Islamic Swap Free Trading Account

Online gold trades charge swap fees daily. Brokers add this rollover cost for overnight holds. Traders pay it to keep positions open past a day. It acts like interest on gold spots.

Since XAUUSD pits gold against the US Dollar, and given the USD interest rate is currently 0.75%, a trader engaging in XAU vs USD transactions will either incur interest payments or receive interest based on the position they maintain.

Buy Trade context: Executing a 'Buy Gold' order signifies that the XAUUSD trader is purchasing Gold while simultaneously selling the US Dollar. The consequence of selling USD is an obligation to pay an annual interest rate of 0.75%. Since this rate is yearly, the online trader incurs only a minuscule portion of that 0.75% interest charge each day.

Sell Trade - Executing a sell trade on XAUUSD means a gold trader is selling Gold while simultaneously purchasing US Dollars. Acquiring USD entails payment or receipt of interest amounting to 0.75% annually. Consequently, the online trader will receive a minor daily proportion of this 0.75% annual interest.

However, while the monetary value of this interest paid or received by the trader may be negligible, the principle of exchanging interest payments is considered problematic within the Islamic faith.

This issue of paying and getting paid interest, which is an issue in the Islamic Religion, brings us to the Swap Free Islamic Accounts. The Islamic Religion does not allow paying and getting paid interest. For Islamic Gold metal traders, there is an account designed according to their Values: It's known as a Swap Free Trade Account.

For this swap free trading account a xauusd trader will not pay the overnight rollover interest on XAUUSD & will also net get paid any interest, this is also known as Shariah Compliant where there is no paying of RIBA (interest) - also referred to & known as Islamic Trading Accounts.

Gold traders requiring a swap-free account should look for brokers that offer the "Islamic Trading Account" option, typically found in the Trading Accounts section on their gold trading platforms. This includes instructions on how to open a swap-free account.

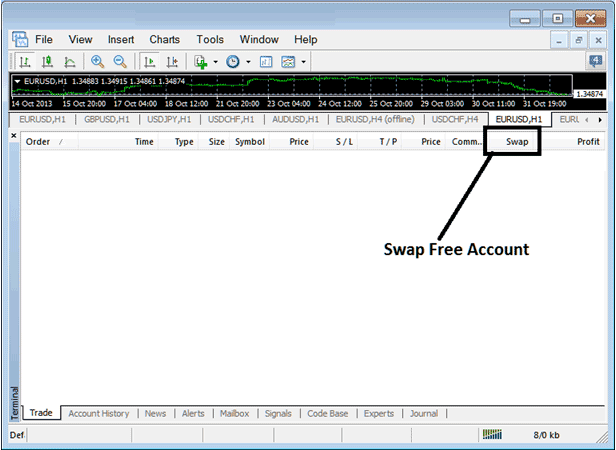

Once a trader opens this Islamic XAUUSD Trading Account, the fee for holding Gold overnight is removed. Once this no-interest rule is set, if a trader is using the XAUUSD platform, which is MetaTrader 4, the record of rollover interest will be set to zero.

Islamic Forex Account

The rollover fee is charged daily at the end of the trading day for those holding an open Gold trade for which the swap roll over fee is to be applied. As a trader if you do not want to pay this roll-over swap fee you should close-out your transactions before the end of the day, that way you will not pay the rollover interest as you're no longer holding the open gold trades. Since the online trading market closes on Saturdays and Sundays, they roll over the interest for those two days on Wednesdays. That means, if you're trading XAUUSD, you pay the rollover fee for Wednesday, Saturday, and Sunday, all on Wednesday. So yeah, you get charged the swap fee three times that day.

Open trades with an overnight fee are often called Overnight Positions by traders. Day Traders hardly ever keep trades open overnight and close all of them before the trading day ends. But Swing Traders might keep their trades open for a few days and leave these trades overnight to get more movement in the market trend.

Once you find a swap-free broker for XAUUSD trading and open an Islamic account, you get the same market access as others. You just skip the swap fee. Use MT4 like everyone else to trade gold, currencies, indices, CFDs, metals, and other tools the broker offers.

However, be careful in choosing a swap free broker, some brokers will add a commission or add some pips to the spreads you trade with to cover the swap(This are Swap Fee Online Brokers). This isn't supposed to happen as the online trader will still be paying for the interest even though it is disguised as another type of payment, good online brokers don't add any commission nor do they add any charge onto the spreads.

Some brokers may impose rollover interest charges if an XAUUSD trade remains open for more than 5 or 7 days. However, this practice should be avoided, as carry-over interest should not be applied regardless of how long a position is held beyond this time frame. For traders wanting to open this swap free Trading Account it's good to check for any additional terms and conditions of trading for the Islamic Account that you're going to be opening to make sure that the broker you select is really a - no swap broker.

Brokers started swap free accounts because more Islamic Gold and online forex traders wanted accounts without carry over interest. Regular trading accounts made people pay rollover interest, also known as rollover interest. Because of this, they created Interest Free Trading Accounts so Islamic traders could trade while following their rules about not paying or getting interest, using things like XAUUSD and other currencies.

Learn More Lessons & Courses:

- How do I trade forex news breakouts on price charts?

- What Time Does Wall Street30 Stock Index Open?

- Fib Ratios Expert Advisor Setup

- XAU/USD Course: How to Open a Gold Account

- Strategies for Trading USD/NOK Currency Pairs

- Tutorial on BTC/USD Candlestick Chart Analysis Using MT4 Software

- A Comprehensive Inventory of Forex Topics Essential for Trader Education

- AUDUSD System AUD/USD Trading Method

- Steps to Formulate a USD SEK Strategy

- Basic Forex Trading Terminology