How to Calculate Leverage & Margin in Gold Trading

Leverage means you control a large sum of money with just a small amount of your own cash. You borrow the rest. This draws many traders to online gold trading.

Online trading has many platforms on the web. MetaTrader 4 stands out as the top choice. Its strengths include these points.

With this, you borrow $100 for each $1 in your XAUUSD account.

In simple terms, your broker provides you with capital at a leverage ratio of $100 for every $1 in your account. This is referred to as leverage. Therefore, if you deposit $20,000 into an account and apply a 100:1 leverage ratio, you will have access to $100 for every dollar you own, leading to the total capital managed through leverage as follows:

If for $1 the broker gives and provides you $100 dollars

After that, you will have a total of if you have 20,000:

20,000 dollars multiplied by 100 equals 2 million dollars.

You now have control over $2,000,000 worth of investments.

A lot of new people who trade Gold want to know the best leverage to use with accounts of $20,000, $50,000, or $100,000. When starting a real Gold account, it's always better to pick 100:1 instead of 400:1.

What's Margin?

Brokers need margin to let you trade with borrowed funds. In gold trading, margin covers your open deals. It shows as a percent. At 100:1 leverage, you handle $2,000,000, as the image above explains.

Can you compare a person putting in $20,000 to one putting in $2,000,000? No way. Leverage changes that. It shifts you from $20,000 to $2,000,000, or from $50,000 to $5,000,000. Where does the extra cash come from? You borrow it from your online broker. That's leverage in simple terms. As a gold trader, you borrow against the $20,000 you deposit with the broker. Picture it this way: control a big sum with a small amount of your own cash, and borrow the rest. Without leverage, trading XAUUSD lacks profit. In fact, gold traders can pick no leverage, like 1:1, but profits come slow. They barely make money that way. Leverage makes online trades in financial tools pay off.

Explanation of how to calculate leverage:

The margin needed here is 20,000 dollars (your money): if it's shown as a percentage of the 2,000,000 dollars you're in charge of, it is:

If leveraging = 100:1

20,000 divided by 2,000,000 times 100 equals 1%

Margin required = 1 %

(1/100 *100 = 1%)

"TradeForex- Please simplify because I am a Beginner Trader Trader"

(Simply put - if you have $20,000 and use leverage, you control $2,000,000 - what % of $2,000,000 is $20,000? It's 1%) That is the amount of money you need to trade.

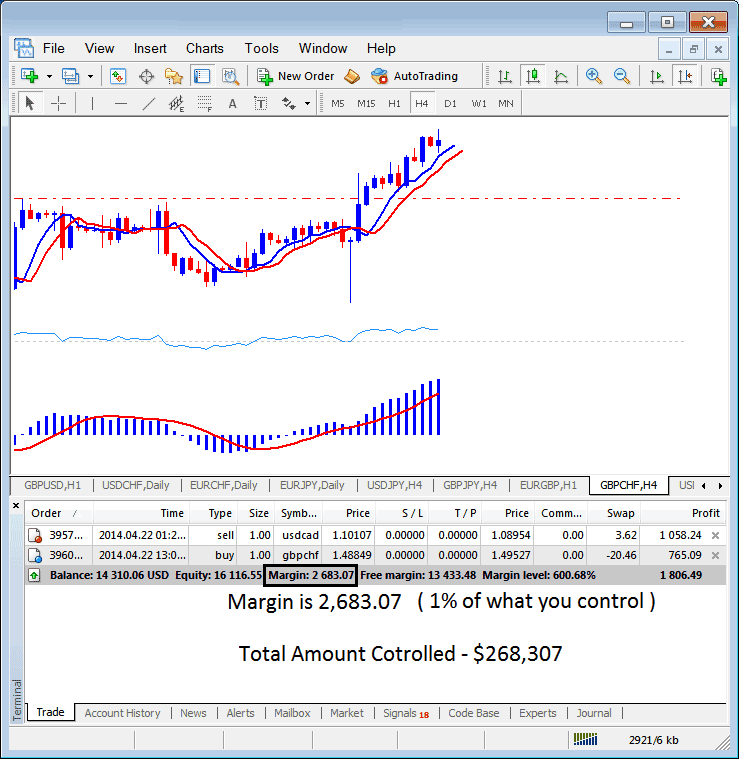

In the chart below, the setting allows control of 100 times the deposit. The needed deposit is 1 percent, or $2683.07. So the full position size is $268,307. With this setup, the trader puts up just 1 percent of their own funds. The rest comes from the broker. One percent equals $2683.07. That makes the whole amount $268,307.

MT4 Trading Window - Online Software to Trade Gold and Different Types of Money Online Simply

If leverage = 50:1

Then margin requirement = 1/50 *100= 2%

If you have $20,000,

20,000* 50 = $1,000,000.

20,000 / 1,000,000 * 100 = 2%

Your $20,000 capital with leverage controls $1,000,000. That makes 2% your margin need.

If leverage = 20:1

Thus, the margin requirement equals 1 divided by 20 times 100 equals 5%.

If you possess twenty thousand dollars,

20,000* 20 = $400,000.

20,000 / 400,000 * 100 = 5%

These boundaries, representing overbought and oversold conditions, are employed as benchmarks for booking profit on indices, and this market assessment will guide decisions on when to close active stock positions.

If leverage = 10:1

Then margin requirement = 1/10 *100= 10%

If you possess twenty thousand dollars,

Twenty thousand multiplied by ten equals two hundred thousand dollars.

20,000 divided by 200,000 times 100 equals 10 %

Your capital is $20,000. With leverage, you control $200,000. The $20,000 is 10% of that amount. This sets your margin need.

Max Leverage vs Used Leverage: Key Differences Explained

Note the gap between maximum leverage and used leverage. Maximum leverage comes from your broker. It's the top amount you can use as a gold trader. Used leverage ties to your open lots. One is the broker's set leverage (Maximum leverage) & the other is the trader's leverage used (Used leverage). To illustrate this specific concept we will use the example above:

If your broker grants a maximum leverage of 100:1, but you only execute trades equivalent to $100,000, the actual leverage utilized is:

$100,000 dollars (1 lot): $10,000 (your money)

Used leverage - 10:1

Suppose you have employed 10:1 leverage, even though your account's ceiling is set at 100:1. This implies that regardless of whether your maximum allowance is 100:1 or even 400:1, you are under no obligation to utilize the full extent. Prudence dictates maintaining your utilized leverage at a maximum of 10:1, while still opting for the 100:1 ceiling on your account settings. The surplus leverage provides what we term as Free Margin. As long as a positive Free Margin remains in your trading account, your broker will not liquidate your open positions, as the margin utilization will stay above the minimum required level. Should your free margin drop below this mandatory threshold, your broker will have no alternative but to forcibly close all active trades, a process known as a margin call. Maintaining sufficient free margin effectively shields your positions from premature closure resulting from a margin call against your account.

In gold trading, one key rule for your XAU/USD plan is to keep leverage under 5:1. Look at the screenshot above. The trader handles USDCAD and GBP/CHF with $2,683.07 in margin. This controls $268,307 overall. Yet equity stands at $16,116.55. So used leverage hits ($268,307 / $16,116.55) = 16.64:1. Used leverage: 16.64:1.

We've used the illustration of a gold trader trading currencies, now download the MT4 software platform, open a practice trade account and open 1 lot of Gold & determine the leverage that's used to open that trade position.

Leverage & Trading Gold Lots

In XAUUSD trading, deals happen in lots. One lot equals 100 units of XAUUSD. Each unit stands for one ounce of gold. So one lot means 100 ounces of XAU/USD.

If the price of Gold is $1200 dollars per ounce, trading 1 lot of XAUUSD equivalent to 100 ounces of Gold means that a gold trader will be trading a lot worth $1,200*100= $120,000 dollars. Therefore, 1 XAUUSD lot will be equal to $120,000 dollars - to trade this 1 lot a gold trader with leverage ratio 100:1 only requires to have $1,200 as their margin & then borrow the rest using leverage from their online broker.

Margin accounts let traders control a large amount of money with only a small amount of their own money, borrowing the rest. With this account, you can borrow money from your broker to trade Gold lots: these Gold lots are worth around $120,000.

The amount of money your account lets you borrow is called "leverage" and is usually shown as a ratio. A ratio of 100:1 means you can control things worth 100 times the money you put in or the amount in your account.

In trading, 1% margin lets you handle a $120,000 position. You deposit just $1,200.

But, using this account makes it more likely you could earn or lose a lot of money. When trading online, you can't lose more than you put in. Your losses are limited to your deposits, and brokers will usually close a trade that goes beyond your deposit by doing something called a margin call. So, traders should try to keep their margin level higher than what their online broker requires. If you use money management rules and keep your leverage below 5:1, then you can learn how to handle this as a trader and keep your risks as low as possible.

Update: it is now possible with certain brokers to incur losses exceeding your initial deposit online: hence, when establishing an account, seek out a Negative Balance Protection Policy (NBP), which guarantees you cannot lose more capital than you have deposited.

Advantages of Leverage Option

As said before, this type of trading account gives you more buying power and the chance for bigger gains or losses. Here's how it works: a 1% margin lets you control a $2,000,000 trade with $20,000. When you start a $2,000,000 trade, small price changes in gold can lead to large gains or losses.

Gold changes are measured in points, which are called pips. For example, the US dollar is traded in amounts down to two numbers after the dot. The last number is a pip. You might see XAU/USD priced at $1200.50. If you trade 1 lot, or $120,000, each pip is worth $1 of profit. So, if the price goes up 1 pip to $1200.51, you make $1. A $1 change in the price of XAUUSD is like 100 pips. If XAUUSD moves $3 (300 pips) in a day, you make $300. But if it goes against you, you lose $300.

Imagine opting to increase your leverage and place a trade for 10 lots of Gold concurrently. If 10 lots equate to a notional value of $1,200,000, then each pip movement yields a $10 profit. Thus, if the price advances by one pip to $1200.51, you realize a $10 gain. A $1 change in the XAUUSD price corresponds to 100 pips. If XAUUSD moves up by $3 (a 300-pip shift) in a single day, your potential profit reaches $3,000: conversely, a move against you results in an equal $3,000 loss. This illustrates why employing excessively large positions, such as $1,200,000 across 10 lots, is generally discouraged, even if account equity theoretically permits it. Instead, it would be prudent to cap positions at amounts like $120,000 or $240,000. With these smaller exposures, a $1 price fluctuation would translate to gains or losses of only $100 or $200, respectively, significantly reducing the potential strain on your account equity. Furthermore, future tutorials will cover essential concepts like money management protocols and risk management frameworks, equipping traders with the knowledge to utilize leverage effectively for long-term profitability.

If the price changes from 1200.00 to 1200.50, which is a change of 50 pips, that equals a $50 profit. If you had $20,000 without using leverage, the price moving from 1200.00 to 1200.50 equals $0.5 profit. So, the good thing about XAUUSD trading is that it can greatly increase your profit, because your profit is multiplied by 100, 50, or 20 based on the leverage used.

You don't need a calculator for these calculations: the trading platforms show these levels. For example, in MT4, you can see these levels in the transactions window by pressing CTRL+T: they're displayed just below your open positions.

Get More Tutorials:

- Guide to Locating the EUR SEK Chart on the MetaTrader 4 Application

- Compilation of FX trade tutorial guides tailored to novice investors.

- Check out the Bollinger Bands indicator for MetaTrader 5.

- How to Add Hang Seng on Mobile MetaTrader 5?

- Indices trading strategies for the HSI 50 Stock Index.

- Example of how to calculate gold margin level in the MT4 platform.