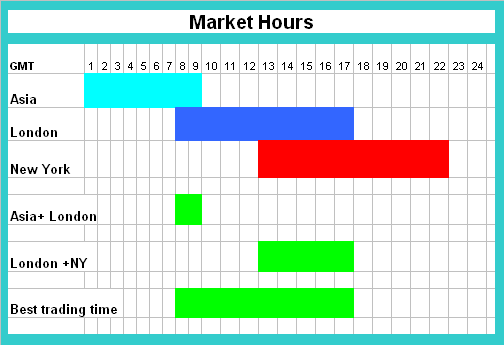

The FX market is the biggest money market worldwide, with $7.2 trillion exchanged daily, compared to the $0.5 trillion in US stocks. FX operates all day because it is a market between banks, so when banks close in the USA, banks in Europe open, and then banks in Asia open when those close. A typical day begins in Sydney, moves to Tokyo, then London, and ends with the New York session.

In the market 90% of all trades is done for the purpose of speculation for profit, the rest is traded for the purpose of settling international trade positions between countries. This is made possible because the forex is an over the counter interbank market, that can facilitate transactions between a lot of traders through brokers.

FX is based on the concept of floating currencies in the open exchange market, in what is referred to as the international money markets where the participants are Banks, Brokerages, Fund Managers, Governments, Central Banks and individual traders. The value of currencies is determined by demand supply forces & a country monetary policy. Other factors & aspects which affect currency value is political stability of the country.

Forex Trading for speculators

Forex trading used to suit only pros at big banks, investment firms, money managers, dealers, brokers, and huge companies. With online access now, traders ask what trading really means.

But with the rise of the internet and brokers, speculators and normal traders are now able to participate in the market using brokers.

With desktop computers and widespread internet access, online forex trading has gained immense popularity. Numerous forex brokers can now be found easily online.

Historically, Forex trading was restricted to the affluent segment possessing over $1 million in capital. However, due to the proliferation of the internet, brokers can now facilitate retail accounts requiring as little as $100 to commence currency trading operations online.

Forex traders can begin trading by downloading online software provided by brokers, opening an account, and seamlessly trading currencies through these online platforms.

Forex Trading - How to Start Trading

Unlike the stock markets or the currency futures market, currency exchange is not centralized. Thousands of sites around the globe engage in currency trading using many computers and phones via an interbank network, which is an inter-network of banks.

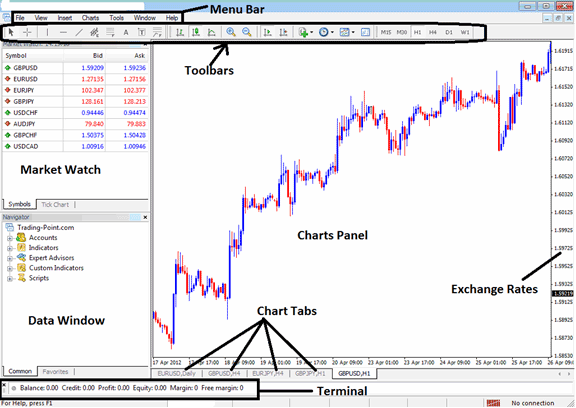

Forex trades are placed from Online Platforms like the one below.

The forex market, often called Forex, is where banks, traders, speculators, and other market players trade one country's money for another. Most of the forex activity happens between the five main currencies.

- US Dollar

- British Pound

- Japanese Yen

- Euro and

- Swiss Franc

Forex trading represents the largest financial market globally. While US stocks handle $700 billion daily, the forex market trades approximately $7.2 trillion within 24 hours.

The forex market never sleeps - it runs 24 hours a day, with currencies traded in the interbank market. Trading moves around the globe, starting from major banking hubs in the US, then to Australia and New Zealand, over to Asia, Europe, and then back to the US.

Until now, only professional traders from the major international commercial/investment banks used to dominate the market. Other market participants who have now joined in range from big multinational firms, registered dealers, international money brokers, global money managers, futures trader, options traders, retail traders & private traders.

There are three primary reasons for getting involved in the trading market

- One is to facilitate an actual transaction, where the international corporations convert and cash on the profits made in the foreign currencies in to their local domestic currency.

- Corporate treasurers and money managers also trade Forex so as to hedge against unwanted exposure to future price action movements in the currency exchange market.

- The third and most popular reason is based on the speculation for trading profit. In fact, it's estimated that less than 5% of the total trade position activities on the forex is what actually facilitates commercial transaction, the other 95% is speculation based transactions retail trading.

The forex market is identified as an Over the Counter (OTC) or 'Inter-bank' market due to trades executed between two counterparties over an electronic network.

Global Forex Trading Hours

Unlike stock and futures markets, the Forex market does not have one central location for trading. Forex is really a market that's open 24 hours a day, starting in Sydney, then going to Tokyo, then London, and finally New York, as it circles the globe. When talking about global forex, traders are able to react to changes in currency values caused by economic, social, and political happenings as soon as they happen, at any time.

How Do I Begin Forex

If you're hunting for a different way to invest your money, Forex trading is worth a look. A lot of people have switched from stocks to Forex, either to mix things up or to earn some extra income. Done right, Forex gives you a solid shot at growing your investment.

What's FOREX?

FOREX is short for market. What is FOREX? is best understood as the buying and selling of currencies. This happens on the worldwide market.

Participants of the market buy a particular currency & sell it when it is favorable to do so. Your best chance as a learning Forex trader is to understand analyze the trends so you as a forex trader can pick and trade a trending forex currency, whether it's the Japanese Yen, the Euro, or another currency.

Practice Forex Trading on Demo Account

Real money in forex makes people wary about joining. But you can practice without risking cash. Learn trade methods through demo accounts. Do your research. When ready, download software and test it out.

During the demo period, you as a forex trader can use virtual money(like monopoly game money) to trade currencies. You can use this time to better understand fx market & how to use the software & technical tools. There are many web resources that you can find that offer info on the market and how you as a forex trader can analyze the information and predict changes in currency prices. Once you as a trader have a good forex system & a reliable forex plan that you use & it is profitable on a demo account you can then try to trade with real money.

What's the Risk?

As with any financial undertaking, inherent risks exist. Even extensive research into trading techniques, trend study, and forecasting market shifts does not guarantee immunity against adverse outcomes. The soundest counsel here is to rely on common sense and good judgment, with paramount importance placed on implementing sound forex equity management rules. Many individuals quickly grasp the potential of leveraged currency trading, become overconfident, exhibit greed, take excessive risks, and subsequently lose their capital due to lacking an investment strategy or plan. As a forex trader, discerning the optimal times to trade and when to refrain is critical. Excessive greed often leads traders to overtrade or stubbornly hold onto losing positions for too long.

You can use a stop loss order to exercise better control of your trading activities & limit your losses and risks to the down-side. You can set up automatic stop orders and the software that will close out an open fx trade when this target is hit. This also applies in both ways: you as a FX trader can set an upper limit to take profit & a lower limit to stop loss orders.

How to Start Forex

Where to Trade FX? - Trade forex online from your home or office computer. You need software and quick internet. This gives full control over your trades anytime. Platforms let you adjust positions day or night. Online forex brokers are easy to find.

Always test the software using a demo account to ensure familiarity and comfort with it.

Fundamental Forex Education: Defining FX, Where to Conduct Forex Trading, and Essential Trading Techniques.

Explore Further Subject Areas and Programs:

- How to Start Gold for Beginners Lesson Tutorial

- Forex Parabolic SAR in Bullish & Bearish Forex Market

- Minimum Deposit XAUUSD Brokers Accounts

- Strategy for Trading FTSEMIB 40 Indices

- Index Trading Strategy Lesson

- How Do I Trade MACD Fast Line & MACD Center Line Crossover?

- How Can I Trade Pullback in Index?

- DeMarks Range Extension Indicator for MetaTrader 5

- Kurtosis Analysis on Forex Charts

- Forex Price Action 1-2-3 Method Price Break-out