Trade Journal Example and How to Write One

A trading journal logs every position you take. Stick to this easy tip for journaling, and boost your forex outcomes. Start like this:

Step 1: Note why you trade in your forex journal before you place the order.

Write in a journal the reasons for making the transaction before and before initiating it. It doesn't have to be lengthy or even complete sentences. Simply list a few of the main reasons for your trade stance in the journal.

Be honest with this trading journal. If you are honest, it will prevent you from making the biggest mistakes in your forex trading. If you see that you're making the trade transaction because of anything other than a sound strategy. DON'T MAKE THE FOREX TRADE TRANSACTION!

Following a losing trade, refrain immediately from opening a subsequent forex transaction in an attempt to instantaneously recover the deficit: this behavior is termed 'revenge trading,' and one must not seek retribution from the market. It is advisable to power down your computer, step away from your workstation, and take a moment to cool down with a refreshing pause. Keep in mind that capital you do not personally allocate cannot be lost. A successful trading methodology is defined not just by the magnitude of your profits, but equally by the extent to which you control and avoid losses.

Second Step - Clearly define your intended exit strategy for the transaction *before* you finalize the opening of your market position.

Do not get trapped with a great entry strategy without having an exit strategy. Your trading strategy should have both great entry & exit strategies. One is useless and not useful without the other.

But you ask, Why bother? I know my fx trading exit strategy. Why do I ought to have it written down?

Well, the explanation is this: human beings are mostly irrational, impulsive, and emotional creatures. If you have your forex exit strategy written down, you have a point of reference when you exit a trade position. You'll refer to your trading journal PRIOR TO & BEFORE exiting and getting out of a trade transaction. If you are closing a position for any explanation other than your initial forex exit strategy, you as a trader must ask yourself why?

Your journal will save you more funds than you as a forex trader can imagine. It will stop you from making impulsive moves, which is usually and generally why people lose money in forex.

Step three - Write down why you exited the FX trade position.

This matches the reason you noted in step two. If not, review your take on it. Traders often skip their plan due to poor discipline. Your journal will show clear proof of why you lose.

Step 4 - How Can I Interpret the Forex results

Self-correction through learning from mistakes in forex trading is the superior method for any trader aiming to enhance their profitability. Everyone makes errors, but accomplished traders differentiate themselves by learning from these errors and avoiding repetition.

Keeping track of your mistakes in a trading journal is the best way to learn from them. Even years later, a forex trader can look back and see if they're still repeating the same mistakes they made when they first started trading forex online.

This specific knowledge cannot be acquired through published books or seminars. Your trading journal is an intensely personal record uniquely reflecting your approach. Your individual temperament will dictate the type of trader you evolve into, and also the specific errors you are prone to making.

Not only does your journal highlight your weaknesses, it'll reveal the transactions which are most profitable. After a little while you'll see the type of trade setups which make you the most money, & a setup will emerge. Do not let this data on your trading journal go to waste.

You should make and do all the effort to understand the reason why those trades went well & then try to replicate that as often as possible. The traders who are profitable know and are aware of their strengths and weaknesses. They capitalize on their strengths & try to minimize on their weaknesses.

As a trader, do not be lazy and forget about your trade journal. Always write down your trades, especially when you are still learning how to trade. Recording your trading steps and thoughts is the quickest and most reliable way to improve your Forex trading skills. Do this consistently, and you will find out more about your own habits than you think.

Aim to spot and fix bad trading habits quick. If you hold losers too long, act to stop it next time.

Summary

Your forex journal is invaluable: it contains critical information that plays a significant role in your success as a forex trader.

We recommend that you use it for at least a month. If you have not made more money in 30 days, then please feel free to cancel it.

But before choosing not to, give it a try. Perhaps it's all that's needed to advance your forex trading to the next level and start making a profit.

Sample Trading Journal Template

Here's a sample journal format traders can adapt to track their own trades:

Date - Friday 22 August

Page 1

EURUSD - Short Sell

Day

- Day Trade trend is short sell, RSI 33

- Volatility is high bollinger bands pointing down

- Price was retracing but downtrend is still in place confirmed by RSI, market has resumed downwards direction

4H

The downward direction of price is signaled by MA crossovers pointing down, the Relative Strength Index sits at 46 and is declining, and volatility levels are low.

1H

The Moving Averages are sloping downward, the Relative Strength Index sits at 34, the volatility level is moderate, and the price is positioned below the middle Bollinger Band.

Go short on a daily downtrend. Wait for RSI at 33 and all H1 entry signals to align.

Take Profit - at 100 pips between support1 & support2

Profit by Market Close: +33 pips

Why Trade Was Profitable

The 1-Hour Moving Average for H1 indicated a consistent downtrend throughout the day: a sell signal emerged from the MACD following its exit from the overbought zone, the RSI reading was below 50, price movement on H1 demonstrated a downward bias, volatility was moderate, and the Bollinger Bands displayed a downward slope.

Day - Daily moving averages crossed to hint at a long trend. But MACD pointed short, with RSI at 32. This made it a non-confirmation. It was only a pullback. The trade started as price turned down. Still, just a retracement.

On the 4-hour chart, retracement had already completed, and the Moving Average system indicated a downtrend through a crossover signal. Indicators like RSI showed downward movement, with MACD also confirming a short signal.

Page 2

USDCHF- Buy Long

Day

Based on an RSI reading of 65, flat Moving Averages, upward-pointing wide Bollinger Bands, the trend is identified as bullish, accompanied by elevated volatility.

4H

Relative Strength Index at 50, stochastics leaving oversold, MA crossover has given an uptrend crossover signal.

1H

MA moving up, RSI at 64, stochastics heading upwards

Initiating a Long Position Based on the Daily Chart Once All Criteria for a Buy Long Signal Are Satisfied

Profit at Market close +45 pips

Why Trade Was Profitable

H1- Moving Average for 1 Hour headed up all day, MACD gave a buy signal after coming up from oversold, RSI was above 50 all day, volatility high and bollinger bands going upwards.

Day - the daily MACD said buy, the RSI was at 68 and rising, the market price was pulling back but had already begun to rise, and the market was jumpy because bollinger bands were going up.

The Relative Strength Index was moving upward, the MACD was above the zero center line marker, volatility was minimal, and the 4-hour moving average had an upward crossover signal.

Page 3

GBPUSD- Short Sell

Day

Day Trading trend is short, RSI is at 23, the market has dropped again after pausing, a big black Marubozu candlestick is present.

4H

Price has turned downwards after a retracement, RSI at 38, stochastics leaving overbought heading down & Moving Average Cross-over strategy has given a short sell signal heading down.

Britain's GDP figures were released below expectations, leading to a bearish outlook based on GBP Fundamentals and Technical Analysis, suggesting a downtrend.

Entering a short position relies on the daily trend and has fulfilled all sell trade signal criteria within the 1-hour timeframe.

Profit at close +35 pips

Why Trade Was Profitable

1H- MA were decreasing very fast all day long, and the MACD showed it was too bought, signaling to sell for the whole day, while the RSI was consistently low around 30: key technical numbers pointed to a very negative outlook, the price changed a lot, and bollinger bands pointed downwards.

On that day, the daily moving averages almost crossed over. But the pullback sent prices down fast with a big red candle of 250 pips. MACD turned bearish, RSI dropped to 22, and Bollinger Bands sloped down. Volatility spiked.

On the 4-hour chart, the moving average gave a down crossover signal. The MACD was below zero, and the Relative Strength Index was under 50.

Page 4

USDJPY- Buy Long

Day

The day's trend is up. RSI sits at 52, stochastics are climbing, and the MA's moving sideways. After a pullback, the market's heading up again.

4H

MAs going upwards, stochastics leaving oversold region, RSI at 52

1H

MAs going up, RSI at 65, both stochastic heading upwards

Entry criteria dictate a Long position based on the confirmation of all prescribed buy signal rules on the Daily timeframe, with corresponding signals met on the 1H chart.

Profit at close +64 pips

Why Trade Was Profitable

H1- MAs were going up all day, MACD showed a signal to buy, RSI was over 50, price swings were big, and bollinger bands were pointing up.

Day Trade - The MACD was in bullish territory above the zero center line. Although the RSI was below 50, it was trending upwards. The moving averages were flat, Bollinger Bands pointed upwards, and volatility remained low.

4H- on the 4 hour chart the moving averages had given a buy crossover signal, Relative Strength Index at 51 after crossing above the 50 center-line mark.

Profit at Market Close

EUR USD +33 Pips

USDCHF +45 Pips

GBPUSD +35 Pips

USD JPY +64 Pips

Total = 177 Pips

Why trade positions were profitable

Trades won because we used multiple time frames right. We followed the system rules in the forex plan. This caught the price direction.

Entry conditions in the one-hour chart aligned before these trades started.

Fundamental Technical Indicators were also used to predict some moves.

In Short - Today I stuck to all the trading rules of my system

..........................................................................................................

Using Journal Entries: Step-by-Step Examples With Images

1.

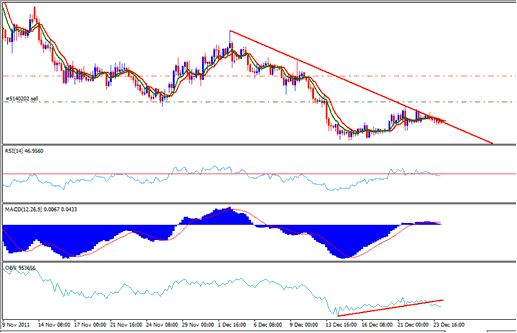

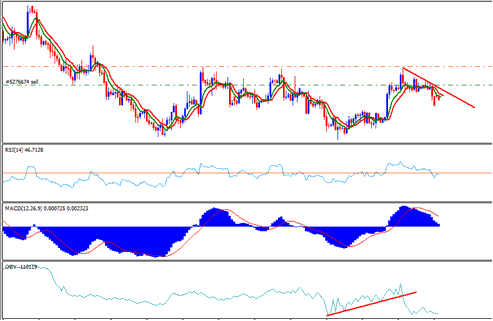

EURJPY Sell Position 13-December-2011

Position opened EURJPY Short Sell

Date - 12-13-2011

Time frame: 4 hr Chart

Why Trade Was Opened

- Both MAs were heading downwards

- Relative Strength Index is below 50 Level, therefore the currency is bearish

- MACD is heading towards Bearish Region

- OBV has broken the upwards trend line, thenceforth direction is downwards

The price also touches the downward trend-line, making it a favorable point to sell the currency.

Closed

Closed by Take-Profit 300 Pips

Date - 01-02-2012

Why this position was profitable

It was profitable because the risk reward ratio of this set-up was very high.

The trade went back to its downwards after touching the downwards trend line.

The OBV indicator is a leading signal: if its upward line broke, the price was probably going to go lower.

Subsequent to this initial signal, all subsequent indicators started signaling a definitive bearish momentum and a downward market shift.

2.

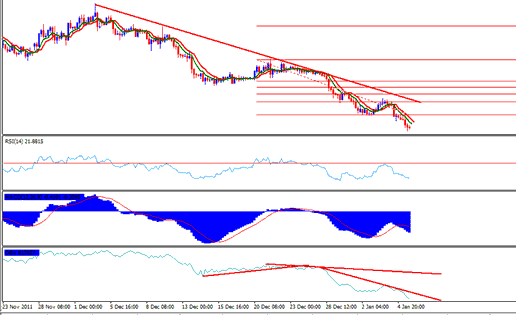

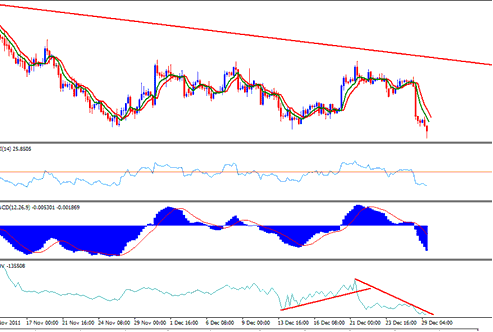

EURUSD Short Sell - 13-December-2011

EURUSD Short Sell Trade Signal

Date: 12-13-2011

Why Trade was Opened

- Both of the MAs were heading downwards

- Relative Strength Index is below 50 centerline level

- MACD is heading downwards

- OBV indicator has broken its upwards trend line

Closed

Closed by Take Profit 300 pips

Date - 01-05-2012

Why the transaction was profitable

Adherence to Every Tenet of Our Trading Strategy Preceded Entry into the Short Sale Position.

The long-term trajectory of EURUSD's price movement is downwards, as evidenced and visualized by descending trendlines drawn on the chart.

Using Technical Analysis for Forex Trades

EURUSD rallied to the old resistance but stopped there. It was a smart spot to sell again. In the chart, the first trade locked in profit. The second one is still open.

EUR USD Closed by Take-Profit

3.

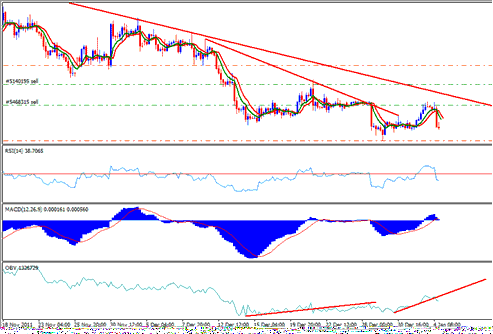

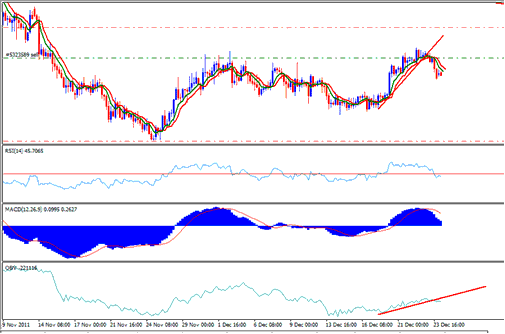

GBPUSD Short Sell - December-20-2011

Date - 20.12.2011

Position Opened - GBPUSD Short

Timeframe - H4 chart

Why Trade Was Opened

- Both Moving Averages are heading downward

- RSI is below 50 center-line mark

- MACD is heading down

- OBV has broken upwards trend and the market now is bearish.

A line showing a downward trend can be drawn on the price chart, which means our trading strategy's rules have been followed and the market is falling.

Take Profit Order - 300 pips

StopLoss - 100 pips

Take Profit Order Hit

Closed by tp order

Date: 29.12.2011

Why This Position was Profitable:

All rules for the trade system were met before opening the transaction.

GBP/USD after hitting takeprofit.

4.

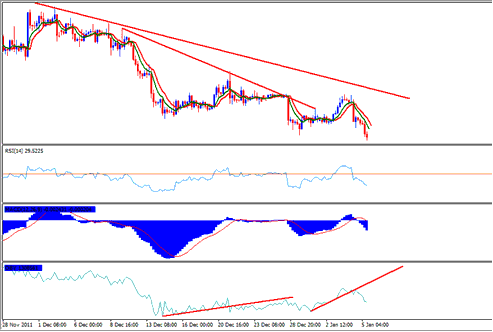

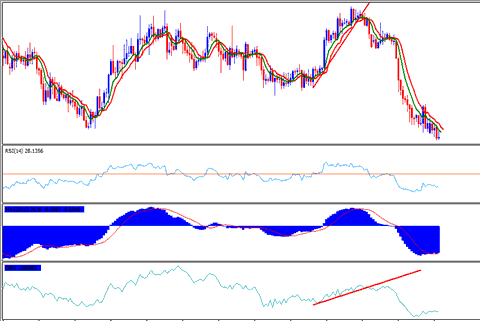

GBP JPY Sell - December-22-2011

Date: 22-12-2012

Opened: GBP JPY Short Sell

Time Frame: 4 hr chart time frame

Why the transaction was opened

- Both moving averages MAs heading downward

- Relative Strength Index below 50 center-line level

- MACD is moving down

- OBV has broken upward trend-line meaning the price will follow soon.

The price will break the upward trend line and begin to move downward since volume always comes before price. Furthermore, prices are falling over the long run.

Closed

Closed by take profit order (300 pips)

Date: 01-02-2012

Why This position was profitable

The long-term trend is a downward.

All the trading rules of the system were followed before opening the position.

GBP/JPY short sell closed after take-profit.

Study additional tutorials and courses at.

- Stochastic Indicator Analysis Trade Forex Strategies

- Buy Entry Limit Order and Sell Entry Limit Order

- Gold Demo Account

- How to Find and Get GER 30 in MT4 PC

- How Can I Add IT40 in MT4 App?

- Explanation of the Balance of Power Indicator with Examples.

- Understanding a Forex Candlestick Chart Tutorial

- How Do I Trade FX Market Using Forex Technical Analysis Methods & Techniques?

- CCI Gold Indicator MetaTrader 4 Technical Indicator Analysis

- What are Types of Forex Risks?