Trading Applications of Stochastics Oscillator for Both Bullish and Bearish Divergence

The Stochastic Oscillator can also be used for divergence trading in forex, where divergence signals help pinpoint potential market turning points.

Divergence forex trading is a signal that a rally or retracement is losing steam and is likely to reverse. It means that last buyers or the last sellers are pushing forex price in one way whereas majority of other traders have stopped trading in that direction & are cautious of a price correction/retracement.

List of the 4 types of divergence setups

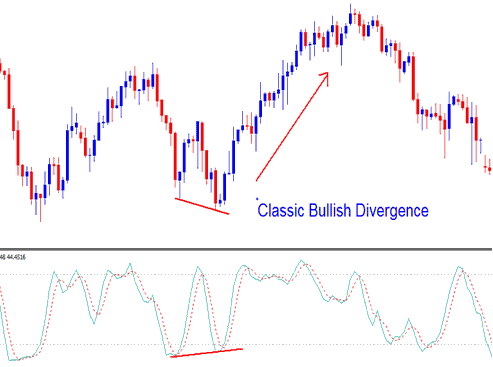

Example 1: Classic Bullish Divergence

A Classic Bullish Divergence in the Stochastic Indicator, followed by an increase in the forex price.

Stochastics Oscillator Technical Classic Bullish Divergence Trading Setup

If forex prices hit new lows but Stochastic does not, a reversal nears. The down move may end. An up rally could follow.

In the currency above example the forex price set a new low but it was not accompanied with a new low in the measure of Stochastic oscillator indicator, when price formed a new low then the stochastic indicator should have followed suit, but the stochastic indicator did not thenceforth the forex classic divergence trade setup.

The classic divergence setup in forex is particularly potent when it combines a divergence trade with a rise above the 20% trading indicator level, merging overbought and oversold thresholds with the divergence strategy.

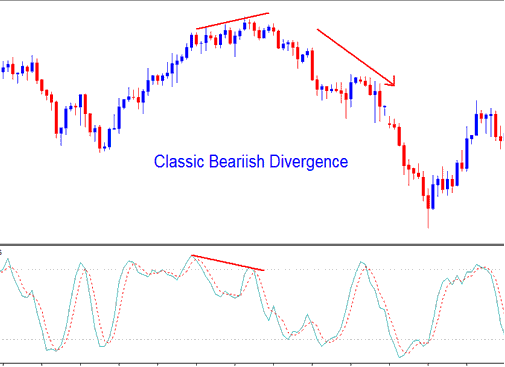

Example 2: Classic Bearish Divergence

A standard bearish divergence in the stochastic indicator comes with the forex price. Then prices fall.

Stochastic Oscillator Classic Bearish Divergence Trade Setup

When price hits new highs but the Stochastic oscillator fails to top its last high, the uptrend will reverse. This leads to a bearish divergence trade in forex.

This typical bearish divergence trade is even more powerful because it combines a divergence with a drop below the overbought level of 80.

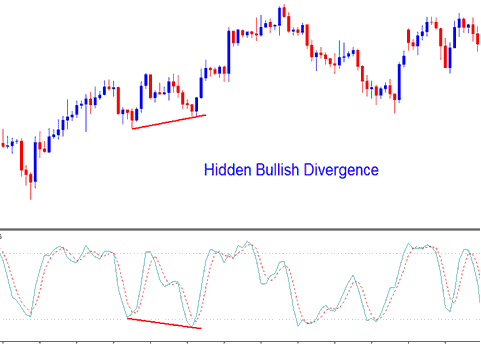

Example 3: Hidden Forex Bullish Divergence

A Hidden Forex Bullish Divergence trade setup signals a market pullback occurring within an existing upward trend in forex. This specific hidden divergence trading setup is highly favorable for trading because the position is taken in alignment with the established trend's direction, rather than attempting to trade a reversal.

Stochastic Oscillator Hidden Forex Bullish Divergence

Even though, the stochastic oscillator indicator made a lower low the forex price low was higher than the previous low (higher low). This means that even though the forex sellers made a good attempt to push forex price down as indicated by the stochastic indicator, this wasn't reflected on the forex price, and price didn't make a new low. This is the best place which to open a buy trade, since it is even in an upwards forex trend there is no need for you to wait for a confirmation trading signal, because you're buying in an upwards trend.

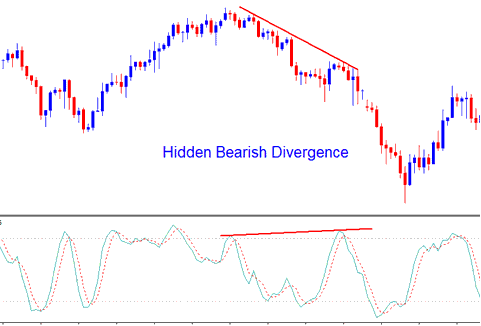

Example 4: Hidden Forex Bearish Divergence

Hidden Forex Bearish Divergence setup signifies a retracement in a downwards trend.

Stochastic Oscillator Hidden Forex Bearish Divergence

Hidden forex bearish divergence is the top divergence to trade. You trade with the market trend, not against it. This spot is ideal for a sell order. In a downtrend, no extra signal is needed. You sell right in the downward move.

Get More Tutorials & Lessons:

- USD/HUF Spread Explanation

- How to Get MT4 Stocks Trade Chart

- How do you analyze candlestick strategies?

- EURNOK Currency Pair Open and Close Time Details

- Pip value information for SPAIN35 indices

- XAUUSD Trend Following Trading Strategies Explained

- FX Trading MT4 Bar Chart on Charts Menu

- How to Calculate Leverage and Margin in XAU/USD

- Setting Up S&PASX 200 on MetaTrader 5 on my PC

- How to Open Chart in MetaTrader 4 Shown