TSI Technical Analysis & TSI Signals

TSI Indicator

Conceived and Constructed by William Blau

TSI is a tool that measures momentum. The TSI is created using a momentum calculation that reacts more quickly to price changes, making it a leading tool that closely follows the direction of price action in the market.

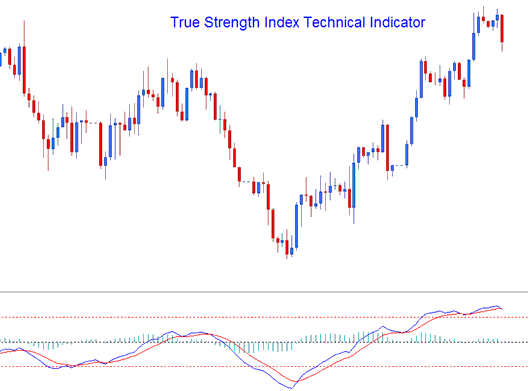

TSI appears as a blue line. A red signal line joins it. Crossovers between them create buy or sell alerts.

The TSI indicator also generates a histogram that depicts the difference between the TSI line and the signal line. When the histogram crosses above or below the centerline, it indicates bullish or bearish crossover signals, respectively.

Gold Analysis & Generating Signals

TSI uses different ways to create signals. This indicator can be used like the RSI to find the general xauusd trend of markets. TSI can also show when markets are overbought or oversold. The most common ways to create trade signals are:

Zero Line Gold Crossover (Focus on Histogram, Not Lines) for XAUUSD Trading Strategies

- Buy - when the histogram crosses above 0 a buy is generated

- Sell - when the histogram crosses below the 0 a sell is generated

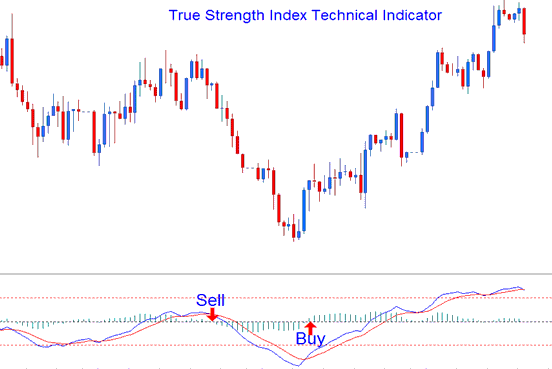

Trading Signal line Crossover

- A buy is derived & generated when TSI line crosses above SignalLine

- A sell is derived & generated when TSI line crosses below Signal-line

This signal is identical to the one mentioned above, and the timing aligns with the moments when the histogram crossovers occur.

Divergence XAU USD

Spot divergence to find XAUUSD trend turns. Look for reversal setups in the charts.

Classic Divergence

XAU USD Classic Bullish Divergence Setup: Lower lows in price and higher lows on the indicator

XAUUSD Classic Bearish Divergence Setup: Observing Higher Highs in Price Contradicted by Lower Highs on the Indicator Reading

Divergence trading spots possible xauusd trend continuations too. These include continuation divergences.

Hidden XAUUSD Trading Divergence Trading Setup

XAUUSD Hidden Bullish Divergence: higher lows in price & lower lows on the indicator

XAUUSD Hidden Bearish Divergence Identified: Price forms lower tops while the indicator registers higher peaks.

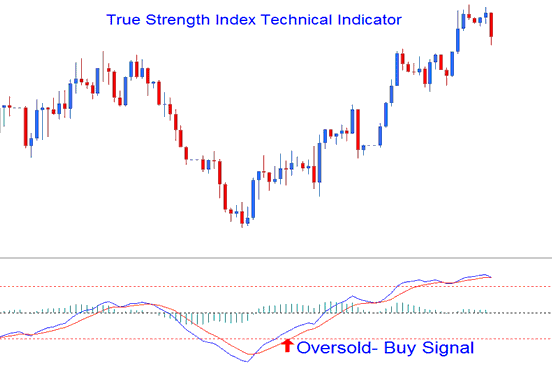

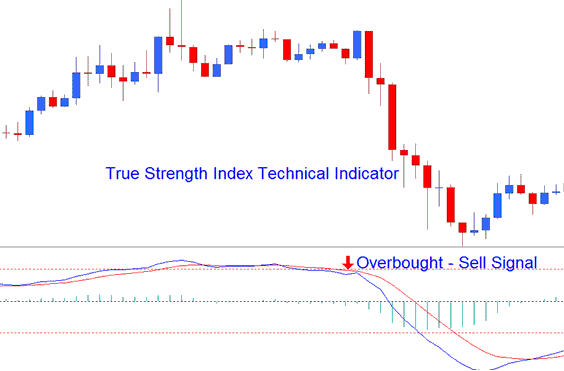

Over-sold/Overbought Levels in Indicator

This capability makes it useful for recognizing market states characterized by excessive buying (overbought) or excessive selling (oversold) in price motion.

- Overbought condition - levels being greater than the +25 level

- Oversold condition - levels being less than the -25 level

Trades can be derived and generated when TSI crosses these levels.

Buy signal happens when levels cross above -25. That creates the signal.

Sell signal - when the levels cross below +25 level a sell signal is generated.

Oversold

Over-bought

The overbought/oversold levels are indicated the use of horizontal traces drawn on the +25 & -25 tiers.

Explore More Topics and Courses: