Stochastic forex system: Pair stochastics with other indicators

This lesson should be called: Combining Stochastic Oscillator with other Indicators, but Stochastic Trading Strategy sounds real nice.

The Stochastic indicator can be integrated with additional indicators to construct a robust trading system. For our demonstration purposes, we will combine it with:

- RSI

- MACD

- MAs Moving Averages Indicator

Example 1: Stochastic Oscillator System

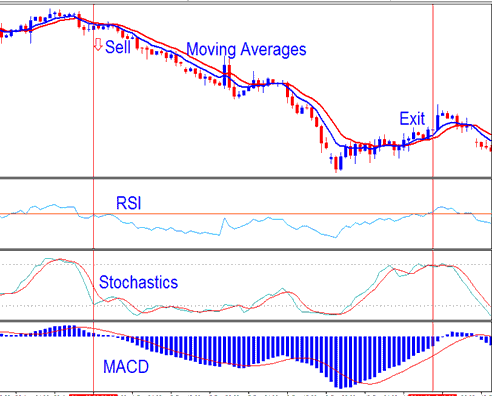

Sell Signal Generated using Stochastic Oscillator Trading System

From our system sell signal is generated/derived when:

- Both Moving Averages are heading downward

- RSI is below 50

- Stochastic heading downwards

- MACD heading downward below center line

The sell signal was triggered when all forex trading criteria were satisfied. Conversely, an exit forex signal is generated when an opposing market signal arises, indicating a reversal in trading indicators.

The good thing about such a system is using different indicators to ensure the trade signals are correct and prevent as many false signals as possible during this process.

- Stochastic - is a momentum oscillator technical indicator

- RSI- is a momentum oscillator technical indicator

- MAs Moving Averages Indicator- is a market trend following fx indicator

- MACD- is a price trend following forex indicator

It's very useful to combine more than one forex indicator, as a combination of trading signals is much better than relying on just a single forex indicator. The forex trading indicator combinations re-inforce each other, and cancel out false whipsaw forex signals.

A trend following technical indicator helps a trader to see the over-all picture, while using more than one momentum technical indicator gives and generates better and more reliable entry & points to exit trading forex.

Forex indicator mixes and their cues help explain much of the market action.

Example 2: Stochastic Oscillator System

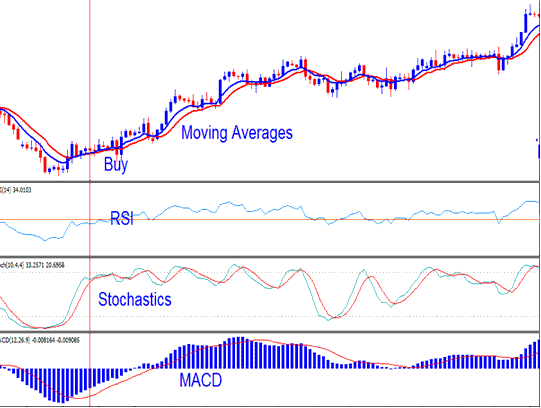

Buy Signal Generated using Stochastic Oscillator Trading System

For this specific illustration, the forex trend is manifestly upward, yet the stochastic oscillator trading indicator generated several instances of forex whipsaws. Can you identify these erroneous signals? Consequently, the pivotal question is how to effectively circumvent trading these misleading forex whipsaws.

The response indicates that by examining additional technical indicators like MACD, a forex trader could have circumvented the whipsaw effect. Even though the MACD did not provide a crossover signal, it was very close to the zero center-line, and the slope at which the moving averages changed was not steep enough to indicate a significant trend reversal in the forex market. Recognizing whipsaws in the forex market is not immediately clear: it is a skill that requires time to develop. With experience, however, one can easily recognize whipsaws from a great distance.

One tip is that as long as MACD is above zero center line even if the MACD lines are moving downward then the trend is still upwards. As you can see from the above example MACD never went below zero line & afterwards the upward trend continued with the MACD trade technical indicator maintaining above Zero line & continuing to move upward.

During ranging forex markets Stochastic Oscillator will give the fastest forex signals which are prone to whipsaws. This is why stochastic indicator is best combined together with other technical indicators and the forex signals traded are confirmed by another one or 2 other technical indicators.

Explore Additional Topics and Tutorials:

- Head and shoulders vs. inverse head and shoulders - setting up the chart

- Downloading JP 225 Index Trading Platform

- Setting Stop Loss Forex Orders Using Support Resistance Levels

- Forex Money Management Rules for Serious Traders

- Customizing & Arranging Charts Tool Bars in MT4 Trade Platform

- How Do I Trade Forex Using Elliot Wave Principle?

- List of AUS200 Trade Strategy

- Fib Pullback Levels on Upward XAU USD Trend and Fibo Pullback Levels on Downwards XAUUSD Gold Trend

- How to Do Forex Practice & Learn Trade the Forex Market

- Example FRA 40 Index Strategy