Stochastic Trading Indicator Over-bought & Oversold Levels

The Stochastic Oscillator is commonly employed to detect overbought and oversold conditions in forex trading. Overbought levels are above the 80% threshold, while oversold levels fall below 20%.

The crucial point is to monitor the Stochastic oscillator forex indicator not only when the %K or %D lines reach or breach the overbought/oversold thresholds, but also specifically when they cross back through these same levels.

Like other forex momentum indicators such as RSI, the Stochastic oscillator forex indicator can stay in overbought and oversold areas for some time. If this stochastic indicator stays in these areas for a long time, it means there is a strong upward Forex trend (overbought) or a strong downward Forex trend (oversold).

Generally speaking, a future forex trend reversal is indicated when the stochastic lines cross back over or below these overbought and oversold levels.

If the overbought or oversold conditions are becoming more trustworthy, a trader may search for additional foreign exchange signals.

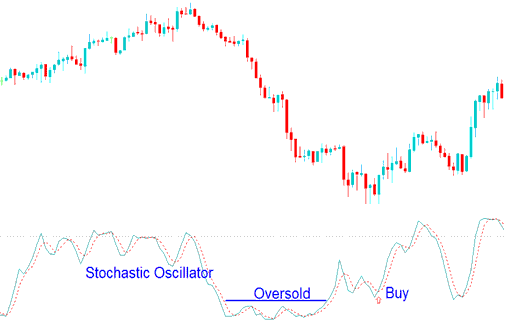

Identifying Buy Signals Using the Stochastics Oversold Indicator

- Before and Prior to Buying, the %K & %D lines turn upward from below 5 %.

- A reading that is floating near 5% means that bears are in control and there is selling of the currency pair. A trader should wait for the Stochastics Oscillator Technical to move back above 5% as a sign that the selling pressure is easing.

A buy signal is validated when the stochastic oscillator moves out of the oversold zone, temporarily dips back, and then climbs upward without lingering in the oversold area for long.

Buy Signal Using Stochastics Oscillator Technical Over-sold Levels

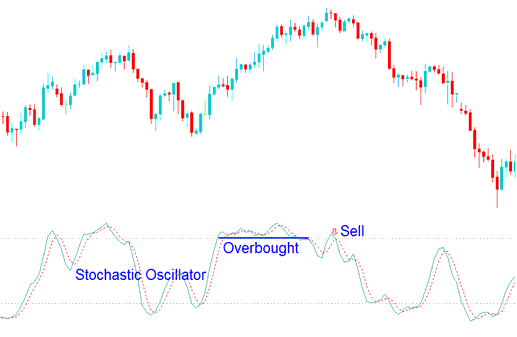

How to Use the Stochastic Oscillator to Spot Sell Signals at Overbought Levels

- Before and Prior to Selling, the %K & %D lines turn downward from above 95%.

- A reading that is floating above 95% means that bulls are in control and there is buying of the currency pair. A trader should wait for the Stochastic oscillator to move below 95% as a sign that the buying pressure is easing.

- The sell signal gets to be confirmed when stochastic oscillator goes below overbought, then after a while returns to overbought but this times moves downwards immediately without staying at the overbought.

Sell Trade Signal Using Stochastics Oscillator Overbought Levels

When utilizing oversold and overbought levels, it might also be useful to look at various chart timeframes in order to determine the best course of action for starting a transaction.

Main theory is to trade with the forex market trend. Always double check the forex signals with the longer term stochastic indicators to confirm signals on the shorter forex chart time frame periods.

Obtain Further Programs & Instructional Material:

- Forex Currencies Traded in the Forex Market Online

- How Can I Add Index to MT4 Platform Software?

- List of Top Forex Broker Ranking

- Where to Trade GER30 Indices

- What's the Pips Value for USD/PLN FX Pair?

- Saving Your Workspace or Strategy in MetaTrader 4

- How to Improve Trade Forex Psychology with These Methods and Tips