How to draw Fibonacci retracement levels when the market's moving up or down.

Gold prices on a chart don't move in straight lines. They zigzag up and down. Fibonacci Retracement helps you spot where these zigs and zags might pause. The key pullback levels are 38.2%, 50%, and 61.8% - these are common spots for retracements.

Retracement means a pullback in price. The market then picks up its main trend again.

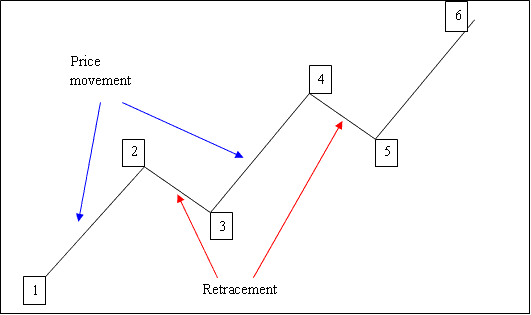

Zigzag Pattern Examples: Price Rises in a Zigzag Way.

The diagram below shows movement in an upward market.

1-2: Price moves up

2-3: Pull-back

3-4: Moves up

4-5: Pull back

5-6: Moves up

considering that we will perceive wherein a pull returned starts on a chart, how do we recognize wherein it's going to attain?

The answer is we use Fibonacci retracement indicator.

This is a type of line study used in xauusd to predict & calculate these levels. This xauusd indicator is placed directly on the chart within the trading platform provided by your broker, This xauusd indicator will then automatically calculate these technical levels on the chart.

What are The Retracement Levels

- 23.6 %

- 38.2%

- 50.0 %

- 61.8%

38.20% and 50.00% Levels are the most used and most times this is where the pull-back will reach. With 38.20% being the most popular/liked & most widely used.

61.80 % is also oftenly used to set stops for trades opened using this strategy.

This tool will be oriented in the same way as the market is trending, as you can see in the examples displayed below.

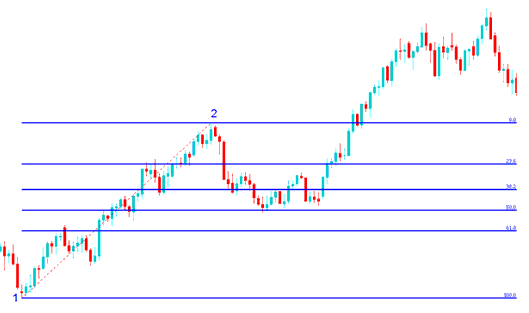

How to Draw on an Upwards Bullish Market

In the accompanying visual, the price ascends between markers 1 and 2, subsequently pulling back after point 2 to the 50.00% retracement zone, before resuming its upward momentum in the original direction. Observe that this specific technical instrument is charted projecting from point 1 to point 2, aligning with the prevailing market direction (Upward).

Because we know that this is just a pull back based on strategy of using this technical indicator, we put a buy order just between the areas 38.20% & 50.0% and our stoploss just below 61.80% retracement mark. If you had put buy at this point in the trade example shown & displayed below you would have made a lot of pips.

Explanation for the Above Example

Once the trade hit the 50% level, that area gave strong support. After that, the xauusd market picked up the original uptrend and kept moving higher.

23.6% provides minimum support and is not an ideal place to place an order.

38.2 % provides some guide however rate in this case persisted to retrace upto the 50 % quarter.

50.00% affords a variety of support and in this situation, this became the perfect region to set a buy order.

In this example, the drop went to the 50.00% level, but often the market will drop back to 38.2 %, and because of this, traders usually place their buy orders at the 38.2 percentage, and then place a stoploss just below 61.8%.

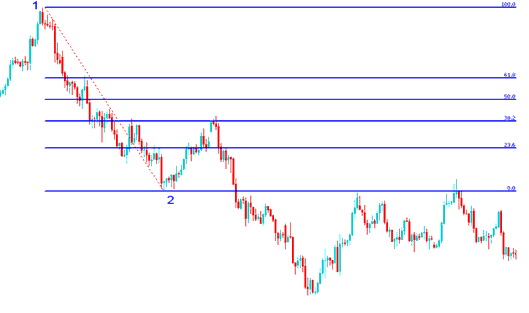

How to Draw on a Downward Bearish Market

In the accompanying diagram, the market exhibits a downward movement between points 1 and 2. Following point 2, the price undertakes a retracement up to the 38.20% level before continuing its descent in the established downward trend. Note that this technical indicator was plotted from point 1 to point 2, aligned with the prevailing direction of the overall market trend (downwards).

Since this is just a retracement, we set a sell order at the 38.20% level and put the stop loss just above 61.80%.

If you had entered a sell order at the 38.2% retracement level, as demonstrated in the example below, you could have gained significant pips afterward. In this case, the price retraced to the 38.2% level without reaching the 50.0% mark. From experience, utilizing the 38.2% level is frequently advantageous since pullbacks often do not extend to 50%.

Explanation for the Above Example

In the example above, price pulls back right after hitting the 38.2% level. It's an ideal setup.

This location presented significant resistance for the price pull-back: it was an ideal point for an investor to issue a sell limit order, as the market swiftly declined once it reached this point.

Study More Lessons & Topics: